Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

U.S. Cryptocurrency Funds Experience $952M Decline Amid Clarity Act Hold-Up – However, These Two Altcoins Remain Resilient

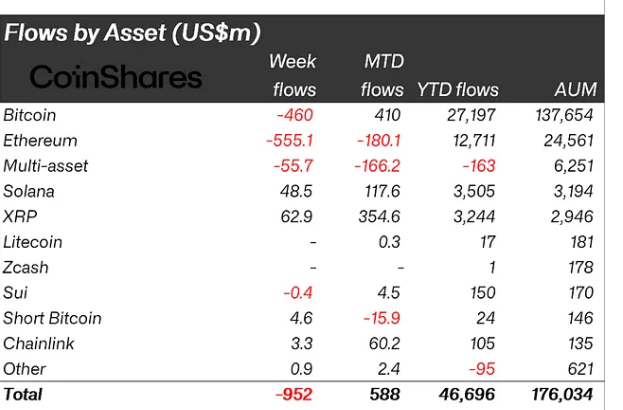

Digital asset investment funds in the U.S. experienced their first weekly withdrawals in a month, totaling $952 million, as delays associated with the long-awaited CLARITY Act unsettled investors and reignited concerns regarding regulation.

Data from CoinShares indicates that digital asset investment products faced $952 million in net outflows over the last week, representing the first negative flow since late November.

Source: coinshares.com

Source: coinshares.com

The decline was primarily influenced by delays related to the Digital Asset Market Clarity Act, commonly known as the CLARITY Act, which has prolonged regulatory ambiguity for cryptocurrency firms operating in the United States.

Concerns about continued selling from significant holders further dampened market sentiment.

Ether and Bitcoin Lead Crypto Fund Outflows While SOL and XRP Remain Resilient

The outflows were predominantly concentrated in the U.S., accounting for $990 million of the total.

Source: coinshares.com

Source: coinshares.com

This was only partially countered by inflows from Canada and Germany, where investors contributed $46.2 million and $15.6 million, respectively.

Ethereum was significantly impacted by the selling, experiencing $555 million in outflows.

Analysts observed that Ether is particularly sensitive to regulatory changes, given its pivotal role in decentralized finance and staking-related products that could be directly influenced by U.S. market structure regulations.

Despite the recent downturn, Ethereum investment products have still garnered $12.7 billion in inflows this year, significantly higher than the $5.3 billion recorded during the same timeframe in 2024.

Bitcoin products closely followed, with $460 million in outflows. Although Bitcoin continues to lead the market in absolute terms, year-to-date inflows of $27.2 billion are below last year’s $41.6 billion.

Total assets under management across all crypto exchange-traded products now amount to $46.7 billion, down from $48.7 billion at the same time in 2024, making it unlikely for the sector to exceed last year’s figures.

U.S. spot Bitcoin ETFs experienced similar pressures, reporting a weekly net outflow of $497.05 million as of December 19, even as cumulative inflows remain high at $57.41 billion.

US SOL Spot ETF Source: Sosovalue

US SOL Spot ETF Source: Sosovalue

In contrast, Solana and XRP continued to draw in new capital. Solana investment products saw inflows of $48.5 million, while XRP products gained $62.9 million.

US XRP Spot ETF Source: Sosovalue

US XRP Spot ETF Source: Sosovalue

This trend was reflected in U.S. spot ETFs, where XRP funds recorded $82.04 million in weekly inflows, and Solana ETFs added $66.55 million during the same period, continuing a multi-month trend of consistent accumulation.

Crypto Market Bill Encounters New Delay as Senate Postpones Vote to January

The market response unfolded as lawmakers confirmed additional delays to the CLARITY Act.

On Thursday, White House AI and crypto advisor David Sacks announced that the Senate markup for the long-anticipated Clarity Act will occur in January 2026, pushing back previous expectations that the bill would reach President Trump’s desk before the end of 2025.

We had a great call today with Chairmen @SenatorTimScott and @JohnBoozman who confirmed that a markup for Clarity is coming in January. Thanks to their leadership, as well as @RepFrenchHill and @CongressmanGT in the House, we are closer than ever to passing the landmark crypto…

— David Sacks (@davidsacks47) December 18, 2025

The House approved the legislation in July, but the Senate has yet to finalize its review, with the timeline disrupted by a record 43-day government shutdown in October and November.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump’s decisive Oval Office intervention rescues stalled crypto agenda.#GeniusAct #Trumphttps://t.co/Lm2tCBbimp

— Cryptonews.com (@cryptonews) July 16, 2025

The bill aims to clarify whether digital assets are classified under securities or commodities law and to delineate the roles of the Securities and Exchange Commission and the Commodity Futures Trading Commission.

While proponents argue it would alleviate uncertainty and create clearer compliance pathways, progress has been hindered by political and procedural obstacles.

Senate Banking Committee Chair Tim Scott and Agriculture Committee Chair John Boozman are anticipated to lead the markup, which may still undergo amendments before reaching a full vote.

Senator Cynthia Lummis had previously indicated that the bill could reach President Donald Trump’s desk before the end of 2025, but that prospect now seems less certain as election-year pressures begin to impact bipartisan discussions.

The post U.S. Crypto Funds Shed $952M as Clarity Act Delay Sparks Panic – But These 2 Alts Survive appeared first on Cryptonews.