Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Tokenized Gold Contributes 25% to RWA Expansion as Trading Volume Surpasses Gold ETFs

A recent report from the cryptocurrency exchange CEX.IO indicates that tokenized gold emerged as one of the fastest-growing sectors within the real-world asset (RWA) market in 2025.

Both trading activity and market growth surpassed many conventional gold investment products.

Tokenized Gold Represents a Quarter of RWA Expansion

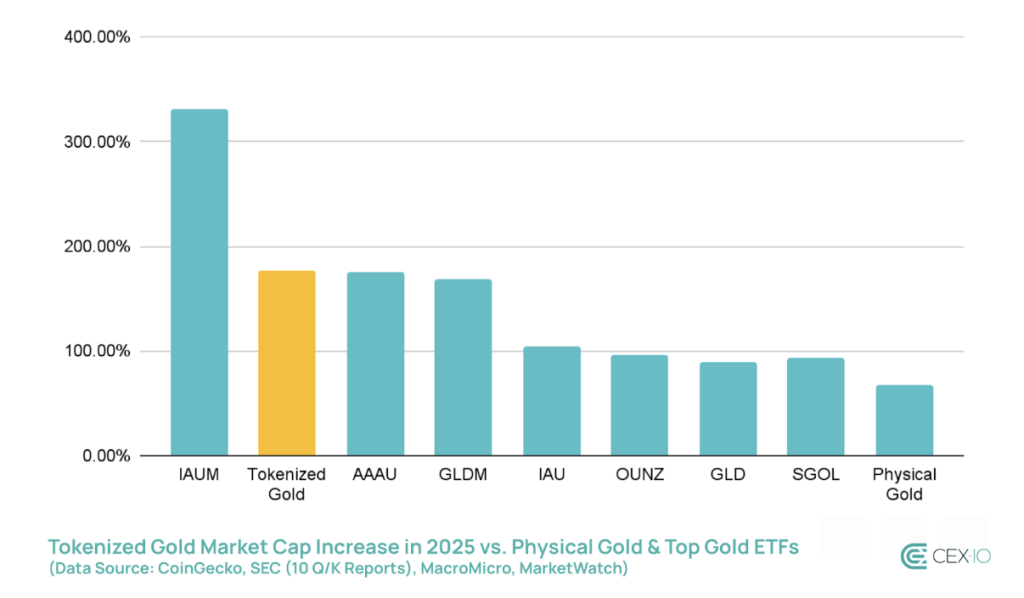

As per the report, tokenized gold experienced a 177% surge in market capitalization in 2025, escalating from approximately $1.6 billion to $4.4 billion. This increase contributed nearly $2.8 billion in net worth, accounting for about 25% of the total net growth in RWAs throughout the year.

In contrast, the broader DeFi market faced challenges in regaining momentum, with total value locked (TVL) rising by merely 2%, while RWAs saw an approximate growth of 184%, marking them as the standout performers in crypto.

CEX.IO points out that tokenized gold grew 2.6 times faster than physical gold, which also had a robust year amid inflation worries and geopolitical instability.

This category also noted a 198% rise in total holders, adding over 115,000 new wallets—growth that exceeded that of tokenized U.S. Treasuries and other tokenized bonds.

Trading Volumes Compete with Gold ETFs

The trading activity presents an even more remarkable narrative. The trading volume of tokenized gold surged by 1,550% compared to the previous year, achieving a total volume of $178 billion in 2025. In the fourth quarter alone, the volume surpassed $126 billion, exceeding the combined trading volume of five significant gold ETFs.

While SPDR Gold Shares (GLD) continued to be the largest gold investment product by volume, the report suggests that tokenized gold would position itself as the second-largest gold investment vehicle globally by trading volume, ranking ahead of all ETFs except GLD. This underscores a fundamental shift in where gold trading liquidity is increasingly migrating on-chain.

A Market with High Concentration

Despite the swift growth, the market remains significantly concentrated. The top three tokenized gold assets—Tether Gold (XAUT), Pax Gold (PAXG), and Kinesis Gold (KAU)—command approximately 97% of the total market capitalization, while the top four account for 99% of trading volume.

XAUT significantly led trading activity in late 2025, constituting 75% of the total Q4 volume following a reserve attestation that seemed to enhance market confidence.

CEX.IO also emphasized emerging products such as Matrixdock Gold (XAUM), which experienced market cap growth exceeding 1,000% after its integration with the Plume ecosystem.

Complementing Rather than Replacing Stablecoins

The report clarifies that tokenized gold does not compete directly with stablecoins but rather serves as a strategic hedge. During times of market stress, traders appear to shift capital into tokenized gold as a compromise between risk-on crypto assets and risk-off stablecoins.

In summary, CEX.IO concludes that 2025 marked a pivotal moment for tokenized gold, transitioning it from a niche RWA category into a significant, liquid gold investment vehicle.

While concentration risks persist, the data indicates that tokenized gold is now firmly established as a vital element of both the RWA and global gold investment landscape.

The post Tokenized Gold Accounts for 25% of RWA Growth as Trading Volume Overtakes Gold ETFs appeared first on Cryptonews.