Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Stablecoins Facilitate Property Transactions Ranging from $500K to $2.5M in the UK, France, and Malta: Study

Over the past year, stablecoins have enabled property transactions valued between $500,000 and $2.5 million across the UK, France, and Malta, as affluent cryptocurrency holders increasingly turn to digital currencies for real estate acquisitions.

As per recent reports from Coindesk, Brighty, a crypto payments application licensed in Lithuania, has facilitated over 100 of these transactions, allowing high-net-worth individuals to circumvent traditional banking systems for more rapid and efficient dealings.

This trend indicates a growing trust in cryptocurrency as a credible option for substantial investments, particularly as conventional banks remain reluctant to handle such transactions.

THE AFFLUENT ARE UTILIZING CRYPTO FOR REAL ESTATE PURCHASES

Numerous wealthy investors are turning to crypto to acquire properties throughout Europe. Brighty co-founder Nikolay Denisenko states that the firm has already facilitated over 100 real estate transactions for high-net-worth individuals using cryptocurrency. pic.twitter.com/nLARidklwc— Coin Bureau (@coinbureau) January 10, 2026

Brighty’s platform caters to between 100 and 150 affluent clients, with an average monthly expenditure of $50,000. Residential property purchases constitute the higher end of transaction volumes across various European locations, including Cyprus and Andorra.

Euro Stablecoins Surpass USDC for European Transactions

Nikolay Denisenko, co-founder and CTO of Brighty App, detailed that crypto transactions present considerable benefits compared to traditional systems like SWIFT, the global interbank payment network utilized by over 11,000 banks.

Transforming stablecoins like USDC into euros simplifies the complexities and delays tied to standard wire transfers, enhancing efficiency for both purchasers and sellers.

This significant shift in stablecoin preferences has been noted among affluent customers.

While Circle’s USDC had previously been the leader for large transactions, buyers now prefer euro-pegged stablecoins to eliminate conversion fees when acquiring properties in Europe.

Brighty recorded an increase in average transaction sizes backed by euros, rising from €15,785 in Q3 to €59,894 in Q4, as high-net-worth individuals executed substantial deals in Circle’s EURC instead of USDC.

