Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Web3 Losses Decrease by 23% in Q1 2024, Potential $100 Billion in Locked Funds Targeted by Hackers – Immunefi

The initial quarter of this year has recorded a loss of $336 million due to Web3 hackers and fraudulent activities, with nearly half of the funds taken in January alone. However, this figure indicates a 23% decline compared to the first quarter of 2023, as per the latest findings from bug bounty and security services platform Immunefi.

Significantly, the team noted that approximately $100 billion in capital has been secured within Web3 protocols as of March 2024, adding:

“That capital represents an unparalleled and attractive opportunity for blackhat hackers.”

Additionally, it is important to highlight that $73,885,000 has been retrieved from stolen Web3 assets in 7 distinct cases.

Specifically, $62 million was recovered from the Munchables exploit and $5.3 million from the Seneca exploit.

This recovery accounts for 22% of the total losses in the first quarter, the report stated.

$336.3 Million Lost in 61 Web3 Incidents

The report examined the amount of cryptocurrency funds lost by the community due to hacks and scams during the first three months of this year.

In particular, the Immunefi team analyzed all occurrences in Web3 where:

- blackhat Web3 hackers targeted crypto protocols;

- protocols were allegedly involved in a rug pull.

They identified 61 such incidents, encompassing both successful and semi-successful hacks as well as alleged fraud.

Source: Immunefi

Source: Immunefi

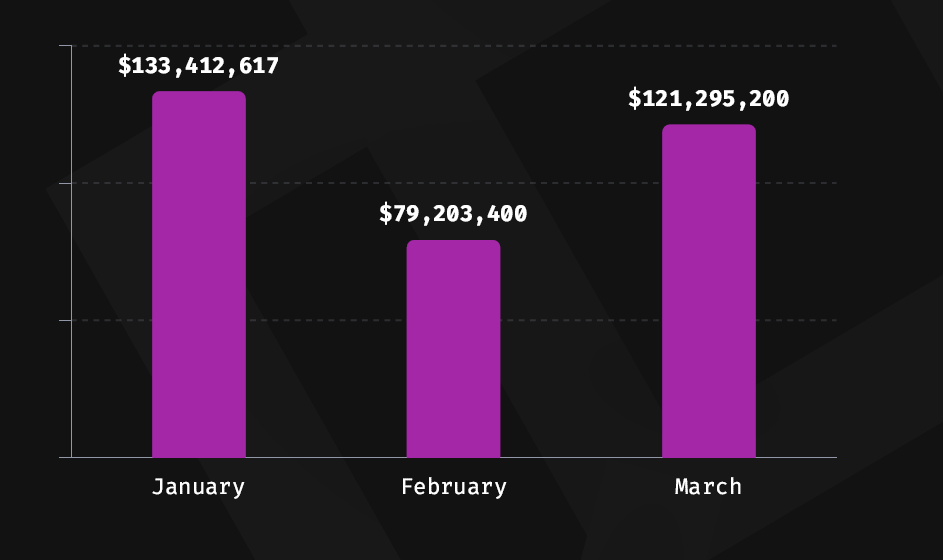

Overall, the team found that $336,311,217 was lost in Q1 2024.

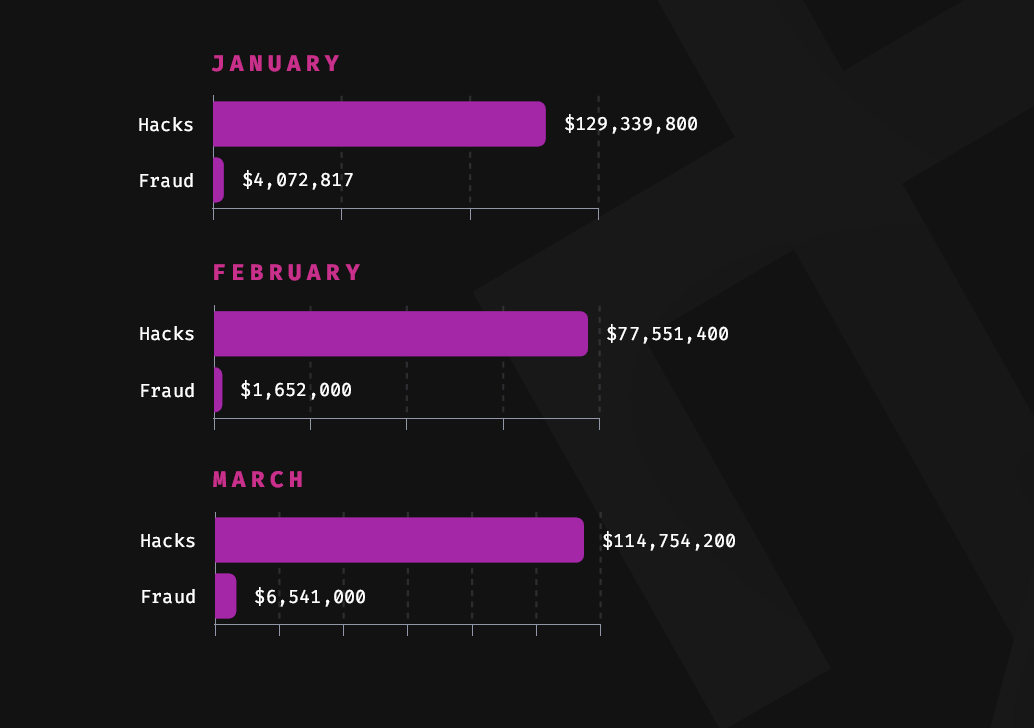

Of this total, hacks accounted for $321,645,400 across 46 specific incidents.

Fraud was responsible for an additional $14,665,817 lost across 15 specific incidents.

