Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

XRP Price Forecast: Retail Participation Fades, On-Chain Activity Plummets – Is XRP Gradually Fading Away?

You may not want to hear this, but XRP metrics are on the decline.

Retail participation is dwindling in on-chain activity, raising questions about optimistic XRP price forecasts.

As of this writing, XRP is valued at $1.60, which is another crucial support level that may soon falter (ouch).

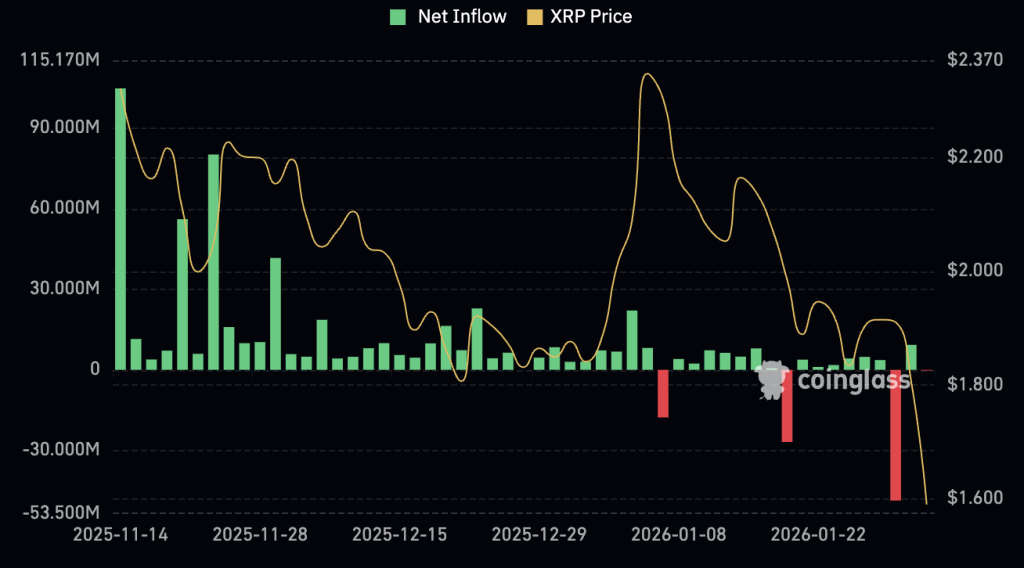

This is occurring while XRP ETFs have experienced largely positive inflows. However, the outflow figures surpassed the steady inflows, resulting in a negative January.

Total XRP Spot ETF Netflow / Coinglass

Total XRP Spot ETF Netflow / Coinglass

XRP On-Chain Activity Plummets: Is Retail Departing?

XRP active addresses have dropped to unprecedented lows throughout January. The XRP Ledger has recorded 15,743 active accounts, the lowest point since February of the previous year.

Source: XRP Ledger: Active Addresses / CryptoQuant

Source: XRP Ledger: Active Addresses / CryptoQuant

This indicates a decline in retail involvement or on-chain demand. Velocity data supports this perspective. Despite some fluctuations, it has not maintained an upward trend comparable to what was observed in 2024.

Rather, it has remained unstable, suggesting that token movement is primarily influenced by short-term trading rather than sustained usage by an expanding user base.

XRP Price Outlook: Is There Any Positive News?

The open interest in XRP has decreased to approximately $2.9 billion, marking its lowest point in over a year as prices continue to trend downward. This demonstrates a widespread decrease in trader confidence.

XRP’s price remains trapped in a steep declining channel, and the latest movement only exacerbates the situation. The price has retreated back to the $1.60 region after failing to regain resistance around $2.20, which keeps the overall trend distinctly bearish.

The RSI is around 28, indicating that XRP is technically oversold, and a short-term rebound is possible, but that rebound would likely be corrective unless the price can break above the channel and maintain a daily close over $2.20.

If $1.60 fails to hold on a daily close, the chart opens up for a deeper decline towards the $1.40 area, where the next substantial demand resides.

Until on-chain activity stabilizes and the price reclaims lost resistance, any strength in XRP appears to be a relief move within a broader capitulation phase, rather than the beginning of a genuine recovery.

Retail Exiting XRP Could Be Opting for Bitcoin Hyper

The collapse of XRP’s on-chain activity, the outflow of open interest, and the declining price are not solely issues pertaining to XRP. This is what occurs when retail exits the market, and speculation diminishes.

Bitcoin Hyper is attempting to engage in a different strategy. Instead of pursuing retail excitement or short-term rotations, it concentrates on enhancing Bitcoin itself.

The concept is straightforward. Bitcoin still commands value, but it is slow, costly, and cumbersome to use during market stress. Bitcoin Hyper aims to resolve these issues.

Designed as a Layer 2 focused on Bitcoin, Bitcoin Hyper is integrating Solana’s speed and low fees into the Bitcoin ecosystem while maintaining Bitcoin’s security.

Rapid payments, smart contracts, dApps, and even meme coins are all included in the plan, yet anchored to Bitcoin rather than drifting as another fragile alt-narrative.

Despite the market’s bleak outlook, interest in the project continues to grow.

The presale has already garnered over $31,000,000, with $HYPER priced at $0.013635 prior to the next increase.

Staking rewards of up to 38% are also available, providing early investors with yield exposure at a time when most altcoins are just losing value.

Bitcoin Hyper has undergone audits by Consult and is progressing towards a complete ecosystem with wallets, bridges, staking, explorers, and on-chain tools. The focus is not on a quick surge but on what genuinely works when retail evaporates and speculation wanes.

If this market is indeed eliminating weak narratives, Bitcoin Hyper is betting that improving Bitcoin is more advantageous than merely hoping that altcoins suddenly revive.

Visit the Official Bitcoin Hyper Website Here

The post XRP Price Prediction: Retail Is Disappearing, On-Chain Activity Collapses – Is XRP Quietly Dying? appeared first on Cryptonews.