Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Tether Reports Record Crypto Revenue in 2025: $5.2B from Stablecoin Leadership

Tether emerged as the leading crypto entity in profitability in 2025, generating an estimated $5.2 billion in revenue as stablecoins surpassed all other protocol categories in earnings.

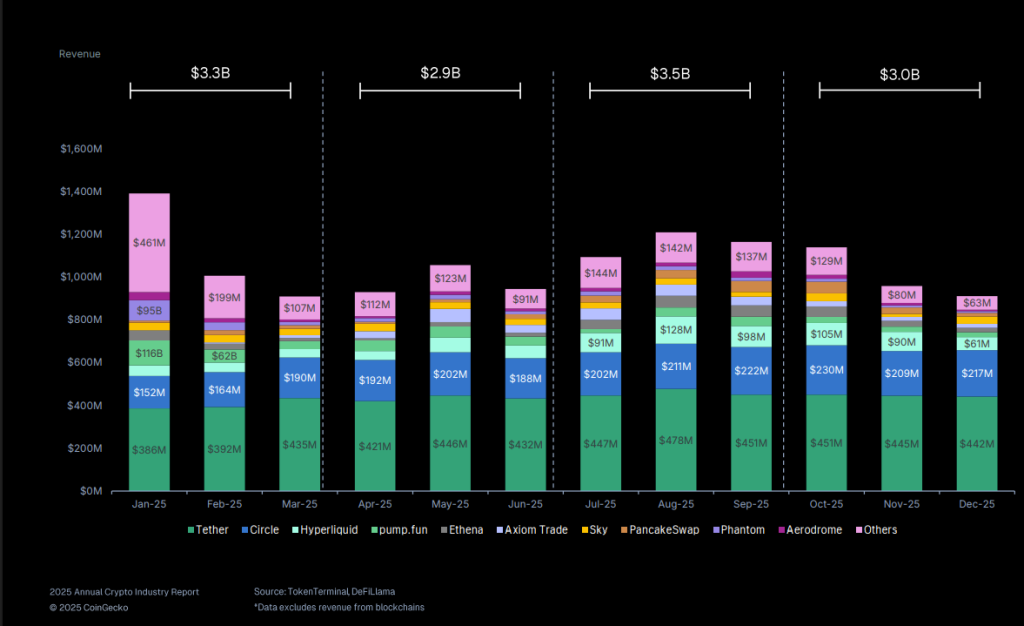

As per the most recent Coingecko annual crypto industry report, Tether was responsible for 41.9% of total stablecoin-related revenue in 2025, outpacing rivals such as Circle, Hyperliquid, Pump.fun, Ethena, Axiom, Phantom, and PancakeSwap.

The findings indicate that dollar-pegged digital currencies have established themselves as the most resilient revenue source in the crypto space, despite market conditions varying throughout the year.

Tether Dominates Stablecoin Issuers to Seize Crypto Revenue Title

Among over 168 crypto protocols monitored in 2025, stablecoin issuers collectively achieved the highest revenue, with Tether positioned prominently at the forefront.

INSIGHT: Stablecoins generated $5.2B in revenue in 2025, accounting for 41.9% of total protocol revenue. pic.twitter.com/fjJrAn9k7B

— CoinGecko (@coingecko) January 25, 2026

Its $5.2 billion revenue placed it significantly ahead of Circle and other major competitors, reinforcing USDT’s role as the primary settlement asset in the industry.

Among the top ten revenue-generating protocols, only four entities, led by Tether and Circle, accounted for 65.7% of total earnings, roughly amounting to $8.3 billion.

Source: Coingecko

Source: Coingecko

The other six protocols in the top ten were all focused on trading platforms, emphasizing a significant contrast between stable revenue streams and income reliant on market fluctuations.

This distinction became evident as trading revenues experienced significant volatility in line with investor sentiment during the year.

For instance, Phantom recorded $95.2 million in revenue in January during the peak of the Solana meme coin excitement, only to see earnings drop to $8.6 million by December as speculative enthusiasm waned.

USDT Captures 60% Share Of $311B Stablecoin Market

The broader stablecoin market saw rapid growth, with total market capitalization increasing by $6.3 billion in the fourth quarter alone, reaching a record $311.0 billion.

This represented a 48.9% year-over-year growth, adding $102.1 billion as adoption accelerated across various regions.

Tether retained clear dominance with 60.1% of the total stablecoin market cap, approximately $187.0 billion, followed by Circle’s USDC at 24.2%, equivalent to $72.4 billion.

Source: Coingecko

Source: Coingecko

Tether has now become the world’s third-largest digital asset by market value, standing at $186.8 billion, reflecting an increase of roughly 50% from the previous year.

While the leading players solidified their positions, shifts within the top five indicated changing risk preferences.

Ethena’s USDe experienced the steepest decline, with its market cap dropping 57.3%, or $6.5 billion, after a depeg in mid-October on Binance undermined confidence in high-yield looping strategies.

Other stablecoins demonstrated mixed but noteworthy movements as capital rotated within the sector.

PayPal’s PYUSD surged by 48.4%, adding $1.2 billion to reach $3.6 billion and briefly taking the fifth position before World Liberty Financial’s USD1 reclaimed it by nearly $1.

Additional high-growth tokens included Ripple’s RLUSD, which increased by 61.8% to add $488.2 million, and USDD, which rose by 76.9% with a $366.8 million gain.

Exploring Tether’s $500B Valuation Path and Expanding Investment Empire

Looking forward, Bitwise CIO Matt Hougan recently indicated that Tether could potentially become the world’s most profitable company if its current path continues.

“There’s a possibility that numerous emerging market countries will shift from primarily using their own currencies to adopting USDT,” Hougan noted, highlighting Tether’s overwhelming presence outside Western markets.

Based on anticipated interest income, estimates suggest that managing $3 trillion in assets could yield annual revenue surpassing the $120 billion earned by Saudi Aramco last year.

Source: Electric Capital

Source: Electric Capital

Tether CEO Paolo Ardoino previously expressed to Cryptonews his confidence that USDT will maintain its lead due to the company’s profound understanding of practical applications.

Beyond stablecoins, Tether has aggressively expanded into traditional assets and investments.

@Tether_to has initiated an all-cash offer to acquire Italy’s @juventusfcen, a proposal that was reportedly declined quickly.#Tether #Cryptohttps://t.co/4iTBXWjo5V

— Cryptonews.com (@cryptonews) December 13, 2025

The company has recently become the second-largest shareholder in the Italian football club Juventus and is reportedly exploring raising $20 billion for a 3% stake, a deal that would imply a valuation near $500 billion and position Tether among the most valuable companies globally.

The post Tether Posts Largest Crypto Revenue in 2025: $5.2B From Stablecoin Dominance appeared first on Cryptonews.

@Tether_to has initiated an all-cash offer to acquire Italy’s @juventusfcen, a proposal that was reportedly declined quickly.#Tether #Cryptohttps://t.co/4iTBXWjo5V

@Tether_to has initiated an all-cash offer to acquire Italy’s @juventusfcen, a proposal that was reportedly declined quickly.#Tether #Cryptohttps://t.co/4iTBXWjo5V