Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Trump Tariffs Resurface — Implications for Bitcoin, Ether, XRP, and Cryptocurrency?

Bitcoin — along with the stock market — reacted negatively to “Liberation Day,” when Donald Trump revealed intentions to impose tariffs on several of America’s closest trading allies.

The leading cryptocurrency plummeted to approximately $75,000 in the week following his April announcement, driven by concerns that aggressive tariffs on imports would heighten inflation and potentially lead the U.S. into a recession.

Equities and digital currencies quickly recovered when Trump made a significant reversal — stating that tariffs would be postponed to allow major economies to negotiate trade agreements with the White House.

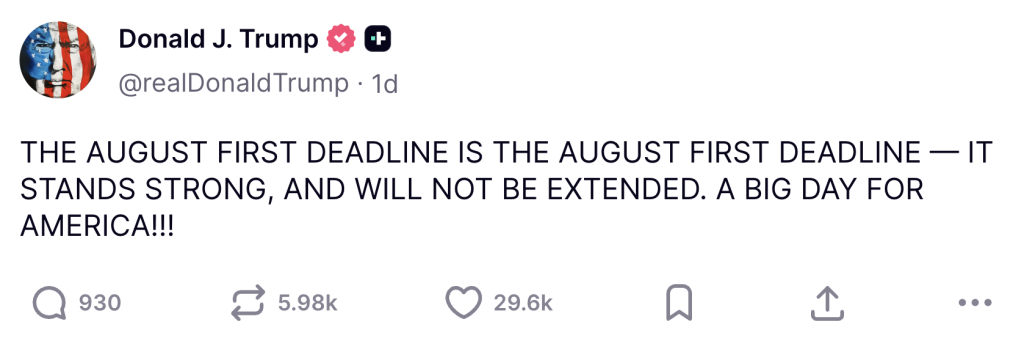

However, the president emphasized that his deadline of August 1 would not be extended, indicating that countries failing to reach an agreement with Washington by that date would soon face substantial financial repercussions.

Several of the world’s largest economies have successfully negotiated trade agreements with Trump during this period — encompassing billions of consumers — including the European Union, the United Kingdom, Japan, and South Korea.

However, late Thursday night, a wave of breaking news emerged from the White House, detailing what numerous countries — many of which are economically disadvantaged — will now incur when exporting their goods to the United States.

The most notable announcement pertains to neighboring Canada, where tariffs on certain goods have surged to 35%. Conversely, Mexico, located just across the border, has secured an additional 90-day extension.

Approximately 90 countries will face increased costs, with the BBC providing a breakdown of some affected nations:

Image: BBC

Image: BBC

As illustrated in the graphic above, even nations not explicitly mentioned in this new executive order will still encounter a baseline tariff of 10%. This intensified trade conflict is set to impose costs on everyone involved.

It is important to note that some of these tariffs will not take effect immediately. In most instances, they will only apply starting August 7 — suggesting a brief window for last-minute negotiations. Additionally, the levies will not apply to goods arriving by sea until early October, which may help mitigate significant price increases during the holiday shopping season.

Asian stocks experienced a sharp decline early on Friday as investors processed the news — enduring their worst week since “Liberation Day” — and it is anticipated that similar trends will follow across Europe and the Americas later on Friday. Many analysts contend that raising tariffs to their highest levels since World War Two is unnecessary and constitutes economic self-sabotage.

24h7d30d1yAll time

Bitcoin, which operates 24/7, was not exempt from this latest wave of uncertainty. At the time of this report, it had decreased by 2.3% over the past 24 hours, yet continued to trade above $115,000.

Altcoins have performed significantly worse. Ether has declined by approximately 5%, while XRP has seen losses nearing 6%. As is often the case during crypto downturns, meme coins have been hit the hardest — with pump.fun losing 20% of its value and Pudgy Penguins dropping by 11%.

BTC may find itself in a precarious situation if these developments lead institutional investors to withdraw their capital from exchange-traded funds — intensifying selling pressure. The revival of tariff discussions also diminishes the impact of the White House crypto report released just a day prior.

A major concern for both crypto and equity investors is the uncertainty created by this latest round of tariffs. While there has been a surge of high-profile earnings reports in recent days, many have yet to fully reflect the effects of these trade tensions on financial results. Most retailers will likely have no choice but to pass some of the increased costs onto consumers, which could result in reduced spending levels.

Additional uncertainties loom on the horizon. It remains to be seen whether the U.S. will be able to finalize a deal with China — the world’s largest exporter of goods — by the separate deadline of August 12. At one point in April, Trump had suggested that tariffs on Chinese products could escalate to an astonishing 145%.

A new wave of unpredictable announcements from Trump, combined with lower trading volumes during the summer months, may mean that Bitcoin struggles to regain its footing for some time.

The post Trump Tariffs Return — What Does It Mean for Bitcoin, Ether, XRP, Crypto? appeared first on Cryptonews.