Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Tether Surreptitiously Emerges as a Major Player in the Global Gold Market, Possessing 140 Tons of Gold

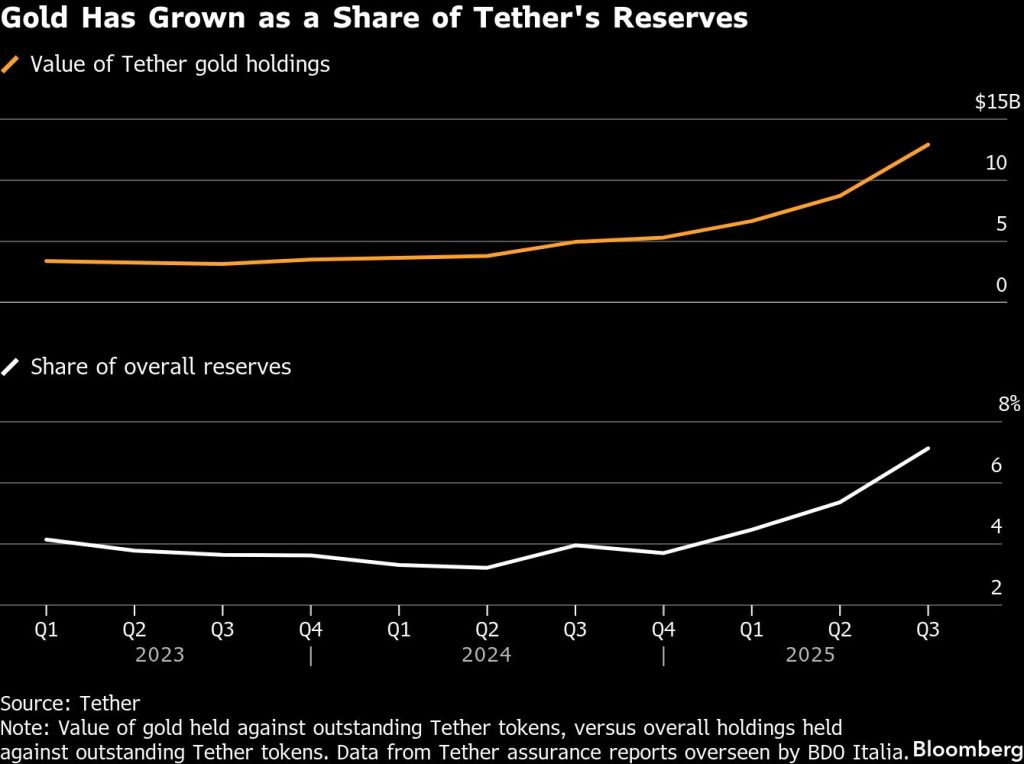

The cryptocurrency powerhouse Tether Holdings has been making waves in the expanding gold market through substantial metal accumulation over the last year. As per CEO Paolo Ardoino, the stablecoin issuer currently possesses approximately 140 tons of gold.

During an interview with Bloomberg, Ardoino expressed that Tether is focused on enhancing its significant profits from these holdings, positioning itself as a competitor to banks in the bullion trading sector.

“We are on the verge of becoming, let’s say, one of the largest gold central banks globally,” he remarked.

Tether’s Swift Gold Acquisitions in the Past Year

The cryptocurrency company procured over 70 tons of gold throughout the previous year for its reserves as well as for its gold-backed stablecoin, XAUT, according to a Bloomberg report released on Wednesday.

This accumulation of the yellow metal surpasses the figures reported by the three largest exchange-traded funds, it noted.

With 140 tons of gold reserves, Tether’s bullion accumulation is valued at $23 billion based on current market prices, making it the largest known treasury outside of those held by central banks, ETFs, and private banking institutions.

Ardoino mentioned that the firm has been acquiring more than a ton of gold weekly. “And it’s only increasing,” he stated, adding that Tether plans to maintain this pace for “certainly the next few months.”

“Then of course, based on market conditions, we will make a decision, but yes, I believe we will persist in this direction,” Ardoino said. “Perhaps we will scale back, but that remains uncertain. We will evaluate our demand for gold on a quarterly basis.”

Tether Stores Bullion in Swiss Nuclear Facility

The issuer of USDT is meticulous in its approach to storing its extensive gold holdings. The company has opted for “the unconventional method” of storing the valuable metal in a former nuclear bunker in Switzerland, secured by multiple layers of thick steel doors, Ardoino, 41, noted.

“It’s a James Bond-esque location; it’s quite extraordinary,” he described the vaults.

Additionally, Tether is also aiming to engage in trading the precious metal, rivaling major Wall Street entities such as JPMorgan Chase & Co. and HSBC.

“Our objective is to secure a consistent, stable, long-term access to gold,” Ardoino emphasized.

Following this announcement, Tether’s gold-backed XAUT stablecoin experienced a 3.99% increase over the last 24 hours, according to CoinMarketCap data. The asset extended its weekly (+8.88%) and monthly (+18.06%) gains amidst a broader strength in bullion.

The cryptocurrency firm’s gold reserves surpass those of countries like Greece and Australia, placing it among the top 30 holders globally.

The post Tether Quietly Becomes One of the Biggest Global Gold Market Players, Holds 140 Tons of Gold appeared first on Cryptonews.