Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Treasury Secretary Advocates for Additional Rate Reductions Despite Robust Employment Figures

Treasury Secretary Scott Bessent urged the Federal Reserve to hasten interest rate reductions, referring to them as the “only ingredient missing” for enhancing U.S. economic growth ahead of his upcoming statements in Minnesota on Thursday.

This appeal follows the release of new labor market data indicating initial jobless claims at 208,000 for the week ending January 3, which is slightly better than the anticipated 210,000, thereby challenging the rationale for aggressive monetary easing.

Bessent supported President Donald Trump’s economic strategy in prepared remarks obtained by CNBC, asserting that a more accommodative monetary policy would directly aid households and bolster growth goals.

“Reducing interest rates will significantly affect the lives of every Minnesotan,” he stated. “It is the sole missing component for achieving even greater economic expansion. That’s why the Fed should act promptly.”

BESSENT SAYS MORE FED RATE CUTS ARE KEY TO STRONGER GROWTH

Treasury Secretary Scott Bessent insisted that lower interest rates are the “only ingredient missing” for enhanced U.S. economic growth, calling on the Federal Reserve to expedite rate cuts. Speaking prior to remarks to the…— *Walter Bloomberg (@DeItaone) January 8, 2026

Labor Market Displays Resilience

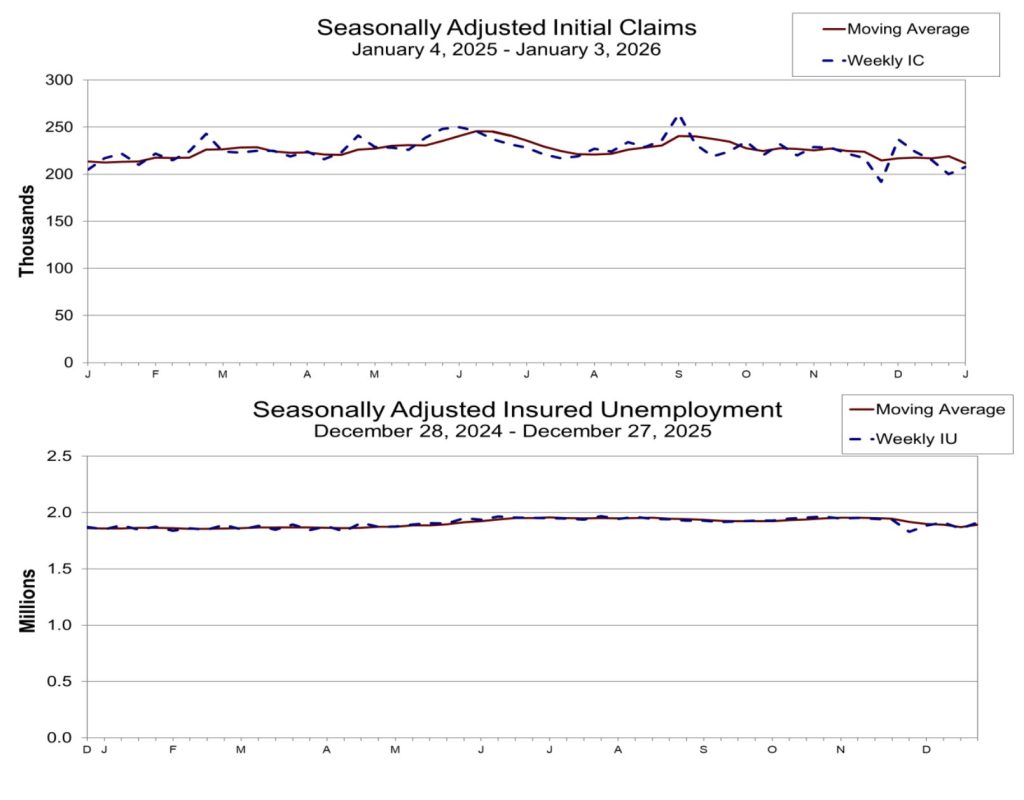

The Department of Labor’s weekly update indicated that jobless claims rose by 8,000 from the previous week’s revised figure of 200,000, marking the lowest four-week moving average since April 2024 at 211,750.

