Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Solana Experiences $125M Increase as Interest in New Tokens Diminishes—Are Previous Meme Coins Making a Comeback?

Solana has experienced a significant increase in activity over the past week, driven by a mix of substantial asset inflows and a renewed interest in older meme coins that continue to lead in trading volumes and investor engagement.

As per on-chain data from Artemis and deBridge, over $125 million in assets have been bridged into Solana from various blockchains in the past week.

REPORT: In the last 7 days, more than $125 million bridged from other chains to @Solana, with over $70 million coming from Ethereum alone.

(An increase of nearly 40% compared to the previous week) pic.twitter.com/jMVTiJZ8jr— SolanaFloor (@SolanaFloor) July 14, 2025

Ethereum Drives $70M Liquidity Influx Into Solana as Meme Coin Excitement Diminishes

Solana is undergoing a significant liquidity resurgence, primarily fueled by Ethereum, as the volume of bridged assets rises. Data from Artemis indicates that Ethereum contributed over $70 million in inflows to Solana, accounting for nearly 56% of the total. Arbitrum followed with $14.1 million, while Polygon and BNB Chain added $7.5 million and $2.6 million, respectively. Other smaller chains contributed the remaining $4.2 million.

The overall bridged volume into Solana increased by nearly 40% week-over-week, with the Ethereum-to-Solana route emerging as the leading channel. Additional data from deBridge confirms that $31 million in assets transitioned from Ethereum to Solana alone.

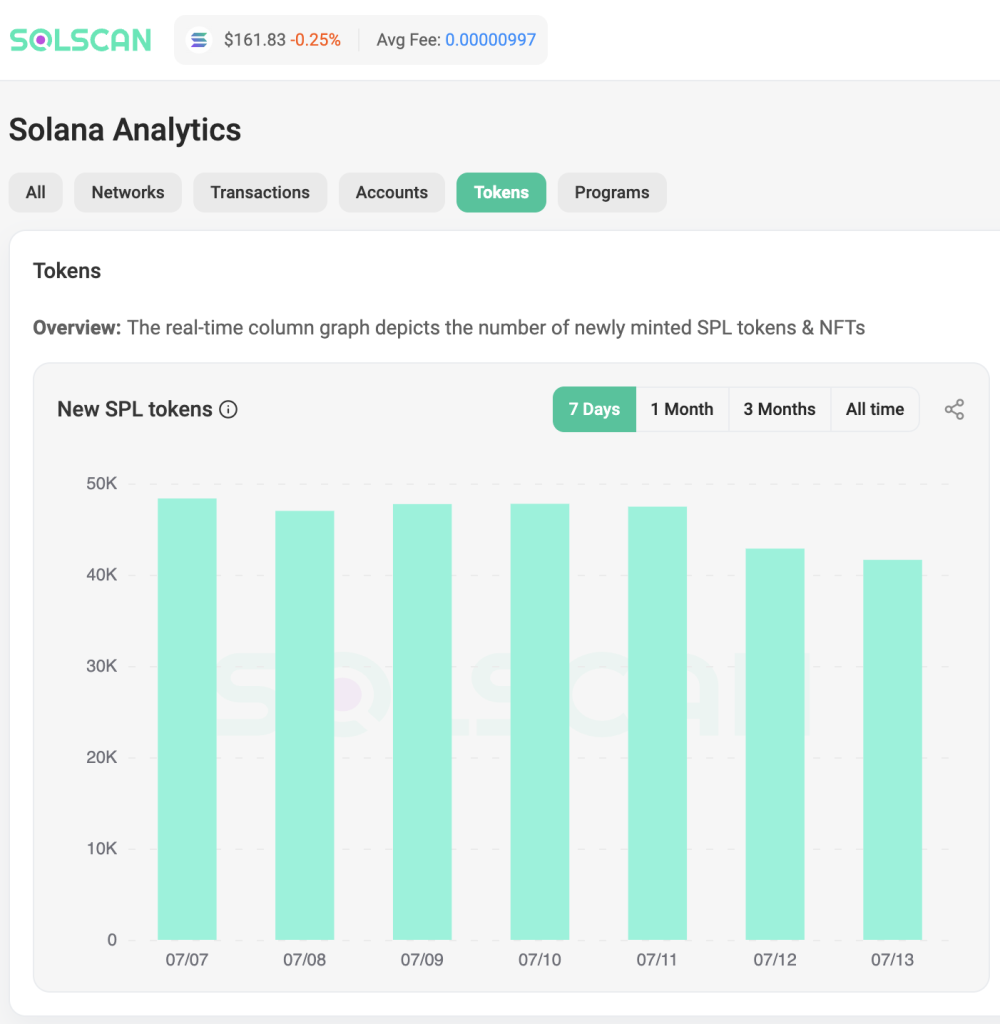

Source: solscan

Source: solscan

This capital movement seems to be associated with a slowdown in the previously explosive meme coin launch activity. While Solana had seen a significant increase in new token launches, last week recorded only 322,000 new token launches, a considerable decline compared to earlier highs. This trend suggests a shift back toward established projects and tokens.

Notably, even amid the competition between LetsBONK and Pump.fun, token activity was relatively subdued. LetsBONK launched 1,243 tokens, double the amount of Pump.fun’s 622, and also introduced 130,605 new tokens, significantly outpacing Pump.fun’s 77,250.

