Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Why Is Cryptocurrency Declining Today? – August 26, 2025

The cryptocurrency market has experienced another decline today, with 98 of the top 100 coins showing losses in the last 24 hours. The total market capitalization for cryptocurrencies has fallen by 2.4%, now at $3.87 trillion, moving further from the $4 trillion threshold. Concurrently, the overall trading volume in the crypto space is at $199 billion.

TLDR:

Crypto Winners & Losers

As of this writing, all top 10 coins by market capitalization have seen declines over the past 24 hours.

Bitcoin (BTC) has dropped another 2%, now trading below $110,000 at $109,971.

Meanwhile, Ethereum (ETH) has decreased by 5%, currently priced at $4,414.

The most significant decline was noted in Solana (SOL), followed by Dogecoin (DOGE), which fell by 7.5% and 6%, now trading at $187.85 and $0.2097, respectively.

The smallest decrease in this category is BNB‘s 1.2%, currently valued at $862.

Among the top 100 coins, three coins have appreciated, with only one exceeding 1%. Cronos (CRO) has risen by 1.9%, now priced at $0.1598.

The others have increased by less than 0.5% each, indicating they are virtually unchanged.

Conversely, Chainlink (LINK) experienced the largest drop, falling 9.8% to $23.08.

This was followed by OKB (OKB), which declined by 8.4%, now trading at $172.

In the meantime, economist and Bitcoin critic Peter Schiff suggested that BTC could fall to around $75,000 or even lower.

He recommended BTC holders to “sell now and buy back later,” expressing that “given all the hype and corporate buying, this weakness should be cause for concern.”

According to Schiff’s forecast, Bitcoin might drop to levels last observed in April 2025. “At a minimum, a decline to about $75K is in play, just below $MSTR’s average cost.”

Bitcoin just dropped below $109K, down 13% from its high less than two weeks ago. Given all the hype and corporate buying, this weakness should be cause for concern. At a minimum, a decline to about $75K is in play, just below $MSTR’s average cost. Sell now and buy back lower.

— Peter Schiff (@PeterSchiff) August 26, 2025

The Path Ahead Could Be Bumpier Than Expected

Sean Dawson, head of research at onchain options platform Derive.xyz, noted that the probability of BTC dropping to $100,000 by the end of September has risen from 20% to 35%, while the chances for ETH retesting $4,000 in the same timeframe have exceeded 55%.

He remarked that: “With macro pressure building and volatility spiking, markets are resetting fast, and the path ahead could be bumpier than many were positioned for.”

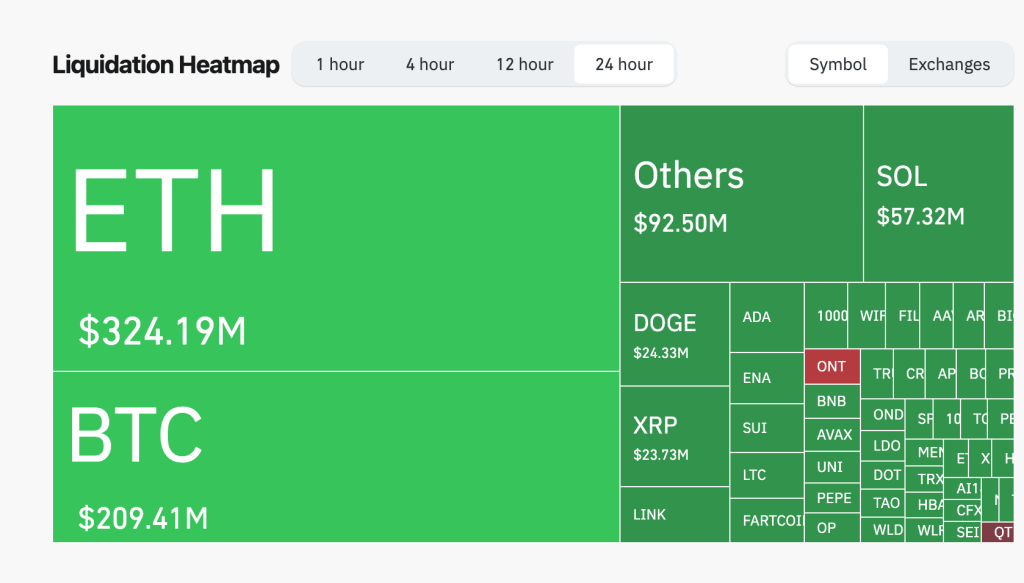

Dawson also stated, “it’s been a bloody start to the week for the majors.” There were over $900 million in liquidations across the market, with ETH and BTC accounting for the majority: $324 million and $209 million, respectively. Furthermore, “nearly all were long positions forced underwater after a broad-based correction.”

Source: Derive.xyz, Coinglass

Source: Derive.xyz, Coinglass

“This sharp move appears to be the result of overleveraged positioning, particularly following ETH’s recent run-up, and an overnight dip in the S&P 500, which weighed on risk assets more broadly,” Dawson explained.

