Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Solana Treasury Entities Increase Holdings to 6.5 Million SOL as Upexi Reports 126% Growth

Solana treasury companies are swiftly increasing their assets, with total reserves rising to 6.49 million SOL, as institutional interest in the network remains robust.

The most recent reports from BIT Mining Limited and Upexi Inc. highlight the increasing activity surrounding corporate Solana treasuries, indicating both long-term confidence and short-term profits from the token’s price surge.

Corporate Investments in Solana Expand as Treasury Gains and Staking Revenue Accelerate

BIT Mining Limited, a cryptocurrency infrastructure firm set to rebrand as SOLAI Limited, revealed the acquisition of an additional 17,221 SOL this week.

JUST IN: Solana treasury company @BITMining_BTCM (NYSE: BTCM) has added 17,221 $SOL to its holdings, bringing its treasury to over 44,000 $SOL worth about $9.95M. pic.twitter.com/6xCe2C101y

— SolanaFloor (@SolanaFloor) September 11, 2025

This acquisition increases its treasury to over 44,000 SOL, valued at roughly $9.95 million as of September 10, 2025.

Chairman and COO Bo Yu stated that the company recognizes ongoing value in enhancing its presence within the Solana ecosystem, noting that validator operations will remain a core aspect of its strategy to secure the network and earn staking rewards.

While BIT Mining is still in the initial phases of developing its Solana portfolio, Upexi Inc. has already positioned itself as one of the largest corporate holders.

The supply chain and consumer products firm shifted its focus in April to a Solana treasury strategy and now reports holdings of 2,018,419 SOL valued at $447 million.

This amount represents an unrealized gain of $142 million, with the majority of the company’s tokens staked to yield an annual return of approximately 8%. Daily staking rewards currently approximate $105,000.

Upexi’s treasury strategy has also yielded gains on a per-share basis. The firm introduced an “adjusted SOL per share” metric to account for the impact of capital issuance, staking income, and discounted locked SOL purchases.

1/ The Evolution of DATs:@UpexiTreasury was an early mover in the SOL and altcoin treasury movement, and we continue to lead on new, creative, and intelligent capital issuances. We see many investors and funds who dismissed DATs now launching their own!

— Allan Marshall (@UpexiAllan) September 11, 2025

As of September 10, the adjusted SOL per share was recorded at 0.0197, or $4.37 in dollar terms, reflecting increases of 56% and 126%, respectively, since the initiative’s launch.

Chief Executive Allan Marshall described the recent weeks as “extremely strong,” highlighting both treasury performance and increased visibility through participation in finance conferences.

The company has also formed an advisory committee to enhance its positioning, with former BitMEX CEO Arthur Hayes joining as its inaugural member.

Chief Strategy Officer Brian Rudick underscored Upexi’s execution, citing three capital issuances that were “materially in the money” and ongoing growth in SOL per share as indicators of successful treasury management.

Conversely, BIT Mining transitioned to Solana earlier this year when it announced plans to raise up to $300 million to establish an SOL treasury and move away from its previous focus on Bitcoin, Litecoin, Dogecoin, and Ethereum Classic mining.

Under this strategy, all existing crypto assets are being converted into SOL, with funds to be raised in stages based on market conditions.

BIT Mining has also introduced DOLAI, a U.S. dollar-backed stablecoin launched on Solana in collaboration with Brale Inc.

Introducing DOLAI – a USD-backed stablecoin launched with BIT Mining (NYSE: BTCM), issued on Solana via Brale’s regulated platform.

Built for Agentic payments.![Solana Treasury Entities Increase Holdings to 6.5 Million SOL as Upexi Reports 126% Growth1]()

pic.twitter.com/IMPVqnSMx3

— brale (@brale_xyz) August 26, 2025

This stablecoin aims to connect AI agents, merchants, consumers, and institutional finance, with plans for future multi-chain applications.

BIT Mining, currently ranked as the 17th largest public Bitcoin miner by market capitalization, now sees its future anchored in Solana staking, treasury expansion, and blockchain-enabled services.

The increase in treasury activity coincides with SOL’s ongoing ascent. The token is trading around $226, reflecting a 1.2% increase for the day and approaching its all-time high of $293 set in 2021.

Institutional Treasuries Invest Billions in Solana as New Vehicles Emerge

Institutional interest in Solana is escalating as major firms prepare multi-billion-dollar treasury strategies on the blockchain.

For instance, on August 25, Galaxy Digital, Jump Crypto, and Multicoin Capital entered advanced discussions to raise approximately $1 billion for a new Solana-focused treasury vehicle, with Cantor Fitzgerald advising on the transaction.

The strategy involves acquiring a publicly traded entity to create one of the largest corporate reserves dedicated to Solana, exceeding the size of all current treasuries.

@defidevcorp has added another 196,141 Solana to its treasury, spending nearly $39.76 million.#Solana #SOLhttps://t.co/OHlzvP4kNF

— Cryptonews.com (@cryptonews) September 5, 2025

Meanwhile, DeFi Development Corp increased its balance sheet by 196,141 SOL on September 5, investing $39.76 million at an average price of $202.76 per token.

This acquisition raised its total holdings above 2 million SOL, valued at $412 million, with the firm confirming intentions to stake its entire position for yield.

