Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Stablecoin Expansion Expected to Propel Upcoming Cryptocurrency Surge as Market Capitalization Reaches $200 Billion: CryptoQuant

Liquidity in the cryptocurrency sector has increased significantly, with the total market capitalization of stablecoins recently exceeding $200 billion. This rise has typically been a precursor to price surges.

As liquidity increases, a rally is often observed.

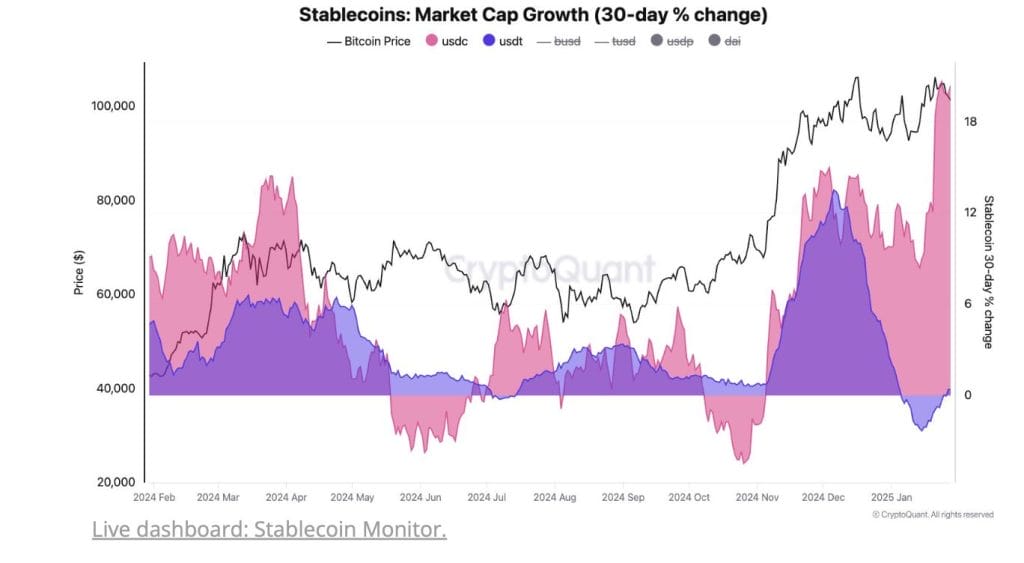

USDT’s 30-day market cap has just turned positive (after a contraction of -2%), while USDC is experiencing a 20% surge—its fastest pace in a year.

Should the momentum of stablecoins persist, higher prices may follow. pic.twitter.com/fD8sQkKSKM— CryptoQuant.com (@cryptoquant_com) January 30, 2025

According to data from CryptoQuant, stablecoin liquidity has risen since the U.S. presidential election, with major stablecoins such as Tether’s USDT and Circle’s USDC leading this growth.

Market Cap Reaches Record High Amid Increasing Liquidity

The total value of USD-denominated stablecoins hit an all-time high of $200 billion last week. Since then, it has further increased to $204 billion, marking a rise of $37 billion since November 4.

CryptoQuant indicates that this increase in stablecoin liquidity reflects growing investor confidence, which has historically triggered upward movements in the crypto market.

This growth has been primarily fueled by Tether’s USDT, the leading stablecoin in the market. However, USDC, which had been losing market share, is now regaining momentum.

An increasing supply of stablecoins typically indicates enhanced purchasing power for traders, driving demand for cryptocurrencies such as Bitcoin and Ethereum.

Another important measure of market liquidity, according to CryptoQuant, is the volume of stablecoins held on centralized exchanges.

The total value of USDT on these platforms has grown from $30.5 billion on November 4 to $43 billion, an increase of approximately 41% ($12.5 billion).

A higher amount of stablecoins on exchanges suggests that traders have substantial capital available to invest in crypto assets.

Such liquidity inflows have often preceded significant price rallies, as traders convert stablecoins into volatile assets in pursuit of gains.

USDT and USDC Lead the Stablecoin Growth

The stablecoin liquidity impulse, assessed as the 30-day percentage change in market capitalization, has turned positive.

CryptoQuant analysts propose that this may indicate a potential upward movement in Bitcoin and the broader cryptocurrency market.

USDT’s liquidity impulse had been declining by 2% at the beginning of 2024 but has now turned slightly positive, suggesting an increase in crypto demand.

Meanwhile, USDC’s liquidity impulse has expanded by 20%, marking the fastest growth rate in at least a year.

Tether’s USDT continues to be the dominant player, with its market capitalization reaching $139 billion, an increase of $19 billion (15%) since November 4.

Conversely, USDC has made a strong recovery, rising by $17 billion (48%) during the same timeframe to achieve a market cap of $52.5 billion.

The increase in liquidity and trading capital has historically coincided with rallies in the crypto market.

If historical trends persist, a growing supply of stablecoins may lead to heightened market activity in Bitcoin and other digital assets.

The post Stablecoin Growth to Drive the Next Crypto Rally as Market Cap Hits $200B: CryptoQuant appeared first on Cryptonews.