Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Solana Price Forecast: Morgan Stanley Has Submitted a SOL ETF Application – Could This Signal Wall Street’s Next Crypto Fascination?

Morgan Stanley, one of the largest banks in the United States, has revealed plans to introduce a SOL-linked exchange-traded fund (ETF), indicating a positive outlook for Solana as Wall Street’s enthusiasm for cryptocurrencies continues to expand.

The bank submitted the necessary documentation to list both Solana and Bitcoin ETFs on Tuesday. This marks their initial foray into crypto-related products in the U.S. market.

Since the launch of the first Solana ETF in the country six months ago, these funds have already attracted $801 million in investments.

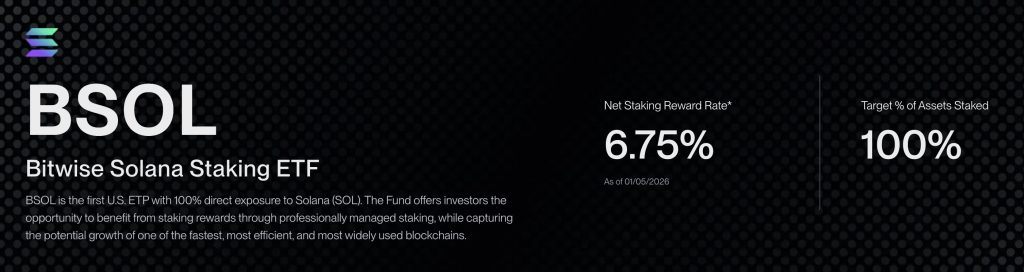

The Bitwise BSOL ETF remains the largest by assets under management (AUM), boasting $730 million.

Staking rewards present an appealing aspect for investors. As of now, BSOL’s staking yield stands at 6.75%. These rewards are added to the fund daily, which should enhance the ETF’s price over time.

Solana Price Prediction: SOL Aiming for $230 as Positive Momentum Builds

Morgan Stanley’s move to launch a Solana ETF significantly enhances this altcoin’s credibility. It also underscores Wall Street’s growing interest in cryptocurrencies beyond Bitcoin.

Source: TradingView

In the last week, SOL has appreciated by 9%, currently trading at $138. At the same time, trading volumes are at $5.5 billion, representing 7% of the asset’s market capitalization.

The daily price movements indicate that SOL has broken out of a falling wedge pattern. This bullish configuration typically signals a trend reversal once it is breached.

The immediate target for the token is the $160 mark, as the market is likely to test the 200-day exponential moving average (EMA).

If SOL exceeds its 200-day EMA, it could quickly approach $200, supported by increasing institutional demand on Wall Street.

As interest in the Solana ecosystem continues to rise, premier crypto presales like Bitcoin Hyper ($HYPER) may also capture Wall Street’s focus. This robust Solana-based Bitcoin Layer 2 is designed to facilitate passive income for BTC investors.

Bitcoin Hyper ($HYPER) Utilizes Solana’s Efficiency to Enhance Bitcoin’s DeFi Landscape

Bitcoin Hyper ($HYPER) provides genuine utility to Bitcoin by enabling rapid, cost-effective DeFi through Solana’s swift infrastructure.

With the Hyper Bridge, BTC holders can access the Hyper Layer 2 directly from the Bitcoin network without relinquishing custody.

This allows for lending, staking, and earning yields on BTC for the very first time.

As more Bitcoin integrates into the Hyper L2, demand for $HYPER is expected to rise sharply.

Investors have already invested over $30 million, recognizing the potential to rejuvenate Bitcoin’s ecosystem and unlock true on-chain utility.

To acquire $HYPER before the presale concludes, simply visit the official Bitcoin Hyper website and connect a compatible wallet such as Best Wallet.

You can exchange USDT or SOL for this token or use a standard bank card to finalize your purchase.

Visit the Official Bitcoin Hyper Website Here

The post Solana Price Prediction: Morgan Stanley Just Filed for a SOL ETF – Is This the Beginning of Wall Street’s Next Crypto Obsession? appeared first on Cryptonews.