Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

South Korean Neobanking Leaders Kakao Bank and Toss to Broaden Cryptocurrency Activities

Kakao Bank and Toss Bank, two of the leading neobanking entities in South Korea, are preparing to enhance their offerings related to cryptocurrencies and stablecoins.

According to a report from Yonhap’s Infomax, Kakao Bank plans to extend its collaboration with the local cryptocurrency exchange Coinone.

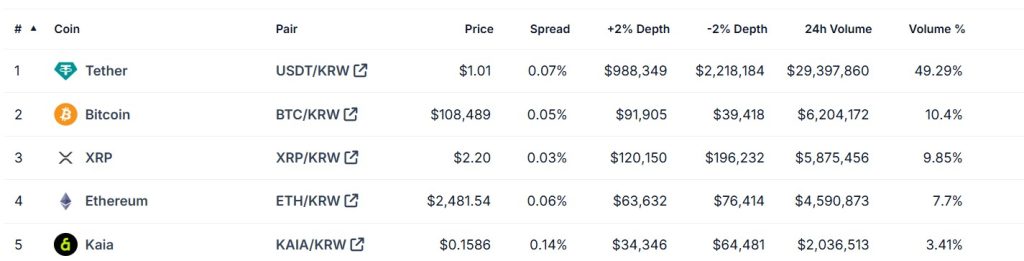

The top 5 coins by trading volume on Coinone on June 30. (Source: CoinGecko)

The top 5 coins by trading volume on Coinone on June 30. (Source: CoinGecko)

The bank is part of the Kakao Group, which also manages the KakaoTalk messaging application and the payment platform Kakao Pay.

Kakao Bank: Upcoming Stablecoin and Crypto Developments

The news agency reported that the bank is closely observing market dynamics and regulatory developments within the cryptocurrency sector.

Kakao and other stakeholders are reportedly anticipating forthcoming changes in the “domestic legal and institutional framework for cryptoassets.”

Since 2019, successive administrations in South Korea have adopted a cautious stance towards cryptocurrency regulation.

This has resulted in a comprehensive prohibition on domestic coin launches and a blanket ban on corporate investments in cryptocurrencies.

Banks and other financial institutions have also found themselves relegated to a minor role in the cryptocurrency landscape, despite their previous ambitions of becoming significant players in crypto custody.

However, this situation is poised to shift following the elections on June 3, with newly elected President Lee Jae-myun adopting a notably progressive approach to cryptocurrency policy.

One of Lee’s primary campaign promises was the introduction of a stablecoin backed by the Korean won. His administration seems prepared to fulfill this commitment by expediting a draft bill for stablecoins.

Companies like Kakao appear eager to ensure they are well-positioned to enter the market promptly if granted approval.

Yonhap reported that the company is currently “making advanced preparations to be able to quickly enter the sector.”

Trading volumes on the Coinone crypto exchange on June 30. (Source: CoinGecko)

Trading volumes on the Coinone crypto exchange on June 30. (Source: CoinGecko)

Additionally, in June, Kakao Bank submitted applications for 12 trademarks across three categories related to cryptocurrencies, specifically:

- crypto-related software

- crypto financial transactions

- crypto mining

Expanded Crypto Offerings

Kakao Bank has also introduced new crypto services linked to Coinone for its traditional finance customers. These services include real-time price tracking for cryptoassets and links to crypto wallets.

Consequently, Coinone wallet holders can view their balances and the KRW value of their crypto holdings directly through the Kakao Bank app interface.

New features will also display the book value of crypto investments, along with statistics related to gains or losses.

Kakao Bank stated that it will continue to seek new collaboration opportunities with Coinone and aim to enhance its “involvement in the cryptoassets market.”

In April of this year, the bank integrated a Coinone-linked “invest in crypto” feature into its banking application.

Kakao Bank has an exclusive partnership with Coinone, meaning that all customers of the exchange wishing to access the KRW market must establish dedicated bank accounts with the financial institution.

The bank may also consider expanding its cryptocurrency operations internationally. It has recently obtained an operating license in Thailand. Yonhap reported:

“More than 20% of the Thai population owns cryptoassets, per some estimates. That is the highest rate in the world. This could also be a good environment for Kakao Bank to consider moving into in the future.”

SK Telecom’s retail partner compensation plan stirs controversyhttps://t.co/IMFGqfX95N

— The Korea Times (@koreatimescokr) June 29, 2025

As discussions regarding cryptocurrency continue to progress in the National Assembly, share prices for both Kakao Bank and Kakao Pay are experiencing growth.

Toss Bank: 48 Trademark Applications

The same media outlet also reported that Toss Bank aims to join the Open Blockchain and DID Association (OBDIA). The OBDIA was authorized to operate as a non-profit organization by the Ministry of Science and ICT in 2018.

However, interest in the organization has surged this year following the establishment of a dedicated stablecoin division.

This division is responsible for exploring the feasibility of institutionalizing stablecoins in South Korea. The organization currently includes nine banks among its members, specifically:

- IBK Industrial Bank

- Kookmin Bank

- Nonghyup Bank

- Suhyup Bank

- Shinhan Bank

- Woori Bank

- KEB Hana Bank

- IM Bank

- K Bank

K Bank serves as the official partner bank for the leading cryptocurrency exchange Upbit.

Other significant financial institutions have also joined the group, including the Korea Financial Telecommunications and Clearings Institute.

Yonhap reported that OBDIA is also contemplating the creation of a joint corporation that could collectively issue stablecoins.

Korean police have arrested 32 Thai nationals on charges of smuggling methamphetamine and yaba into the country and distributing the drugs nationwide.https://t.co/9r1msA9XHq

— The Korea JoongAng Daily (@JoongAngDaily) June 30, 2025

Toss Bank has also filed for a total of 48 trademarks related to stablecoins, including KRWTSB.

Current OBDIA members have similarly submitted applications. Kookmin filed for stablecoin-related trademarks on June 23, while KEB Hana Bank applied for 16 related trademarks, including HanaKRW, on June 25.

Meanwhile, the Financial Services Commission (FSC) has informed the State Affairs Planning Committee that new legislation is necessary to create a safer investment environment for domestic cryptocurrency traders.

The FSC aims to establish new regulations for stablecoins to “ensure global consistency and protect users” as an increasing number of retail investors enter the market.

The post South Korean Neobanking Heavyweights Kakao Bank, Toss to Expand Crypto Operations appeared first on Cryptonews.