Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Venezuelan Man Charged with 20 Years for Alleged $1 Billion Cryptocurrency Money Laundering Plot

Federal authorities have indicted a Venezuelan individual for allegedly laundering around one billion dollars through cryptocurrency wallets and shell corporations, which officials describe as one of the most significant money-laundering cases pursued by the Justice Department.

Jorge Figueira, 59, could face a maximum of 20 years in prison if found guilty of conspiracy to launder money, as officials claim his network facilitated the movement of illegal funds across several continents while intentionally hiding transactions from law enforcement.

The complaint submitted in Virginia’s Eastern District accuses Figueira of managing an intricate laundering system that transformed cash into cryptocurrency, transferred digital assets across various wallets, and then converted them back into dollars before sending the proceeds to designated recipients in high-risk areas, including Colombia, China, Panama, and Mexico.

Prosecutors assert that over one billion dollars passed through identified crypto wallets and financial accounts from 2018 to the present, with the majority of incoming funds stemming from cryptocurrency trading platforms.

The U.S. DOJ has charged Venezuelan national Jorge Figueira with conspiring to launder approximately $1 billion in illicit funds through bank accounts, crypto exchanges, and private wallets. The investigation, aided by the FBI, alleges extensive crypto-based transactions to obscure the origins of the funds.…

— Wu Blockchain (@WuBlockchain) January 16, 2026

Billion-Dollar Network Operated Through Multiple Jurisdictions

Court records indicate that Figueira purportedly recruited accomplices to carry out hundreds of transfers aimed at obscuring the origins and destinations of the funds.

The operation utilized various bank accounts, crypto exchange accounts, personal digital wallets, and shell companies to transfer large sums of illegal money into and out of the United States, according to federal authorities.

FBI Washington Field Office Criminal Division Special Agent in Charge Reid Davis mentioned that the bureau has traced about $1 billion in cryptocurrency moving through wallets linked to Figueira’s laundering scheme.

The network allegedly catered to individuals and businesses globally while executing numerous transfers meant to disguise the nature of the funds and potentially enable criminal activities across multiple nations.

U.S. Attorney Lindsey Halligan highlighted the magnitude of the alleged criminal activity, asserting that “money laundering at this scale empowers transnational criminal organizations to function, grow, and cause real-world damage.”

“Those who facilitate the movement of illicit funds in the billions should anticipate being identified, disrupted, and held fully accountable under federal law,” she cautioned.

Federal Crackdown Extends Across Multiple Crypto Crime Networks

The charges against Figueira come amidst heightened federal enforcement efforts targeting crypto-related money laundering across the nation.

Earlier this week, Manhattan District Attorney Alvin Bragg urged New York lawmakers to criminalize unlicensed crypto operations, which he characterized as a “$51 billion criminal economy.“

Federal statistics illustrate the extent of crypto-enabled crime, with the FBI reporting nearly 11,000 complaints related to crypto ATMs in 2024, totaling in excess of $246 million.

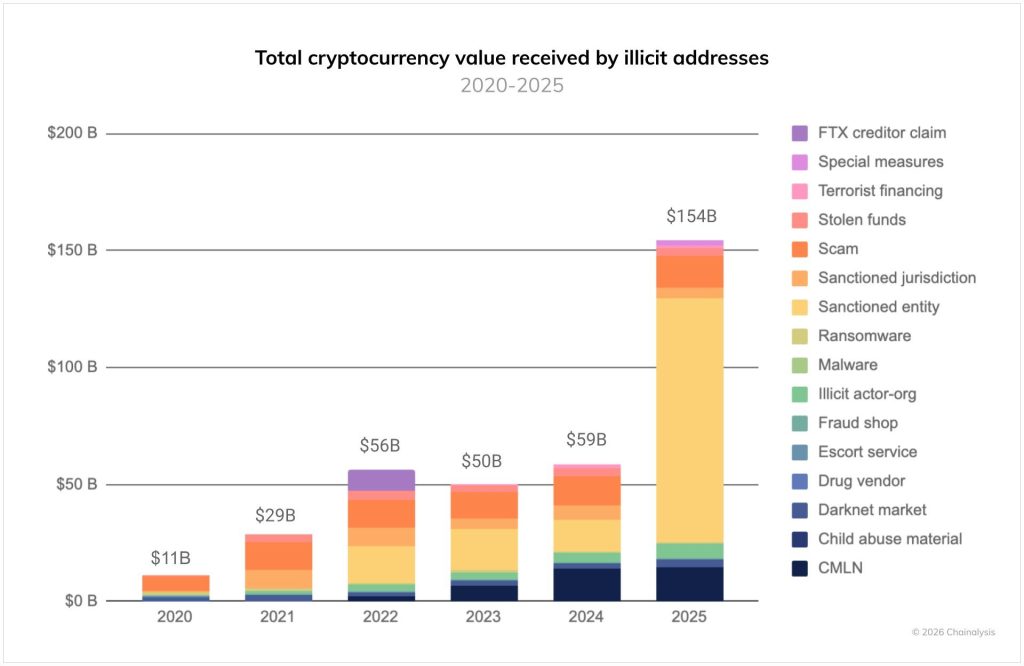

Meanwhile, blockchain analytics firm Chainalysis discovered that illicit crypto addresses received an unprecedented $154 billion in 2025, marking a significant rise from previous years.

Source: Chainalysis

Source: Chainalysis

Recent prosecutions have targeted operations across the criminal spectrum.

On Thursday, Utah resident Brian Garry Sewell received a three-year prison sentence for orchestrating a $2.9 million fraud scheme while concurrently running an unlicensed cash-to-crypto venture that converted over $5.4 million in bulk cash.

Last month, prosecutors charged another 23-year-old Brooklyn resident, Ronald Spektor, with stealing approximately $16 million from around 100 Coinbase users through alleged phishing schemes that relied on panic tactics rather than technical hacks.

Given the ongoing massive seizures, the government has initiated the establishment of the Strategic Bitcoin Reserve, formalizing the retention of confiscated cryptocurrency instead of auctioning it off.

This was one of the first actions taken by Donald Trump upon taking office, including signing an executive order to support it.

Recently, a shift occurred when it was revealed that the U.S. Department of Justice seems to have sold 57 Bitcoin forfeited by Samourai Wallet developers.

A White House crypto advisor stated that the U.S. government has not sold any Bitcoin forfeited in the Samourai Wallet case.#DOJ #Bitcoinhttps://t.co/pfX7fkilo8

— Cryptonews.com (@cryptonews) January 17, 2026

However, White House crypto advisor Patrick Witt confirmed yesterday, Friday, that the Bitcoin forfeited in this case has not been liquidated and will remain part of the reserve per executive order, with current federal holdings estimated at 328,372 BTC valued at over $31 billion.

For the time being, a criminal complaint serves only as an accusation, and Figueira is presumed innocent until proven guilty. Assistant U.S. Attorney Catherine Rosenberg is prosecuting the case, with sentencing guidelines and statutory factors to be taken into account if a conviction is achieved.

The post Venezuelan Man Faces 20 Years for Alleged $1B Crypto Money Laundering Scheme appeared first on Cryptonews.

A White House crypto advisor stated that the U.S. government has not sold any Bitcoin forfeited in the Samourai Wallet case.#DOJ #Bitcoinhttps://t.co/pfX7fkilo8

A White House crypto advisor stated that the U.S. government has not sold any Bitcoin forfeited in the Samourai Wallet case.#DOJ #Bitcoinhttps://t.co/pfX7fkilo8