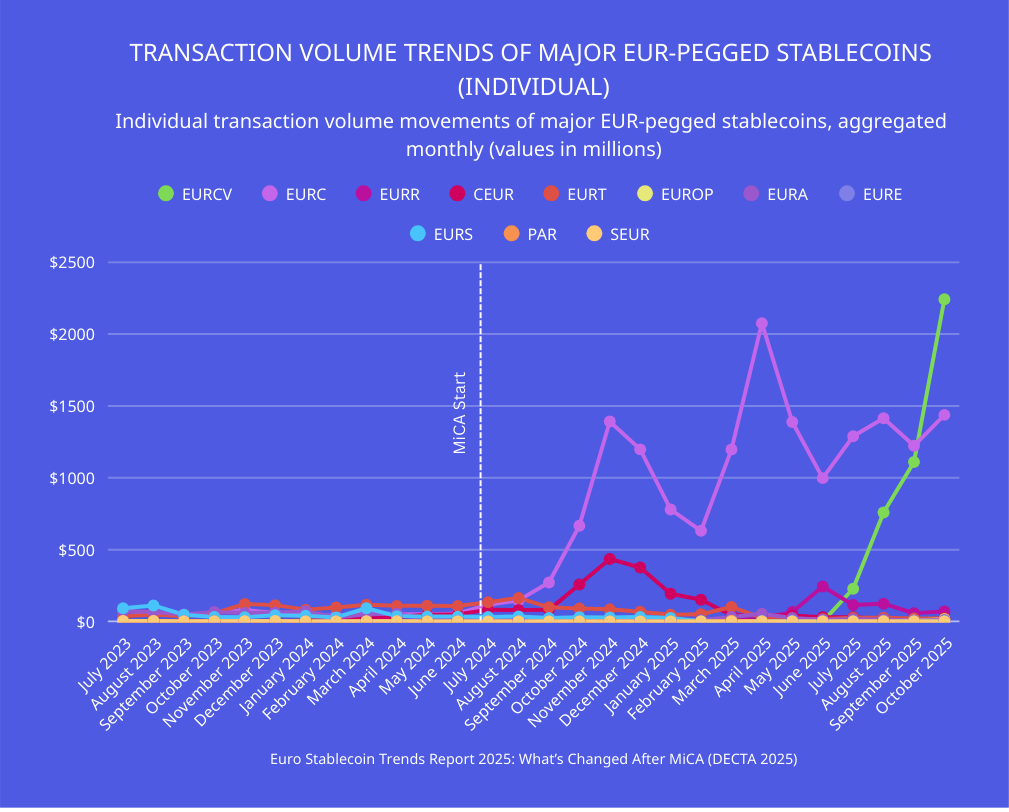

Source: Decta

Source: Decta

The inclination towards euro-denominated stablecoins arises from practical financial factors.

“Lately, we have begun noticing our clients opting for euro stablecoins where they would have previously chosen USDC,” Denisenko noted.

“Why? Because if you deposit in USDC and are purchasing something in Europe, there’s a conversion cost. Thus, it’s more convenient to use EURC as it eliminates any exchange rate issues.”

Looking forward, Denisenko mentioned that Brighty is engaging in multiple discussions with real estate agencies to educate them about transparent, legitimately sourced crypto holdings as acceptable payment options.

Real Estate Industry Adopts Crypto Amid Banking Reluctance

The appetite for crypto-enabled property transactions has escalated as traditional financial entities continue to shy away from such dealings, creating openings for specialized platforms.

Denisenko stated that Brighty is currently working with estate agencies to introduce them to transparent, legitimately acquired crypto assets as payment alternatives.

“Our wealthy clients are simply aiming to mitigate risks in their asset portfolios by investing a portion of their funds into real estate,” he commented.

In addition to Brighty, luxury real estate firm Christie’s International Real Estate established a dedicated crypto division in July 2025 after completing several high-profile transactions, including a $65 million property in Beverly Hills purchased with Bitcoin.

CEO Aaron Kirman informed the Times that “crypto is here to stay” and that the division would facilitate transactions “without banks or fiat currency.”

Meanwhile, outside Europe, RAK Properties collaborated with UAE fintech Hubpay last September to accept Bitcoin, Ethereum, and Tether for property acquisitions, expanding the international market for digital asset buyers.

Dubai’s government-supported tokenized real estate platform aims to tokenize $16 billion worth of properties by 2033, which would represent around 7% of the total anticipated transactions.

London’s high-end rental market has also embraced crypto payments, with Knightsbridge Prime Property completing a £45,000 weekly rental transaction in Bitcoin through the crypto payment platform Bitcashier in March 2024.

San Francisco-based Opendoor Technologies also announced intentions to accept Bitcoin and other cryptocurrencies for home purchases in October 2025, as confirmed by CEO Kaz Nejatian.

Real Estate Giant Opendoor to Accept Bitcoin and Crypto for Home Buying, CEO Confirms

CEO Kaz Nejatian confirms Bitcoin acceptance for the $6.22B real estate platform operating across 44 U.S. markets as company stock jumps to $8.38 following announcement.

The announcement…— Cryptonews.com (@cryptonews) October 10, 2025

The firm operates in 44 U.S. markets with a valuation of $6.22 billion and reported $1.57 billion in revenue during Q2 2025.

Beyond real estate, the private jet company FXAIR has also started accepting cryptocurrency following what its chair described as “tremendous” demand from young Bitcoin entrepreneurs, further showcasing the luxury sector’s adoption of digital currencies.

The post Stablecoins Power $500K-$2.5M Property Deals Across UK, France, and Malta: Report appeared first on Cryptonews.