On September 8, Forward Industries announced a $1.65 billion private placement led by Galaxy Digital, Jump Crypto, and Multicoin Capital, with existing shareholder C/M Capital Partners participating. The raise, one of the largest Solana-specific financings to date, concluded on September 11.

The company stated that proceeds would support a new cryptocurrency treasury program focused on SOL acquisitions, along with working capital and future transactions.

SOL Strategies launches on Nasdaq as STKE with $94M Solana treasury – is this the $SOL breakout catalyst?#Solana #SOLhttps://t.co/aN4Ff5ksHc

— Cryptonews.com (@cryptonews) September 10, 2025

Further contributing to the momentum, Canada-based SOL Strategies began trading on Nasdaq under the ticker STKE on September 10 with $94 million in Solana treasury assets, becoming the first U.S.-listed Solana-focused public company.

Following a share consolidation to comply with exchange requirements, the firm now manages 3.62 million SOL under delegation, including 402,623 from its treasury, and reports record staking participation from nearly 9,000 wallets.

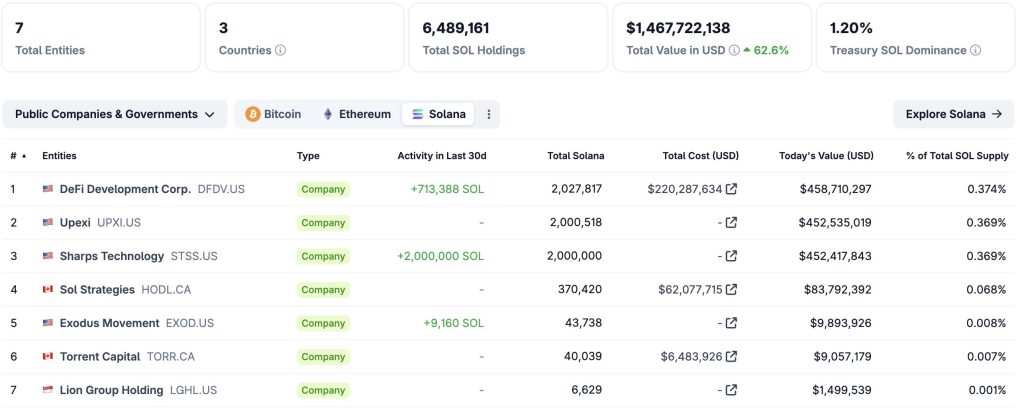

According to CoinGecko’s Solana treasury reserve data, seven entities currently hold 1.20% of Solana, valued at $1.4 billion.

Source: CoinGecko

Source: CoinGecko

Solana Surpasses $220 as DeFi TVL Reaches Record $12.2B Amid Institutional Accumulation

Solana (SOL) has surpassed $220 for the first time since February, achieving a seven-month high as capital inflows and technical indicators suggest renewed momentum. This rally occurs despite a slowdown in new user onboarding, with address creation at a five-month low.

Analysts indicate that the surge is primarily driven by existing holders and institutional accumulation rather than new retail investments.

Significant purchases have contributed to the optimistic sentiment. Data reveals that Galaxy Digital acquired 430,000 SOL valued at $97 million from Binance within an hour, bringing its total over a 12-hour period to 1.35 million SOL worth $302 million.

JUST IN: @galaxyhq’s aggressive Solana accumulation continues as the firm bought 430,000 $SOL worth $97M from @binance in the last hour. Over the past 12 hours, Galaxy has accumulated 1.35M $SOL worth $302M. pic.twitter.com/gOGqJ4Kms6

— SolanaFloor (@SolanaFloor) September 11, 2025

Arkham Intelligence also identified four new wallets receiving 222,644 SOL, valued at $48.2 million, from Coinbase Prime in what appears to be a coordinated accumulation effort.

On the DeFi front, Solana achieved a new milestone with total value locked (TVL) exceeding $12.2 billion on September 11, surpassing its previous record of $12 billion set in January.

TVL has increased by 15% over the past month and has more than doubled from $4.8 billion at the beginning of 2024.

Solana now outpaces Ethereum’s Layer-2 networks combined, although Ethereum continues to lead DeFi with nearly $97 billion locked.

From a technical perspective, Solana exhibits bullish signals after breaking out of a symmetrical triangle pattern around $212, indicating a potential upside target of $240.

Source: TradingView

Source: TradingView

Other charts also indicate a double bottom near $198–200, confirmed by a breakout above the $212 neckline, projecting short-term targets of $222–224.

Indicators support this movement, with the MACD histogram turning positive and the RSI trending upward, indicating renewed buying strength.

Analysts highlight that maintaining levels above $210–212 is crucial for continuation, with resistance anticipated at $220–224.

A decline below $208 could weaken the setup, but momentum appears to favor an upward movement in the near future.

The post Solana Treasury Firms Boost Holdings to 6.5M SOL as Upexi Posts 126% Surge appeared first on Cryptonews.

@defidevcorp has added another 196,141 Solana to its treasury, spending nearly $39.76 million.#Solana #SOLhttps://t.co/OHlzvP4kNF

@defidevcorp has added another 196,141 Solana to its treasury, spending nearly $39.76 million.#Solana #SOLhttps://t.co/OHlzvP4kNF