Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Vitalik Buterin Takes Out 16,384 ETH as Ethereum Foundation Begins ‘Austerity Phase’ — Why?

Vitalik Buterin, co-founder of Ethereum, has withdrawn 16,384 ETH, approximately valued at $44.5 million at present prices, as the Ethereum Foundation enters what he referred to as a phase of “mild austerity.”

In a message shared on X, Buterin stated that the Ethereum Foundation is revising its spending strategy to achieve two simultaneous objectives.

Over the next five years, the Ethereum Foundation is transitioning into a state of mild austerity to effectively achieve two aims:

1. Execute an ambitious roadmap that secures Ethereum’s position as a high-performing and scalable world computer without compromising on…— vitalik.eth (@VitalikButerin) January 30, 2026

The aim includes delivering a bold technical roadmap that preserves Ethereum’s scalability, decentralization, and resilience while also allowing the foundation to become self-sustaining long-term and protect Ethereum’s core principles.

He stressed that this shift is not indicative of financial difficulties but a deliberate response to the current market landscape, necessitating a more focused approach.

Buterin Connects ETH Withdrawals to Open-Source Financing and Fiscal Responsibility

<pas part of this shift, buterin mentioned that he is taking on the responsibility personally, which could have been handled through individual projects within foundation.

He characterized the ETH withdrawal as a gradual process over several years aimed at supporting open-source, secure, and verifiable software and hardware in various fields such as finance, communication, governance, operating systems, secure hardware, and privacy-enhancing technologies.

He also noted his consideration of decentralized staking alternatives, which might allow future staking incentives to be redirected towards the same goals.

This withdrawal coincides with a broader downturn in cryptocurrency markets, with Ether trading at around $2,720, significantly lower than its October peak of about $4,831.

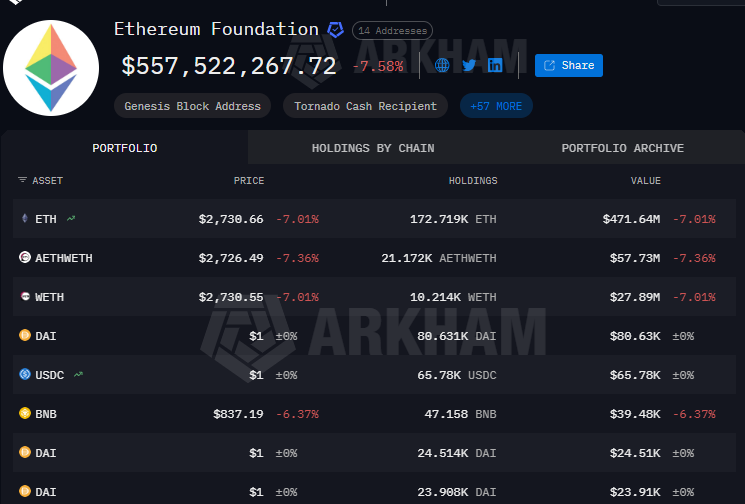

As reported by blockchain analytics firm Arkham Intelligence, the Ethereum Foundation holds a crypto portfolio valued at around $554.5 million, with approximately 172,719 ETH making up the bulk of its treasury at this time.

Source: Arkham

Source: Arkham

Other assets include ETH held in Aave, wrapped ETH, and smaller holdings in stablecoins such as DAI and USDC.

Buterin himself is estimated to possess crypto assets valued at around $666 million.

The foundation has characterized its current phase as one of fiscal responsibility rather than cutbacks.

Officials and researchers with knowledge of its financial situation have indicated that the framing of “austerity” pertains to more cautious spending and extended planning horizons during a market downturn, rather than a lack of funds.

The foundation’s activities include core protocol development, research, and grants, with an ongoing reassessment of discretionary expenditures.

Vitalik Buterin Outlines Vision for a More Efficient Ethereum in 2026

Buterin’s statements can be categorized within a broader array of new declarations outlining his vision for Ethereum’s future.

Earlier in January, he warned that Ethereum risks becoming overly complex unless developers actively simplify the protocol by removing certain features.

Vitalik Buterin (@VitalikButerin) is urging developers to address protocol bloat, cautioning that continuously adding new features without removing old ones jeopardizes trustlessness and self-sovereignty #Ethereum #VitalikButerin https://t.co/ZRSGvofqph

— Cryptonews.com (@cryptonews) January 19, 2026

In another post from January, Vitalik Buterin indicated that 2026 would signify a drive to restore self-sovereignty, highlighting easier full-node operations through zero-knowledge tools, enhanced privacy, and reduced reliance on centralized systems.

These proposals underscored Ethereum as “people-first” infrastructure, emphasizing users who depend on it for financial autonomy and secure communication rather than prioritizing convenience-driven mainstream adoption.

This period also aligns with indications of renewed activity on the Ethereum network.

After the Fusaka upgrade in December, average transaction fees dropped significantly, and activity on the mainnet has surged.

Data from Token Terminal and Etherscan reveal daily active addresses approaching one million in mid-January, briefly exceeding activity on major layer-2 networks.

Source: Token Terminal

Source: Token Terminal

Weekly decentralized exchange volumes on Ethereum have increased to around $13 billion, up from just over $8 billion a month prior, with the overall Ethereum ecosystem reaching nearly $27 billion in weekly DEX volume.

Despite the foundation’s more stringent spending approach, Ethereum continues to be the largest platform for decentralized applications and smart contracts, securing tens of billions of dollars in value across DeFi and other applications.

The post Vitalik Buterin Withdraws 16,384 ETH as Ethereum Foundation Enters ‘Austerity Phase’ — What For? appeared first on Cryptonews.

Vitalik Buterin (@VitalikButerin) is urging developers to address protocol bloat, cautioning that continuously adding new features without removing old ones jeopardizes trustlessness and self-sovereignty #Ethereum #VitalikButerin https://t.co/ZRSGvofqph

Vitalik Buterin (@VitalikButerin) is urging developers to address protocol bloat, cautioning that continuously adding new features without removing old ones jeopardizes trustlessness and self-sovereignty #Ethereum #VitalikButerin https://t.co/ZRSGvofqph