Insured unemployment remained unchanged at 1.2% for the week ending December 27, while continued weeks claimed increased to 1,914,000 from 1,858,000 the prior week.

State data presented mixed trends, with New Jersey recording the largest rise in initial claims at 6,871, followed by Pennsylvania at 5,406 due to layoffs in the transportation, construction, and manufacturing sectors. Texas experienced the most significant decline at 7,951 claims, while California saw a decrease of 6,514.

Source: DOL

Source: DOL

Although the Fed executed three consecutive rate cuts in late 2025 totaling 75 basis points, reducing the benchmark rate to a range of 3.5 to 3.75%, markets now predict considerably fewer reductions in 2026.

Recent projections from Fed officials indicate only one rate cut this year, even with the Treasury’s call for more assertive measures.

Nonetheless, Jerome Powell’s tenure as Fed chair concludes in May, and Bessent is already managing the selection process, which has narrowed down to five candidates.

Policy Tensions Escalate

Minneapolis Fed President Neel Kashkari indicated on Monday that monetary policy is approaching neutrality, implying limited potential for further cuts.

“I suspect we’re quite close to neutral at this point,” Kashkari told CNBC. “We just need more data to determine which factor is stronger. Is it inflation or the labor market?”

Kashkari, who is a voting member on the Federal Open Market Committee this year, stressed that inflation risks remain high despite unemployment falling to 4.6%.

“The risk of inflation is persistent, as tariff impacts take several years to fully manifest,” he noted, while recognizing that unemployment could rise rapidly from current levels.

He also pointed out that the adoption of artificial intelligence among major corporations is causing hiring slowdowns even as it enhances productivity.

“AI is predominantly a large company phenomenon,” Kashkari remarked, adding that businesses once doubtful are now witnessing concrete advantages from the technology.

Fed Governor Stephen Miran, whose term concludes on January 31, expressed a differing opinion in a Fox Business interview on Tuesday, advocating for substantial rate cuts exceeding 100 basis points this year.

“I believe policy is evidently restrictive and hampering the economy,” Miran asserted, claiming that underlying inflation has reached the Fed’s 2% target. His disagreement for a 50-basis-point cut at December’s meeting highlighted growing divisions within the central bank.

Bessent framed his argument for rate reductions within the context of Trump’s comprehensive economic agenda, pointing out that the passage of 2025’s “One Big Beautiful Bill,” trade realignment agreements, and deregulation initiatives have established a foundation for vigorous growth.

“Now, in 2026, we are set to enjoy the benefits of President Trump’s America First agenda,” he stated in the remarks prepared for delivery at 12:45 PM ET.

Crypto Markets Respond to Rate Policy Uncertainty

Bitcoin dipped toward $90,000 today as traders processed tensions surrounding rate policy and stronger-than-anticipated employment statistics.

The cryptocurrency market fell nearly 2% while gold prices rose.

Source: TradingView

Investor Ray Dalio discussed the broader economic outlook in his recent market analysis, noting that currency devaluation skews return perceptions.

“When one’s currency depreciates, it creates the illusion that items priced in it have appreciated,” Dalio wrote, pointing out that gold returned 65% in dollar terms last year, while the S&P gained only 18%, making gold “the top major investment of the year.”

In a discussion with Cryptonews, Kurt Hemecker, CEO of Gold Token S.A., highlighted the changing relationship between these assets.

“Bitcoin and gold reacting differently to macroeconomic pressures isn’t new. This is what we’re witnessing today, as gold strengthens while Bitcoin retreats,” he explained.

The post Treasury Secretary Calls for More Rate Cuts Despite Strong Jobs Data appeared first on Cryptonews.