Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Strategic Bitcoin Holdings: Essential Information You Need to Understand

Every bull market features a prevailing narrative — and this time, it centers on intense anticipation that the U.S. will establish a strategic Bitcoin reserve.

The idea of a global superpower investing in this cryptocurrency was once considered a distant fantasy, but gained traction when Donald Trump included it among his campaign promises… and subsequently won the election.

But what would this actually entail? How could it influence Bitcoin’s price? And will this ignite a global competition where other nations rush to build their own reserves?

What is a Strategic Bitcoin Reserve?

Proponents contend it represents a 21st-century equivalent of stockpiles established for other commodities with finite supplies.

In the 1970s, the U.S. established a Strategic Petroleum Reserve — beginning to store substantial amounts of crude oil in underground caverns, driven by concerns over economic consequences should supplies dwindle.

This extensive network has the capacity to hold up to 713.5 million barrels of crude oil, with recent data indicating it is operating at approximately 50% capacity. The president can authorize the sale of this oil in the event of supply disruptions — and allow producers to securely store reserves during periods of low demand.

The rationale behind creating a strategic Bitcoin reserve is that it could serve as “a hedge against economic uncertainty and financial instability.” Persistent inflation and the threat of de-dollarization have heightened worries regarding the future of the dollar.

It is noteworthy that the U.S. has maintained over 8,000 tons of gold reserves for decades — again as a safeguard against market fluctuations — and Bitcoin advocates have long asserted that this digital asset is a form of “digital gold.”

What Would a Bitcoin Strategic Reserve Entail?

That’s an excellent question, and the specifics remain quite uncertain at this stage.

The U.S. government currently possesses around 200,000 BTC confiscated from criminals — but rather than being retained as an investment, it has been regularly auctioned off, resulting in the government missing out on billions in potential revenue.

Trump has suggested that this could serve as a foundation for establishing his strategic Bitcoin reserve, but legal issues persist — particularly regarding the transfer of these assets from the Justice Department.

The 47th president’s motivation appears to focus on achieving a first-mover advantage over China and nations adopting digital assets.

Some Republican lawmakers advocate for this policy to extend even further, notably Wyoming’s pro-crypto Senator Cynthia Lummis, who was an early Bitcoin investor.

Last summer, she introduced the BITCOIN Act, which calls for the U.S. to acquire an astonishing 1 million BTC over the next five years. This represents about 5% of the total supply of this cryptocurrency, which is capped at 21 million. To contextualize this figure, it would entail a cost of $100 billion, assuming a single coin is valued at $100,000.

This would come with strict stipulations that the Bitcoin must be held for 20 years and can only be sold to reduce federal debt.

Trump has not indicated whether he is willing to pursue this extent, but it is interesting to note that Lummis has been suggested as a candidate to become the first-ever chair of a Senate subcommittee focused on crypto.

24h7d30d1yAll time

How Would It Impact Bitcoin’s Price?

As one might expect, Bitcoin enthusiasts are eager about the potential impact such a policy could have on BTC’s price — particularly given the growing interest among institutions since ETFs have been available for a year. Even the mere prospect of a reserve following Trump’s significant victory last November contributed to this cryptocurrency’s price reaching six figures for the first time.

JAN3 CEO Samson Mow, who has been closely involved with El Salvador’s Bitcoin initiatives, recently told Cryptonews that he anticipates “significant price appreciation into the $1 million range” ahead.

“Many nation-states are actively increasing their investments in Bitcoin, not only as a strategic reserve but also as a means to enhance sovereignty and energy production,” he stated.

There is little doubt that the establishment of the reserve would represent one of the most bullish developments in Bitcoin’s history, leading to substantial buying pressure.

However, some experts have questioned whether Bitcoin alone could adequately address America’s financial challenges — especially considering that U.S. national debt currently stands at $35.5 trillion.

Is it Feasible… or a Wise Idea?

With conflicts raging across two continents, economic difficulties, a migration crisis, and a divided nation, Trump faces numerous pressing issues as his second term begins.

It is challenging to understand how a strategic Bitcoin reserve fits into this list of priorities — despite the new president’s enthusiasm during the campaign.

In the worst-case scenario, it is possible that Trump may not fulfill any of his pro-crypto commitments. He will not be eligible to run for re-election, so there is technically little preventing him from accepting donations from the industry and reneging on those promises.

Here’s the reality: even if Trump aims to establish this reserve, he will encounter his own set of challenges. BitMEX co-founder Arthur Hayes recently cautioned that the president “has at best one year” to implement his most ambitious policy changes — and the slim Republican majority in Congress could dissipate by the end of 2026. These midterms may also hinder progress on Capitol Hill.

NYDIG’s global head of research Greg Cipolaro expressed “caution in expecting rapid changes” in a recent note, adding:

“The U.S. Bitcoin strategic reserve is a highly topical item, but how it comes to be (regulation vs executive order) and its implementation (acquisition vs using existing seized funds) matter greatly as a catalyst.”

And considering Bitcoin’s inception is rooted in a fundamental distrust of governments and financial institutions, is Uncle Sam becoming one of the world’s largest holders truly what Satoshi Nakamoto envisioned?

El Salvador’s Bitcoin reserves

El Salvador’s Bitcoin reserves

Will Other Countries Follow Suit?

The mere discussion of the U.S. beginning to explore a strategic Bitcoin reserve has prompted rival economies to consider this policy.

Canadian opposition leader Pierre Poilievre has supported BTC for years — and may also seek to establish a reserve if he wins an election scheduled for this year.

Lawmakers from Germany to Hong Kong are also urging their governments to examine this possibility.

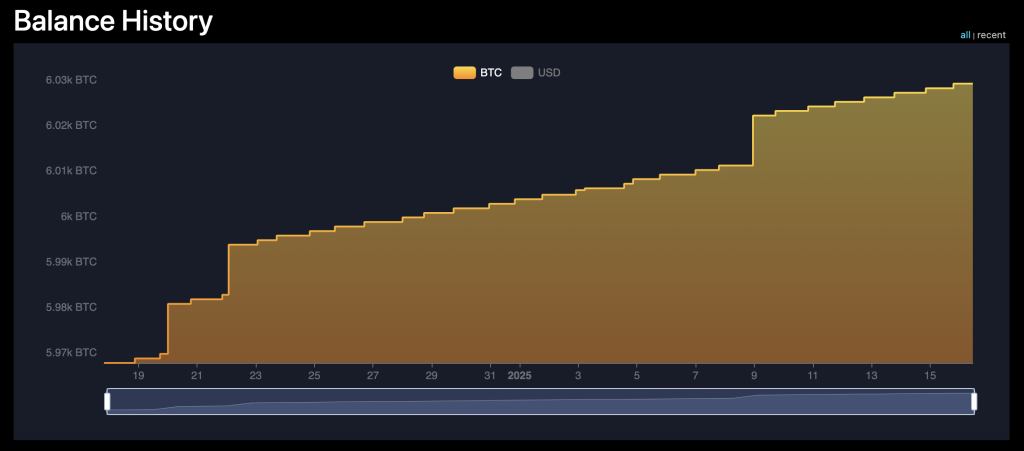

El Salvador technically has a strategic reserve as well, with the nation acquiring 1 BTC daily and generating hundreds of millions of dollars in paper profits.

As former Binance CEO Changpeng Zhao remarked at the Bitcoin Center East and North Africa conference:

“It’s very beneficial for the U.S. to be doing this — and this also has a ripple effect on other nations around the globe. If the U.S. is doing this, then every other country should consider doing the same.”

The post Strategic Bitcoin Reserves: Everything You Need to Know appeared first on Cryptonews.