This total signifies a 23.1% reduction compared to Q1 2023, when hackers and fraudsters took $437,483,543, the report highlighted.

Moreover, the majority of this loss occurred in January alone, with over $133 million stolen.

Mitchell Amador, Founder and CEO at Immunefi, remarked that “while it’s positive that overall losses have decreased, it’s essential to note that DeFi faced significant challenges, accounting for 100% of total losses in Q1 2024.”

“Particularly,” he noted, “the ecosystem experienced a substantial volume of losses due to private key compromises, underscoring the critical need to secure both code and protocol infrastructure.”

DeFi and Ethereum Are Main Targets

Regarding decentralized finance (DeFi), it is not surprising that the sector continues to be the primary target for exploits.

“DeFi represented 100% of the total losses, while CeFi has not experienced a single attack,” the report stated.

To provide context, the $336.3 million in total losses in Q1 across the 61 incidents mentioned above – all of it was lost in DeFi.

Nonetheless, this still reflects a 22.8% decrease compared to Q1 2023, when DeFi losses amounted to $435,675,543.

In contrast, in Q1 of the previous year, centralized finance (CeFi) incurred losses of $1,808,000.

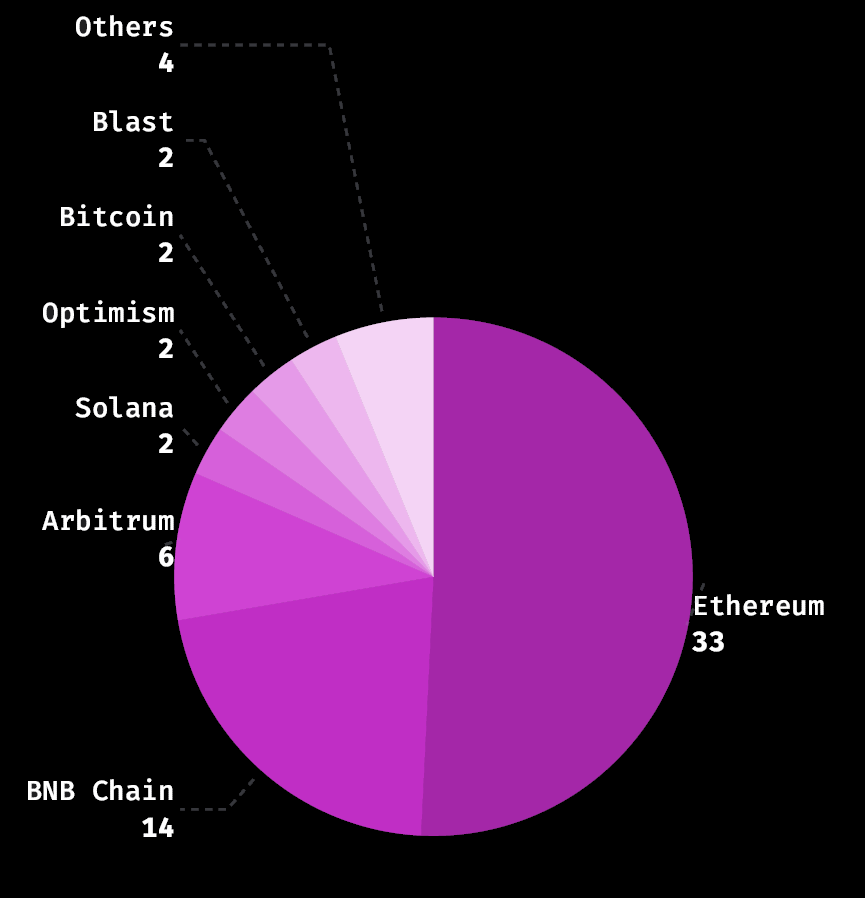

Returning to the first quarter of this year: Ethereum “once again surpassed” BNB Chain as the most targeted chain.

Ethereum experienced the highest number of individual attacks: 33 incidents, or 51% of the total losses across targeted chains.

Following closely, BNB Chain faced 14 incidents, or 22% of total losses.

Together, these two chains accounted for over half of the chain losses in Q1 2024, totaling 73%.

Other impacted chains include Arbitrum, Solana, Optimism, Bitcoin, Blast, Polygon, Conflux Network, and Base, respectively.

Source: Immunefi

Source: Immunefi

Meanwhile, the majority of the $336 million was lost by two projects.

In January, Orbit Bridge, the bridging service of the cross-chain protocol Orbit Chain, suffered a significant exploit amounting to $81.7 million.

In March, Munchables, an NFT game on the Ethereum layer 2 Blast, experienced an exploit resulting in $62.8 million in losses.

These two projects collectively lost $144,480,000, representing 43% of Q1 losses, the report indicated.

Web3 Hackers Lead the Way

In comparison to fraud, hacks remain the predominant cause of fund loss in the scamming landscape.

Hacks constituted 95.6% of losses in Q1 2024, while fraud accounted for merely 4.4%.

In total, hackers took $321,645,400 in Q1 2024 across 46 specific incidents. This marks a 23.1% decline compared to Q1 2023, when losses from hacks reached $418,589,089.

Conversely, $14,665,817 was lost to fraud in Q1 2024 across 15 incidents. This represents a 22.4% decrease compared to Q3 2022, when losses from frauds, scams, and rug pulls totaled $18,894,454, according to Immunefi.

Source: Immunefi

Source: Immunefi

Meanwhile, Immunefi, which safeguards over $60 billion in Web3 user capital, offers more than $155 million in available bounty rewards.

It has disbursed over $95 million in total bounties, preserving over $25 billion in user funds, the team stated.

The post Web3 Losses Cut By 23% in Q1 2024, Hackers May Be Eyeing $100 Billion in Locked Funds – Immunefi appeared first on Cryptonews.