Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

South Korean Lawmaker Investigates Upbit for Potential Monopoly Practices in Cryptocurrency Exchange Market

The South Korean cryptocurrency exchange Upbit is under examination by a lawmaker who is worried that it may be evolving into a “monopoly.”

As reported by Newsis, MP Min Byeong-deok, who is part of the National Assembly’s Political Affairs Committee and a member of the Democratic Party, has also expressed concerns regarding the market dominance of Upbit’s banking partner, K Bank.

Is South Korean Crypto Exchange Upbit a ‘Monopoly?’

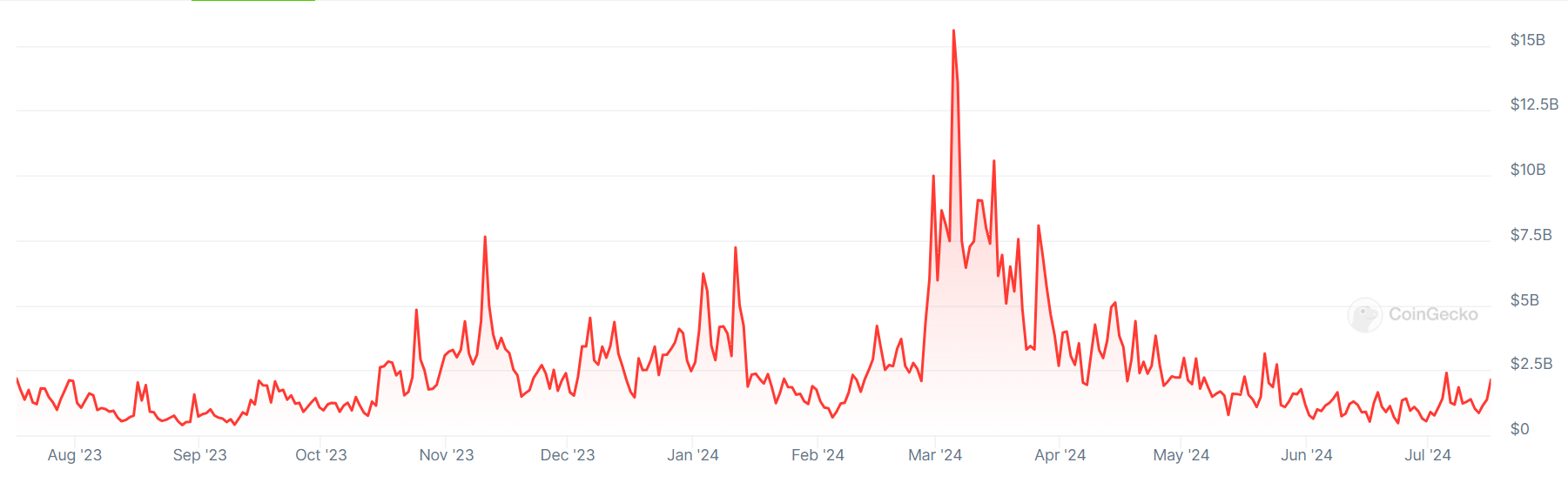

Min highlighted that Upbit represents approximately 60% of South Korea’s overall trading volumes as of July.

This marks a significant decrease from over 80%, a peak it achieved in October of the previous year.

Nevertheless, despite the roughly 20% reduction in market share, Min and others remain apprehensive about “monopolization” within the local market.

K Bank collaborates exclusively with Upbit and surpasses all other banks engaged in crypto exchange-related activities.

Data gathered by Min’s office indicates that K Bank held a 76.87% share of the crypto sector last year.

In 2022, this bank captured nearly 69% of the market. In 2021, just under 73% of crypto-related banking transactions were processed through K Bank.

Trading volumes on the Upbit crypto exchange over the past 12 months. (Source: CoinGecko)

Trading volumes on the Upbit crypto exchange over the past 12 months. (Source: CoinGecko)

In contrast, the commercial banking leader Nonghyup (NH) saw its market share plummet from 95% in 2020 to a mere 18.51% last year.

K Bank’s partnership with Upbit has proven to be highly effective. Its neobanking platform enables customers to register for accounts online.

During the COVID-19 pandemic, this significantly accelerated new account creation on both Upbit and K Bank.

K Bank’s neobanking competitor, Kakao Bank, has attempted to counter this by teaming up with the Coinone crypto exchange.

However, the data reveals that Coinone and Kakao Bank collectively represented only about 3% of the domestic market last year.

Statistics further indicate that nearly half of K Bank’s customers possess accounts linked to crypto exchanges. Min stated:

“The domestic virtual asset trading market is ranked in the top 10 in the world. But we have a unique phenomenon whereby a certain company continues to monopolize the sector.”

South Korea’s foreign exchange market will operate until 2 a.m. from Monday, while its crypto market is set to enter a new phase with the implementation of the virtual asset user protection law this month, which will take effect in the latter half of this year.https://t.co/Zuk6c7Ekco

— The Korea Herald 코리아헤럴드 (@TheKoreaHerald) July 1, 2024

Lawmaker ‘Seeking Expert Opinion’

Min has previously criticized Upbit for what he described as “opaque” token delisting processes.

The lawmaker mentioned that he is seeking “expert opinions” on whether legislative changes to the Virtual Asset User Protection Act are necessary.

Min suggests that lawmakers may “require exchanges to notify” customers about their “listing schedules at least one month in advance of making changes.”

The lawmaker has previously committed to “upgrading” the domestic crypto market. He has supported initiatives to approve spot Bitcoin ETFs.

The Democratic Party, which achieved a significant victory in this year’s legislative elections, has also vowed to advocate for the approval of spot Bitcoin ETFs.

Min is participating in the Democratic Party’s primaries for the role of Gyeonggi Province Chairman.

He has also shown a willingness to “develop” the crypto sector and incorporate more “investor protection” measures into South Korean legislation.

A K Bank office in Seoul, South Korea. (Source: Korea Business News/YouTube)

A K Bank office in Seoul, South Korea. (Source: Korea Business News/YouTube)

Not The First Time Upbit, Dunamu Have Faced Monopoly Talk

This is not the first instance of Upbit and its operator Dunamu encountering scrutiny regarding monopoly concerns from South Korean authorities.

In 2022, lawmakers and the Fair Trade Commission (FTC) indicated they were “looking into” Upbit and the broader issue of monopolies in crypto exchanges.

FTC guidelines specify that any company with a market share exceeding 50% is classified as a “monopoly.”

South Korean lawmakers have previously initiated various measures aimed at curbing the expansion of monopolies.

These measures include the Monopoly Regulation and Fair Trade Act, which imposes regulations on companies with assets valued at around $4 billion.

ICYMI: Korea’s Fair Trade Commission reportedly launched an on-site inspection into Coupang last month on allegations that the online platform used dark patterns to raise the prices of, and keep users subscribed to, its paid membership service. https://t.co/Y1cWGh2iOQ

— The Korea JoongAng Daily (@JoongAngDaily) June 17, 2024

A Crypto ‘Conglomerate’

The head of the regulatory Financial Services Commission has also previously pledged to investigate concerns regarding Upbit’s “monopoly” status.

In May 2022, the FTC designated Upbit as the first official “conglomerate” in the domestic crypto sector.

This classification prevents conglomerate-sized companies from making equity investments or providing loan guarantees with their affiliated firms.

The post South Korean Crypto Exchange Upbit the Subject of Lawmaker’s ‘Monopoly’ Scrutiny appeared first on Cryptonews.