Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

TON’s Trading Volume Surges, Exceeding Layer 1 Rivals – CryptoQuant

The Open Network (TON) has established itself as a prominent Layer 1 solution in recent months.

In September, TON accounted for over 50% of all Layer 1 transactions, surpassing rivals like Ethereum (ETH) and Avalanche (AVAX), as reported by CryptoQuant data.

The Open Network (#TON) is rising as a top Layer-1 solution

“In the past month… $TON captured over 50% of all Layer 1 transactions during this period, largely driven by several major token launches.” – By @JA_Maartun

Read more

https://t.co/0Er9EerVrc pic.twitter.com/hEI4feAwnM

— CryptoQuant.com (@cryptoquant_com) September 30, 2024

The achievements of TON can be linked to various token launches. DOGS, one of the initial significant projects on the network, drew in an impressive 28 million monthly active users (MAU). CatizenAI and Rocky Rabbit, each with 18 million MAU, also garnered notable interest. Watbird and Hamster Kombat further fueled TON’s expansion, with Watbird attracting 12 million MAU and Hamster Kombat achieving an outstanding 110 million MAU.

Solana Retains Dominance

However, CryptoQuant has omitted Solana (SOL), BNB Chain (BNB), and NEAR Protocol (NEAR) from its overall assessment.

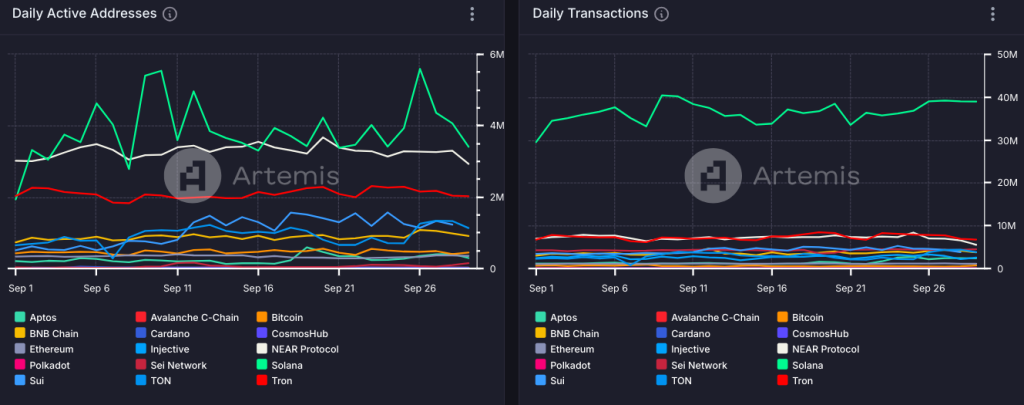

According to Artemis data and the additional chains considered in the analysis, Solana continues to lead all Layer 1 chains in terms of transaction volume and daily active wallets. As of September 30, Solana had processed over 1.1 billion transactions for the month and had gained 3.9 million daily active addresses.

In contrast, while TON has performed admirably, it has been surpassed by Solana in both metrics. TON has recorded 212.5 million transactions so far in September, securing second place in transaction volume. However, in terms of daily active wallets, TON was outpaced by both Solana and NEAR Protocol, with 2.1 million daily active addresses (all data from September 30).

Daily active addresses and daily transactions across L1 chains, MTD. Source: Artemis

Daily active addresses and daily transactions across L1 chains, MTD. Source: Artemis

Bitget Foresees TON’s De-Telegramization

Bitget, a cryptocurrency exchange and significant investor in the Open Network Foundation, presented optimistic forecasts for the TON ecosystem in its latest report from September.

A key prediction in the report is the potential “de-Telegramization” of the TON ecosystem. As Telegram encounters heightened regulatory scrutiny, Bitget indicates that TON may need to separate itself from the messaging platform to reduce associated risks. While TON will likely continue to depend on Telegram’s user base in the short term, the report anticipates a long-term shift towards greater autonomy.

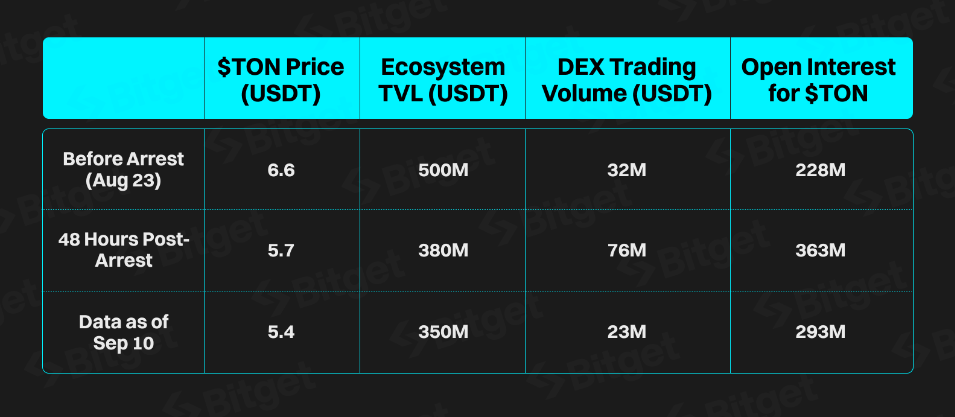

“The news of the arrest [of Pavel Durov, CEO of Telegram, on Aug. 25] has had a significant impact on the TON ecosystem. As a result, the price of the TON token has dropped over 17.6% in the week following the arrest. Furthermore, the TVL on the TON chain has also seen a sharp decline, with a single-day drop exceeding 60%.”

TON price and TVL plunged after Durov’s arrest. Source: Bitget

TON price and TVL plunged after Durov’s arrest. Source: Bitget

As of September 30, TON’s total value locked (TVL) stands at approximately $427 million, a decrease of 45% from its peak of $776 million in July 2024.

Regarding token performance, Bitget predicts that Toncoin, the native cryptocurrency of the TON blockchain, will surpass Bitcoin’s spot returns in a bullish market. The report also foresees increased institutional interest in TON, with many institutions favoring over-the-counter (OTC) transactions.

Despite a notable decline following the arrest of Telegram CEO Pavel Durov in August, Toncoin has still managed to achieve an impressive 149% return since the start of the year. The price has risen from $2.27 on January 1 to $5.82 at the time of writing.

Meanwhile, Bitcoin (BTC) has experienced a more modest 51% increase during the same timeframe, rising from $43,835 on January 1, 2024, to $64,029 at the time of writing.

The post TON’s Transaction Volume Soars, Outpacing Layer 1 Competitors – CryptoQuant appeared first on Cryptonews.