As a result, short-dated volatility has surged. Daily BTC volatility increased from 15% to 38%, while ETH volatility rose from 41% to 70%.

“These movements reflect rising trader anxiety ahead of key macroeconomic catalysts, particularly US GDP figures set to be released on August 28 and the unemployment rate due early September,” Dawson added.

Source: Derive.xyz, Amberdata

Source: Derive.xyz, Amberdata

Lastly, there has been a shift in sentiment. Dawson highlighted that the 25-delta skew has turned negative for BTC and ETH, indicating a preference for puts over calls. “This is the strongest demand for downside protection we’ve seen in two weeks. Traders appear to be preparing for potential retests of $4K for ETH and $100K for BTC,” he concluded.

Levels & Events to Watch Next

As of Tuesday morning, BTC is trading at $109,971. The coin has experienced another sharp decline for the second consecutive day, dropping from $112,815 to $109,214.

It is now 11.4% away from its all-time high of $124,128.

Additionally, it is possible that the price may continue to trend toward the $105,000 level.

Bitcoin Price Chart. Source: TradingView

Bitcoin Price Chart. Source: TradingView

Ethereum is currently priced at $4,414. It too has seen a significant drop today, from an intra-day high of $4,667 to a low of $4,342, before experiencing a slight recovery.

Similar to the overall market, ETH still has potential for further declines, at least for the time being. We are currently considering a possibility of $4,300 and below.

Moreover, the sentiment in the crypto market has further diminished, barely remaining in the neutral zone. The crypto fear and greed index has decreased from 50 yesterday to 43 today. This marks the lowest level since late June.

The current reading indicates growing fear in the market, along with an increase in bearish sentiment.

Source: CoinMarketCap

Source: CoinMarketCap

In addition, as of August 25, US BTC spot exchange-traded funds (ETFs) have ended their recent streak of outflows, with positive inflows of $219 million.

Six funds experienced inflows, all of which were positive. Fidelity leads with $65.56 million, followed by BlackRock and Ark&21Shares, with $63.38 million and $61.21 million, respectively.

Source: SoSoValue

Source: SoSoValue

Conversely, US ETH ETFs saw additional inflows on Monday amounting to $443.91 million.

Seven of the nine funds recorded flows: six inflows and one outflow. Grayscale withdrew $29.17 million, while BlackRock added $314.89 million.

Source: SoSoValue

Source: SoSoValue

Additionally, Pantera Capital is preparing to raise $1.25 billion to transform a Nasdaq-listed company into “Solana Co.,” a public entity designed to accumulate Solana (SOL) as a treasury asset.

Simultaneously, Kraken has engaged in discussions with the US Securities and Exchange Commission (SEC) regarding its plans to expand into tokenized markets.

Kraken met w/ SEC Crypto Task force today to discuss tokenization of traditional assets…

Included the legal & regulatory framework for operating a tokenized trading system in the *US*.

It’s coming. pic.twitter.com/hAbJB7FRa8— Nate Geraci (@NateGeraci) August 25, 2025

Furthermore, B Strategy, a digital asset investment firm established by former Bitmain executives, has announced the launch of a $1 billion BNB-focused treasury company.

Several family offices based in Asia, including those linked to Binance founder Changpeng Zhao, have reportedly supported the initial fundraising.

.@BStrategyTech is launching a US-listed BNB Treasury Company targeting a $1B raise.

It aims to become the “Berkshire Hathaway of the BNB ecosystem.”

Beyond holding, it’ll reinvest into BNB’s infra, builders, and community –fueling capital into ecosystem growth.https://t.co/k3sxJIGYyN

— YZi Labs (@yzilabs) August 25, 2025

Quick FAQ

- Why did crypto move with stocks today?

The crypto market declined over the past day, mirroring the stock market’s performance on Monday. By the end of the trading day, the S&P 500 was down by 0.43%, the Nasdaq-100 fell by 0.31%, and the Dow Jones Industrial Average decreased by 0.77%. The momentum that followed US Federal Reserve Chair Jerome Powell’s speech on Friday has diminished since.

- Is this dip sustainable?

For the moment, yes. It may continue. Positive macroeconomic and regulatory developments could positively influence prices. Meanwhile, the markets will need to endure the recent pullback until they are prepared for the next upward movement.

You may also like: (LIVE) Crypto News Today: Latest Updates for August 26, 2025 The crypto market is showing bearish signals today as the entire crypto market cap is down over 4%. Bitcoin slipped below the $110K mark, triggering nearly $940 million in liquidations in the past 24 hours, out of which $800 million are long positions. Ethereum is also losing momentum after weeks of outperformance. Market fragility is being amplified by heavy ETF outflows, collapsing transaction fees, and thin liquidity, even as sovereign and institutional players quietly accumulate…

The post Why Is Crypto Down Today? – August 26, 2025 appeared first on Cryptonews.