Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

XRP Value Rises as Ripple’s CEO Assumes Position Impacting Cryptocurrency Regulation

The price of XRP has recently experienced a significant increase. The token surged over 8% within 24 hours following the announcement that Ripple CEO Brad Garlinghouse has been appointed to the CFTC Innovation Advisory Committee.

Traders appear to be wagering that Ripple’s closer relationship with regulators may alter the narrative surrounding XRP.

Key Takeaways

- XRP increased by 8.09%, trading near $1.53 after the news of the Ripple CEO’s federal appointment.

- The CFTC selected Garlinghouse along with other crypto leaders to provide guidance on digital asset regulations.

- Institutional investments are on the rise, with Goldman Sachs disclosing a $152 million position in crypto ETFs.

Garlinghouse Joins Expanded CFTC Committee

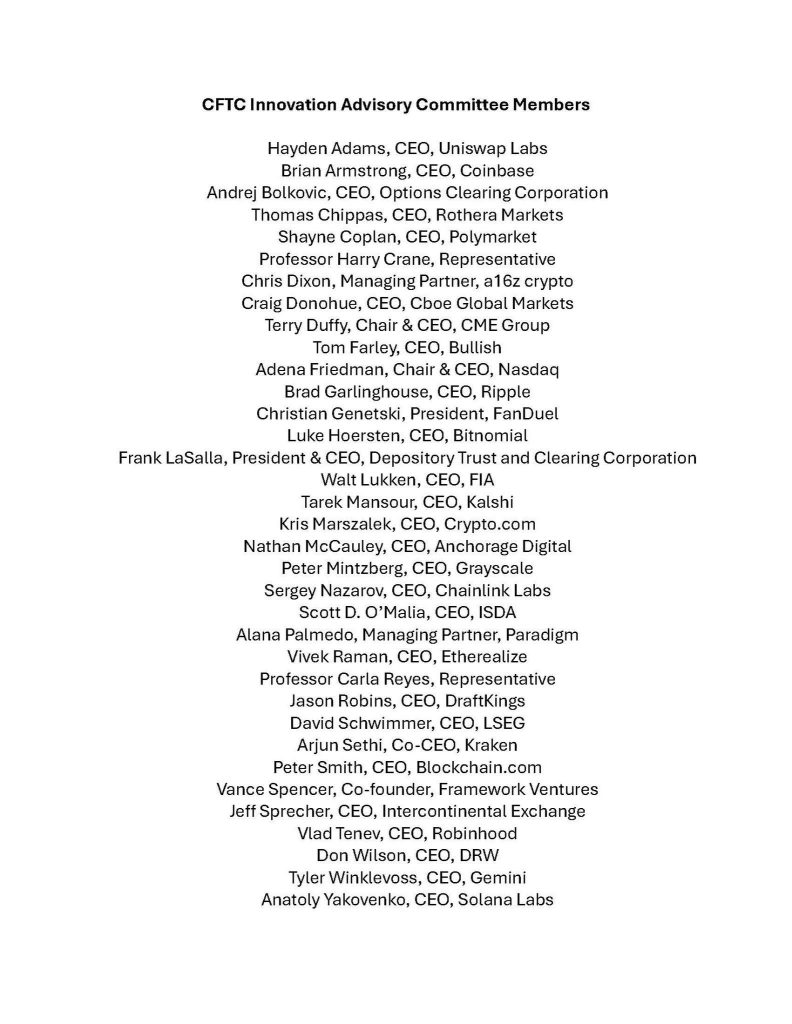

This represents a significant change in Washington. The CFTC has expanded its Innovation Advisory Committee to 35 members, with Brad Garlinghouse now officially included. Chairman Michael S. Selig stated that the aim is to future-proof U.S. markets by collaborating more closely with the industry rather than opposing it.

It is essential to maintain perspective on this development. The CFTC primarily oversees derivatives markets, not spot crypto securities. XRP’s previous legal battle was with the SEC, not the CFTC.

Source: CFTC

Source: CFTC

Garlinghouse is joined by others in this initiative. The committee includes Coinbase CEO Brian Armstrong, executives from Chainlink, Solana Labs, and Uniswap, as well as representatives from traditional finance such as CME Group and Nasdaq. This creates a notable blend of crypto and Wall Street in one setting.

The areas of focus are also significant. Tokenization, perpetual contracts, and blockchain market structure are all directly related to how XRP integrates into the broader landscape.

For XRP holders, this development feels meaningful. Ripple has transitioned from confronting regulators to participating in policy discussions. With lawmakers advocating for clearer crypto regulations, this could signify a new phase in the relationship between the industry and Washington.

XRP Price Bulls Eye $1.54 Breakout

The market responded quickly. XRP is currently trading around $1.57609, reflecting a 10% increase for the day after recovering from a low near $1.40731. This movement has effectively pushed the price out of its mid $1.40 consolidation range, supported by increased volume and expanding Bollinger Bands.

Source: XRPUSD / TradingView

Source: XRPUSD / TradingView

Bulls are now testing the $1.60 session high. Short-term moving averages are positioned beneath the price around $1.47 and $1.48, forming a stair-step support zone. This structure provides some stability to the rally.

On the fundamental front, momentum is also building. Binance has recently completed the RLUSD integration on the XRP Ledger, a development that many analysts view as a potential catalyst for a more significant move if the momentum persists.

Institutional Interest Deepens

In addition to the CFTC news, larger investments are quietly positioning themselves for what could be a more crypto-friendly 2026.

Recent filings indicate that Goldman Sachs holds approximately $152 million in crypto ETFs, a clear indication that Wall Street remains engaged with digital assets.

Garlinghouse has reiterated his vision, describing XRP as the “North Star” of Ripple’s strategy and highlighting 2026 as a crucial year.

While the tone in the U.S. seems to be softening, the global landscape remains mixed. For instance, Dutch lawmakers are advocating for a 36% capital gains tax on crypto, illustrating the fragmented nature of regulation worldwide.

Wider market conditions are also significant. XRP continues to be closely correlated with Bitcoin and overall crypto risk sentiment, meaning macroeconomic factors, including interest rate expectations and ETF flows, could either enhance or limit this breakout attempt.

With the price now approaching the $1.60 resistance zone, the next movement could determine the direction of momentum moving forward.

The post XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation appeared first on Cryptonews.