As new meme coin launches slow down, several older and more established meme tokens on Solana are witnessing renewed interest.

Traders seem to be reallocating liquidity toward more familiar assets, including Pepe (PEPE), Shiba Inu (SHIB), Dogecoin (DOGE), Bonk (BONK), and Pudgy Penguins (PENGU), indicating a transition from novelty to familiarity.

Source: Cryptonews

Source: Cryptonews

PEPE has seen a significant 23.73% rise in market capitalization over the last week and is currently trading at $0.00001217. The token’s 24-hour trading volume is $5.87 billion, reflecting a 78.50% increase from the previous day. This surge in volume indicates heightened market activity. As of today, PEPE’s market capitalization stands at $5.12 billion.

Shiba Inu (SHIB), the second-largest meme token by market capitalization, is also gaining momentum. The token is currently priced at $0.00001329, marking a 14.9% increase over the past week and a 0.6% rise in the last 24 hours. SHIB’s market capitalization has reached $7.83 billion, placing it 23rd in token market cap.

Dogecoin (DOGE), the largest meme coin by market cap, is currently trading at $0.1982. It has increased by 18.5% over the past week, achieving a market cap of over $8.06 billion.

Bonk (BONK) has garnered significant market attention, with its price rising 70% over the last 10 trading sessions. The token is currently valued at $0.00002719, reflecting a 6.27% increase in the past 24 hours. BONK’s market cap has grown to $1.465 billion after a 33.9% increase in the past week.

Pudgy Penguins (PENGU) has also seen a notable resurgence. The token surged 48.2% in the last week, elevating its market capitalization to $1.918 billion. This sudden momentum was further fueled by an unexpected social media endorsement from TRON founder Justin Sun, increasing investor interest.

Collectively, these developments indicate a broader trend of capital rotation back into well-known meme coins, as traders seek stability and momentum within the increasingly crowded meme token market.

Solana Leads Q2 Revenue at $271M, Outperforming Ethereum, Bitcoin & Tron

In the meantime, Solana continues to excel compared to its counterparts in key metrics. The blockchain generated over $271 million in revenue in Q2 2025, surpassing Ethereum, Tron, and Bitcoin for the third consecutive quarter, according to Blockworks.

REPORT: In Q2 2025, @Solana outperformed all L1 & L2 chains in network revenue, marking its third consecutive quarter leading all chains.

– Revenue: $271 million+ pic.twitter.com/ThpsVv97w5— SolanaFloor (@SolanaFloor) July 7, 2025

Transaction volume on the network increased by 32% last week to 590 million, exceeding the combined activity of Ethereum, BNB Chain, and Polygon. Active addresses rose to 24.4 million, and fee revenue grew by 44% to $7.68 million.

Adding to the momentum is the anticipation surrounding Solana ETFs. Polymarket data indicates that traders now estimate a 99% likelihood that the U.S. Securities and Exchange Commission will approve a spot Solana ETF by the end of 2025.

Bloomberg ETF analysts have significantly raised expectations for U.S. approval of spot funds tracking Solana, Litecoin, and XRP.#ETFs #XRPhttps://t.co/dKK2ZIbW8c

— Cryptonews.com (@cryptonews) July 1, 2025

Several prominent firms, including VanEck, Grayscale, 21Shares, and Bitwise, have already submitted applications, indicating strong institutional interest.

Bloomberg ETF analyst James Seyffart echoed this sentiment, stating, “We’re anticipating a wave of new ETFs in the latter half of the year. Solana is clearly at the forefront of that discussion.”

Notably, Solana (SOL) is currently trading at $162.19, reflecting a 9.5% increase over the past week. The token has also experienced a significant rise in trading activity, with 24-hour volume reaching $14.4 billion, a 133.4% increase from the previous day.

Source: Cryptonews

Source: Cryptonews

On July 12, analyst Ali Martinez shared a positive outlook on Solana, highlighting a cup-and-handle pattern forming on the weekly chart, a classic bullish indicator that often precedes significant rallies.

This is a critical level for Solana $SOL. A weekly close above $170 could trigger the next major bull run and pave the way to $2,000! pic.twitter.com/JjTaRdUL4h

— Ali (@ali_charts) July 12, 2025

The pattern suggests that Solana has rebounded from its previous lows near $9.88, following a multi-year ascent from its prior peak around $250. The recent price movements appear to be forming the “handle” part of the structure.

Martinez identifies $170 as a key resistance level. A confirmed breakout above this level, especially with a weekly close, could validate the pattern and initiate a strong upward movement.

Based on Fibonacci projections, potential price targets include $295 (a retest of the all-time high), with longer-term targets of $787, $1,314, and even $2,744.

However, failure to surpass $170 may result in a pullback toward $135 or even $100, which has historically served as strong support.

The post Solana Sees $125M Surge as New Token Hype Fades—Old Meme Coins Back in Play? appeared first on Cryptonews.

REPORT: In Q2 2025, @Solana outperformed all L1 & L2 chains in network revenue, marking its third consecutive quarter leading all chains.

REPORT: In Q2 2025, @Solana outperformed all L1 & L2 chains in network revenue, marking its third consecutive quarter leading all chains.