Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Trump Imprisons ‘Venezuela Informant’: Mysterious Polymarket Whales Fall Silent Following Precise Predictions

US President Donald Trump has asserted that a “leaker on Venezuela” has been identified and imprisoned following a series of unusually well-timed bets on Polymarket after the apprehension of Venezuelan President Nicolás Maduro.

During a statement in the Oval Office this week, Trump mentioned that the person accountable for disclosing sensitive information regarding Venezuela was “currently in jail” and could be facing a lengthy prison term.

Although Trump did not specify the individual or directly mention betting markets, his remarks instantly prompted renewed examination of a group of Polymarket accounts that had placed substantial, highly lucrative wagers on Maduro’s ousting just before the information became public knowledge.

Smart Trades or Leaked Intelligence? Questions Grow as Polymarket Wallets Go Dark

The blockchain analytics company Lookonchain reported that two out of the three wallets previously associated with those Venezuela-centric bets have ceased activity.

Donald Trump claimed that a Venezuelan leaker is now incarcerated.

We observed that two of the three wallets that had made profits from betting on Venezuelan President Maduro’s exit have been inactive for 11 days.

The remaining wallet, “SBet365” made another bet 2… https://t.co/GyZR4Lgd8i pic.twitter.com/fMP7QQ5tst— Lookonchain (@lookonchain) January 15, 2026

Lookonchain indicated that these wallets halted trading around the same time Trump suggested the leaker had been taken into custody.

The firm pointed out that one account, designated as 0xa72DB1, transformed a $5,800 wager into approximately $75,000 by betting that Maduro would be out of office by January 31, 2026.

Another wallet, 0x31a56e, reportedly invested about $34,000 and accrued more than $400,000 before vanishing from the platform around January 8.

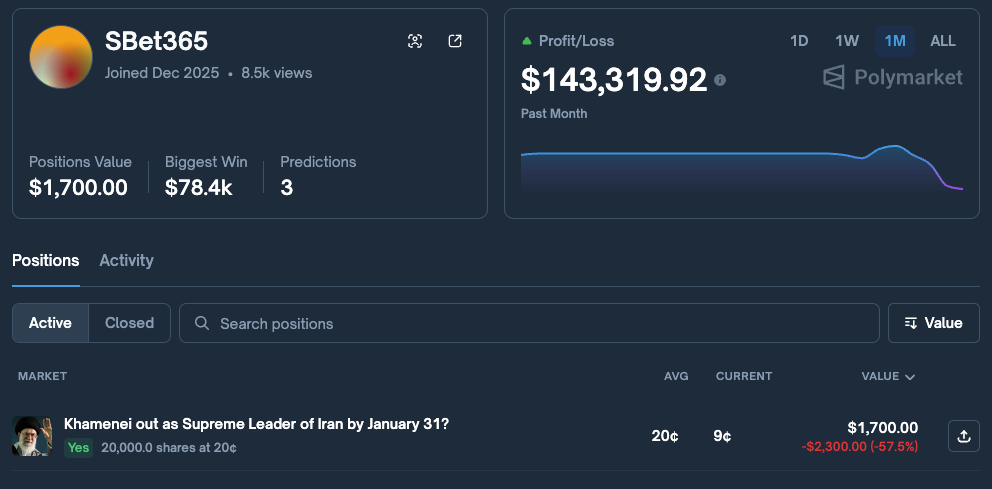

A third wallet, known as SBet365, remains active, with Lookonchain noting that this account placed a new wager two days ago forecasting that Iran’s Supreme Leader Ayatollah Ali Khamenei would be ousted by the end of January.

Source: Polymarket

Source: Polymarket

This same wallet had previously generated around $145,000 from bets related to Venezuela.

At the beginning of January, Lookonchain announced that the three wallets had been established and funded days beforehand, then abruptly placed large bets mere hours before Maduro’s arrest.

Three insider wallets on #Polymarket wagered on Venezuelan President Maduro’s exit just hours prior to his arrest, yielding a total profit of $630,484!

The three wallets were created and pre-funded days in advance.

Then, just hours before Maduro’s arrest, they suddenly… pic.twitter.com/VRAkQh8i9a— Lookonchain (@lookonchain) January 4, 2026

The timing of these trades has amplified concerns regarding insider information infiltrating prediction markets.

Legal experts highlight that leaking classified or sensitive government information can lead to severe consequences under U.S. law, especially under the Espionage Act.

Depending on the nature of the information, intent, and potential damage, sentences can vary from several years in prison to decades, as well as hefty fines and permanent revocation of security clearance.

Recent enforcement actions related to Venezuela-connected leaks indicate that authorities are approaching such cases with vigor.

Polymarket’s Growing Pains Spark Calls for Prediction Market Reform

While Polymarket markets are accessible to the public, critics claim that access to nonpublic government or military information erodes trust in platforms that merge elements of finance, gambling, and political forecasting.

Trump himself suggested that there may be more than one leaker, stating officials would “inform you about that” if others are uncovered.

This controversy arises as Polymarket faces separate criticism regarding its management of Venezuela-related contracts.

On January 7, the platform announced it would not settle millions of dollars in wagers concerning whether the United States would invade Venezuela, despite Maduro’s capture during a U.S. operation.

Polymarket contended that the raid did not fulfill its contractual definition of an “invasion,” which it argued necessitates military action aimed at establishing control over territory.

Over $10.5 million was wagered on the outcome, and the decision was not well-received by many traders, who accused the platform of altering its interpretation of the rules retroactively.

On January 6, Representative Ritchie Torres also announced plans to introduce the Public Integrity in Financial Prediction Markets Act of 2026.

The proposed legislation would prohibit federal officials and political appointees from trading prediction market contracts based on government actions or political outcomes when they possess material nonpublic information or have access to such undisclosed information.

The post Trump Jails ‘Venezuela Leaker’: Suspicious Polymarket Whales Go Silent After Accurate Bets appeared first on Cryptonews.