Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Wintermute Declares End of Crypto Bull Market – Three Factors Will Shape 2026

The conventional four-year cycle of cryptocurrency has disintegrated, giving way to a new market framework where liquidity concentration and investor positioning dictate price movements, as highlighted in a thorough year-end assessment by prominent OTC desk Wintermute.

The firm’s proprietary trading insights indicate that 2025 represented a pivotal change in the trading dynamics of digital assets, with the year’s subdued performance signifying crypto’s shift from speculation-driven surges to a more institutionally supported asset class.

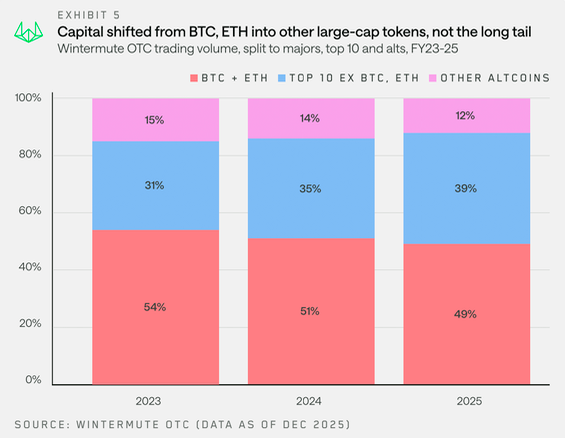

Wintermute’s OTC flow statistics illustrate a significant decline in the historical trend of Bitcoin profits being reinvested into Ethereum, followed by blue-chip assets, and ultimately altcoins.

Source: Wintermute

Source: Wintermute

Exchange-traded funds and digital asset treasury firms have evolved into what the company refers to as “walled gardens,” which create persistent demand for large-cap assets without facilitating a natural capital rotation into the wider market.

As retail attention shifted towards equities, 2025 became a year characterized by extreme concentration, where a select few major tokens absorbed the majority of new investments while the broader market faced challenges.

Source: Wintermute

Source: Wintermute

Traditional Seasonality Disrupted by Structural Changes

Trading patterns in 2025 exhibited a markedly different behavior compared to prior years, disrupting what had seemed like seasonal trends.

Initial optimism at the start of the year regarding the pro-crypto U.S. administration quickly turned to disappointment as risk sentiment sharply declined during the first quarter, coinciding with the waning of memecoin and AI-agent narratives.

Trump’s tariff announcement on April 2 added further pressure on the markets, concentrating trading activity early in the year before a general softening occurred through spring and summer.

The anticipated late-year resurgence seen in 2023 and 2024 failed to emerge, undermining expectations surrounding “Uptober“ and year-end rallies.

Wintermute’s data indicates these were never genuine seasonal trends but rather rallies prompted by unique catalysts like ETF approvals in 2023 and the new U.S. administration in 2024.

Markets became increasingly volatile as macroeconomic forces took precedence, with trading flows becoming reactive and sporadic based on headlines without lasting momentum.

Altcoin rallies sharply shortened, averaging approximately 19 days in 2025, down from 61 days the previous year.

Themes such as memecoin launchpads, perpetual DEXs, and the x402 meta triggered brief spikes in activity but did not evolve into sustained market-wide rallies, primarily due to volatile macro conditions and market exhaustion following the excesses of 2024.

Institutional Engagement Intensifies Despite Lackluster Returns

Although price movements were modest, institutional participants displayed resilience throughout 2025.

Wintermute recorded a 23% year-over-year increase among institutional players, including crypto-native funds, asset managers, and traditional financial entities.

Engagement deepened significantly, with trading becoming more sustained and focused on intentional execution rather than speculative positioning.

The firm’s derivatives data also indicates that options activity more than doubled compared to the previous year, with systematic yield and risk management strategies dominating flows for the first time, rather than sporadic directional bets.

By the fourth quarter, options notional reached 3.8 times the levels seen in the first quarter, while the number of trades doubled, reflecting ongoing growth in both ticket size and frequency.

Both institutional and retail investors shifted back into major assets by year-end following the deleveraging event on October 10, which triggered approximately $19 billion in liquidations within 24 hours.

Altcoin open interest also plummeted by 55%, from roughly $70 billion to $30 billion by mid-December, as forced unwinding eliminated excess leverage concentrated outside Bitcoin and Ethereum.

Three Catalysts Could Expand Recovery in 2026

Wintermute identifies three scenarios that would need to unfold for market breadth to extend beyond large-cap concentration.

First, ETFs and DATs must widen their mandates, with early indications appearing in the Solana and XRP ETF filings.

Second, significant rallies in Bitcoin or Ethereum could create wealth effects that ripple into the broader market, similar to the trend seen in 2024, although the recycling of capital remains uncertain.

Third, and the least likely, retail investor interest might shift back from equities and AI narratives toward crypto, attracting new capital inflows and stablecoin minting.

“2025 fell short of the anticipated rally, but it may signify the onset of crypto’s evolution from a speculative phase to an established asset class,” Wintermute’s analysis concludes.

Independent evaluations from Adler Asset Management reinforce the ongoing theme of deleveraging extending into 2026.

Adler highlighted that the Bitcoin Advanced Sentiment Index plummeted from the High Bull zone around 80% to 44.9%, breaking below the neutral 50% mark and indicating a shift in market regime.

The most significant long liquidation cascade observed during their entire monitoring period occurred on January 19, with over $205 million liquidated in a single hour as the price fell from $95,400 to $92,600 within 24 hours.

Whether concentration endures or liquidity expands beyond a select few large-cap assets will determine the outcomes for 2026, with understanding where capital can flow and what structural adjustments are necessary proving essential for navigating the post-cycle crypto landscape.

The post Wintermute Says Crypto’s Bull Cycle Is Over – Three Forces Will Drive 2026 appeared first on Cryptonews.