Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

U.S. CPI Shows 0.3% Increase in December; BTC Stays at $92K as Rate-Hold Chances Strengthen

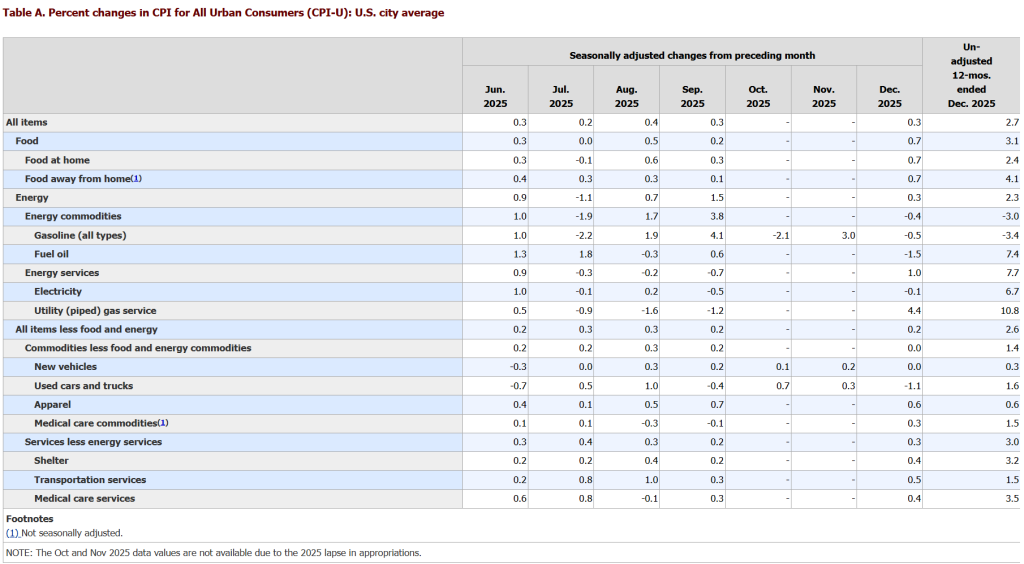

U.S. inflation experienced a marginal uptick in December, as the Bureau of Labor Statistics announced that the CPI-U increased by 0.3% m/m and 2.7% y/y, with shelter rising 0.4% m/m as the primary factor contributing to the monthly increase.

Source: bls.gov

Source: bls.gov

At the time of the announcement, Bitcoin was trading at about $92,176.63 (+1.62% 24h).

Market Response and Rate Expectations

Core inflation remained stable in the headline report. The BLS reported CPI ex-food & energy at 0.2% m/m and 2.6% y/y, consistent with the market’s expectation that “the Fed remains unchanged” leading up to the Jan. 29, 2026, FOMC meeting.

“The shelter index rose 0.4 percent in December and was the largest contributor to the overall monthly increase,” the release stated.

Rate pricing continues to be the main channel for crypto beta transmission. Public snapshots of CME FedWatch-derived probabilities that circulated in late December indicated a rate-hold bias for January, with “no change” likelihoods grouped around the high-70% range, as per KuCoin.

Volatility markets reflect the same macro outlook. Deribit’s documentation describes DVOL as the options-implied volatility benchmark that is settled via a 60-minute TWAP.

Implications for Crypto Markets

The shelter-driven CPI maintains a sticky term premium, yet core inflation at 0.2% mitigates the “higher-for-longer” tail risk that usually impacts BTC duration trades most significantly.

A 0.3% CPI coupled with a 0.2% core keeps the short end stable and redirects the crypto reaction function towards real yields and positioning: systematic funds that rely on macro surprise indices receive no new signal, while discretionary desks continue to treat BTC as a rates-vol proxy due to subdued implieds (DVOL-linked products) that reduce the carry cost for convexity ahead of the Jan. 29 meeting and the Feb. 11, 2026, CPI release date already set by the BLS.

The post U.S. CPI Prints 0.3% in Dec; BTC Holds $92K as Rate-Hold Odds Firm appeared first on Cryptonews.