Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

USDH Stablecoin Launches on Hyperliquid with $2.2M Initial Trading Volume – Is it a Contender for Tether?

Hyperliquid’s native stablecoin, USDH, was introduced on September 23, achieving $2.2 million in initial trading volume.

This launch follows Native Markets’ success in a competitive governance election, where the startup outperformed established competitors, including Paxos and Ethena Labs, to gain the authority to issue USDH on the decentralized exchange.

Trading began with a USDH/USDC spot pair on HyperCore, while Native Markets disclosed that over $15 million in pre-minted tokens were ready for initial distribution.

The stablecoin successfully maintained its $1.00 peg during the early trading sessions, only fluctuating to $1.001 as market participants assessed the new asset’s liquidity and stability features.

USDH is now available for all Hyperliquid users!

The USDH / USDC spot order book is active on HyperCore, with over $15M USDH pre-minted in the last 24 hours.— Native Markets (@nativemarkets) September 24, 2025

Native Markets Initiates Controlled USDH Rollout

Native Markets designed the launch as a phased rollout, initially limiting individual transactions to $800 per user while core functionalities are tested in real-world conditions.

“USDH is now available for all Hyperliquid users,” the company stated on social media, emphasizing the completion of both HIP-1 and ERC-20 token deployments.

Several integration stages will take place over the upcoming months, starting with HyperEVM integrations, followed by the enhancement of USDH’s function as a spot quote asset.

Future advancements include native minting directly on HyperCore and USDH-margined perpetual contracts through the proposed HIP-3 protocol upgrade.

The issuer organized USDH reserves utilizing cash and short-term U.S. Treasury holdings managed off-chain by BlackRock, while on-chain tokenized assets function through Superstate and Stripe’s Bridge infrastructure.

Additionally, Native Markets is dedicated to allocating 50% of its reserve yield to Hyperliquid’s Assistance Fund, with the remaining portions designated for USDH ecosystem development.

This revenue-sharing model arose from the company’s competitive proposal that gained validator approval against more recognized rivals during the governance process in September.

Hyperliquid currently manages over $5.5 billion in Circle’s USDC, which represents approximately 8% of the token’s total supply and generates an estimated $220 million annually in treasury yield revenue for Circle.

Stablecoin Competition Grows as Platforms Aim for Revenue Independence

The USDH launch signifies a broader transformation within DeFi, as trading platforms strive to lessen their reliance on external stablecoin issuers and capture reserve yield revenue internally.

Tether’s USDT presently leads the market, with $173.05 billion in circulation, processing over $24.6 billion daily on TRON alone through around 2.4 million transactions, according to Coingecko’s data.

This infrastructure advantage extends to reserve backing, where Tether asserts 75.86% U.S. Treasury Bills and 12.09% overnight repos within its reserve portfolio.

Native stablecoins like USDH are adopting a distinct strategic approach, focusing on specific ecosystem integration rather than the cross-chain ubiquity that characterizes established players.

Bloomberg described similar governance contests as “bidding wars” spreading across DeFi platforms as institutions recognize significant revenue potential from stablecoin reserves.

The USDH power struggle on @HyperliquidX has concluded, with Native Markets securing the stablecoin mandate. Analysts indicate that competition now depends on branding and partnerships.#DeFi #Stablecoins https://t.co/vRvxxuLmEM

— Cryptonews.com (@cryptonews) September 17, 2025

The stablecoin landscape is experiencing increasing fragmentation, despite USDT’s dominance, with Chainalysis reporting $2.5 trillion in sector-wide transaction volumes that accommodate specialized players.

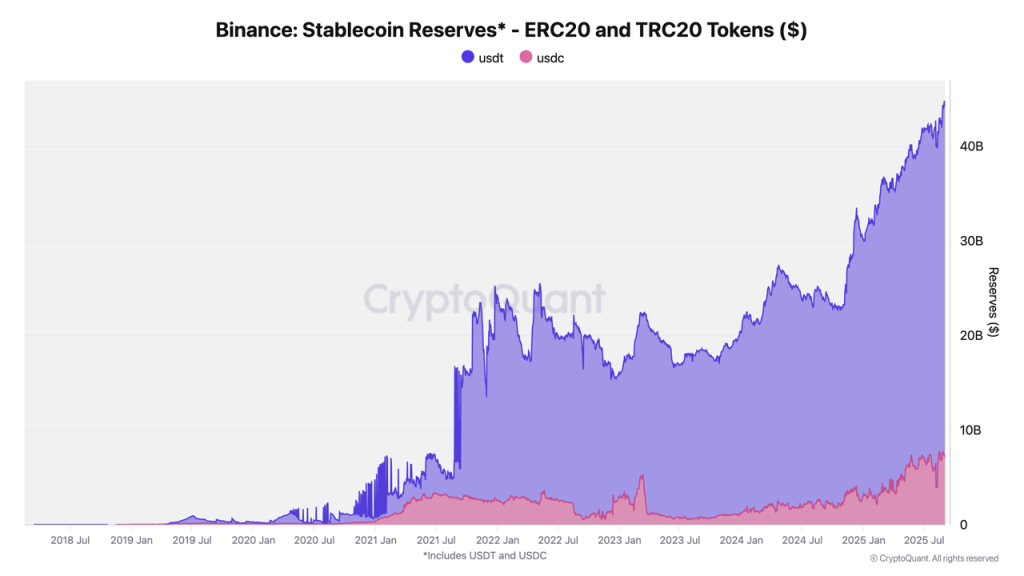

Binance currently holds 67% of all exchange stablecoin reserves, totaling $44.2 billion, which includes $37.1 billion in USDT and $7.1 billion in USDC.

Source: Cryptoquant

Source: Cryptoquant

Smaller stablecoins have also demonstrated rapid growth trajectories, with euro-denominated EURC increasing 89% month-over-month from $47 million to $7.5 billion in transactions over the past year.

Similarly, PayPal’s PYUSD surged from $783 million to $3.95 billion during the same timeframe.

These competitive dynamics arise as regulatory frameworks evolve, with the Trump-backed GENIUS Act and the EU’s MiCA creating opportunities for compliant alternatives to capture market share.

Industry forecasts from Citigroup suggest the sector could surpass a $2 trillion market capitalization by 2030, potentially allowing multiple players to coexist rather than resulting in a winner-take-all scenario.

Looking ahead, the success of ecosystem-focused stablecoins will likely hinge on the growth trajectories of their host platforms. For example, Hyperliquid generated $106 million in revenue during August 2025 alone, while reducing spot trading fees by 80% to enhance liquidity prior to the stablecoin launch.

The post USDH Stablecoin Goes Live on Hyperliquid with $2.2M Early Trading Volume – Can it Replace Tether? appeared first on Cryptonews.