Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Survey Reveals 45% of Young Investors Hold Cryptocurrency Amid Declining Housing Aspirations

According to recent data from Coinbase, almost half of younger investors in the US currently possess cryptocurrency as traditional avenues for wealth accumulation become increasingly inaccessible.

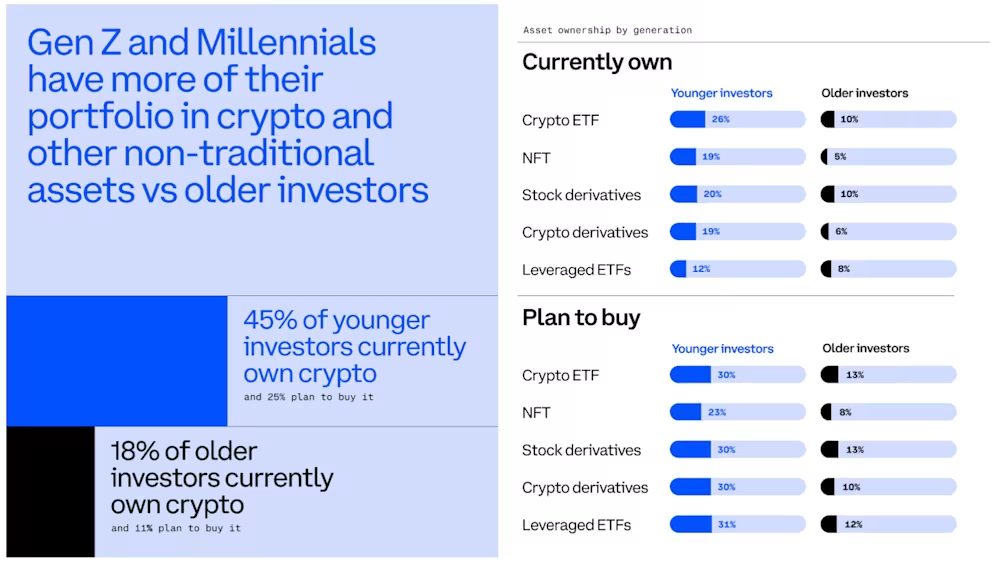

The results indicate that 45% of younger investors own crypto, in contrast to only 18% of older generations, with three-quarters asserting that their generation encounters greater challenges in wealth accumulation through traditional methods compared to earlier generations.

The State of Crypto Q4 2025 report, derived from a survey of 4,350 US adults, including 2,005 active investors, revealed that younger generations allocate 25% of their portfolios to non-traditional assets, which is three times the 8% allocation seen among older investors.

In addition to the allocation disparity, younger investors exhibit significantly different perspectives on digital assets, with four out of five believing that cryptocurrency creates financial opportunities that would not otherwise be available to their generation.

Source: Coinbase

Source: Coinbase

A Generation Challenging Conventional Strategies

While expressing greater optimism regarding overall economic conditions, younger investors do not feel that traditional wealth-building strategies benefit them.

This demographic has observed a decline in housing affordability alongside rising student debt and stagnant wage growth, leading 73% to conclude that their generation faces more significant wealth-building obstacles than 57% of older adults.

This viewpoint directly influences their investment choices. Although stock ownership rates remain comparable across age groups, younger investors are significantly increasing their exposure to alternative assets, actively seeking rewards beyond standard stock dividends.

This strategy reflects a conscious effort to utilize tools and markets that may help bridge generational wealth disparities rather than adopting passive investment strategies.

The allocation to crypto is viewed not as speculative but as a fundamental strategy. Nearly half of younger investors (47%) express a desire to access new crypto assets prior to their general market release, compared to just 16% of older investors.

Four out of five younger adults believe that cryptocurrency will have a considerably larger role in future financial systems, a belief that drops to three out of five among older investors.

Risk Tolerance Expands Beyond Bitcoin and Ethereum

The readiness to explore new opportunities extends beyond direct crypto holdings.

Four out of five younger investors indicate they are open to trying new investment opportunities ahead of others, while less than half of older adults share this sentiment.

Interest encompasses crypto derivatives, prediction markets, continuous stock trading, early-stage token sales, altcoins, and decentralized finance lending products.

This trend signifies a notable shift from recent data indicating a decline in crypto enthusiasm among the broader investor population.

A December FINRA Foundation study revealed that the percentage of US investors considering crypto fell from 33% to 26% between 2021 and 2024, while those perceiving digital assets as extremely or very risky increased from 58% to 66%.

Source: FINRA

Source: FINRA

However, this decline seems to be primarily among older demographics, rather than the younger group that is currently leading adoption.

The generational divide also manifests in trading behaviors and information sources.

Younger investors engage in trading more frequently, take more calculated risks in pursuit of higher returns, and encourage platforms to operate continuously, accommodating a broader range of assets.

US crypto purchase interest falls to 26% from 33% in 2021 as investor risk appetite declines sharply, FINRA study shows.#US #Cryptohttps://t.co/4mTMJ49hLC

— Cryptonews.com (@cryptonews) December 5, 2025

Significantly, social media “finfluencers” now influence investment decisions for 61% of investors under 35, with YouTube being the primary platform, and recommendations from friends and family surpassing those from financial professionals.

The Framework for a New Investment Generation

The trend toward non-traditional assets among younger investors aligns with separate findings indicating that institutional adoption is enhancing confidence.

A November Zerohash survey found that 35% of affluent young Americans had already shifted funds away from advisers who did not provide crypto exposure, with over four-fifths reporting increased confidence as major institutions like BlackRock, Fidelity, and Morgan Stanley began to embrace digital assets.

Concentration in volatile assets raises valid concerns regarding long-term financial stability.

Nonetheless, the trend appears to be sustainable rather than speculative, with median allocations to non-traditional assets reaching significant levels, and younger investors consistently viewing crypto as a crucial component of their wealth-building strategy rather than a mere opportunistic position.

US crypto exchange Coinbase is allowing users to trade stocks on its platform and place bets on a wide array of events through a partnership with Kalshi.#Coinbase #CoinbaseKalshi #PredictionMarkethttps://t.co/7X7UId3tKZ

— Cryptonews.com (@cryptonews) December 18, 2025

In response, Coinbase is developing what it refers to as the Everything Exchange, aimed at facilitating trading across various asset types at any time while ensuring security, compliance, and responsible innovation standards.

This approach acknowledges that younger investors expect platforms that are native to an internet-first generation, rather than traditional market structures characterized by limited trading hours and restricted asset selections.

The post 45% of Young Investors Own Crypto as Housing Dreams Fade: Survey appeared first on Cryptonews.