Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Team A secures victory over Team B in the latest tournament match.

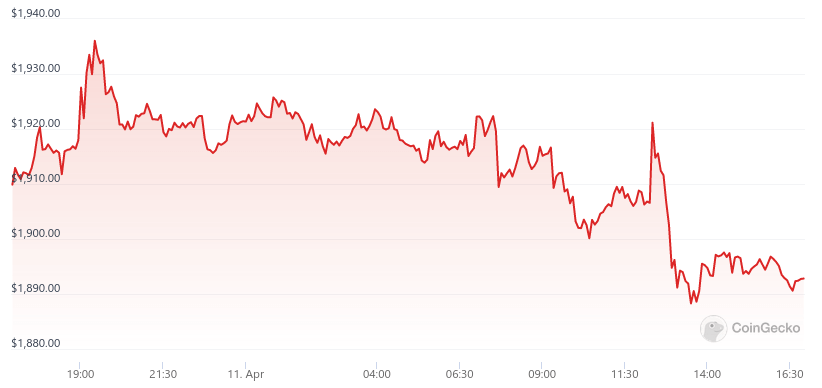

The value of Ethereum (ETH) dropped below $1,900 on April 11, indicating a slight decline in the hours preceding the blockchain’s highly anticipated Shanghai upgrade.

ETH market value dips below $1,900

The market price of ETH decreased from $1,921 to a low of $1,888 within a brief timeframe. This shift was observed during the hour leading up to 8:30 p.m. UTC on April 11.

As of 1:30 a.m. UTC on April 12, the asset is still priced at $1,895. This change in value reflects a decline of just 1.0% over the last 24 hours.

The minor fluctuation is made somewhat more significant by the fact that Bitcoin has risen by 2.0% during the same timeframe. Additionally, the overall cryptocurrency market has increased by 1.0% in the past 24 hours, with several other top 10 tokens also showing gains.

Shanghai upgrade receives positive feedback

General sentiment regarding Shanghai seems to be predominantly favorable. This feature will enable validators to withdraw staked ETH for the first time.

Currently, 18 million ETH is staked, as reported by the Ethereum Foundation. This amount is valued at approximately $34 billion and constitutes a substantial portion of Ethereum’s $227 billion market capitalization. Should a considerable amount of ETH be released into circulation, the upgrade could influence prices.

Nonetheless, it remains uncertain whether a majority of that amount will be unstaked in the long run, and it is not feasible for a large quantity to be unstaked immediately. To mitigate significant market impacts, around 1,800 validators will be permitted to unstake ETH each day.

Despite these reassurances, it is possible that apprehension surrounding the event has prompted some investors to liquidate their ETH holdings, resulting in the slight price decline observed today.

Shanghai will also bring additional features unrelated to stake unlocking. Notably, it aims to lower the gas fees that Ethereum developers incur and implement other enhancements.

The Shanghai upgrade is set to occur on April 12 at 22:27:35 UTC.