Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Singapore Raises Concerns Over Increased Terrorism Financing Risk for Digital Payment Token Services

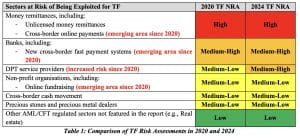

Singapore has elevated the risk classification for digital payment token (DPT) service providers that may be involved in terrorism financing (TF) from “medium-low” to “medium-high” in its recent update to the national risk assessment concerning terrorism financing.

The Ministry of Home Affairs, Ministry of Finance, and Monetary Authority of Singapore collectively disclosed on Monday that the latest risk evaluation, which was last performed in 2020, pinpointed similar areas of terrorism financing risk.

Nevertheless, the report acknowledged a lack of definitive evidence regarding the widespread utilization of digital payment tokens in Southeast Asia. This may be attributed to limited technological infrastructure in regions affected by terrorism, which often lack both financial systems and reliable internet access.

DPT service providers encompass businesses that engage in digital currencies.

Challenges in Stopping Terrorist Financing with Digital Tokens

Although conventional currencies remain the primary means by which terrorists fund their operations, experts globally are increasingly concerned about the potential use of virtual currencies like Bitcoin for such activities. This apprehension has intensified, particularly following the COVID-19 pandemic. Authorities in Singapore are closely monitoring this evolving situation as virtual currencies gain traction.

“While there are no known domestic TF cases involving DPTs, Singapore is aware of the heightened TF risks stemming from the growing presence of DPT service providers,” the report stated.

Several factors contribute to the concern surrounding terrorism financing in relation to DPTs. Firstly, these transactions are frequently anonymous, rapid, and can occur across borders, complicating tracking efforts. Secondly, there is a possibility that even licensed firms in Singapore may engage with unlicensed entities abroad, which could be more susceptible to exploitation.

Moreover, not all nations have adopted uniform regulations for monitoring these transactions, resulting in loopholes that could be exploited by terrorists.

Additionally, features such as anonymity tools and privacy coins hinder the ability to trace the identities of senders and receivers, as well as their locations. Furthermore, these currencies facilitate swift and straightforward cross-border fund transfers, providing a more efficient means for terrorists to move substantial amounts of money compared to traditional methods.

However, this very anonymity and convenience also pose considerable challenges for law enforcement agencies attempting to track terrorist financing through digital currencies.

Singapore’s Focus on Combating Money Laundering in Banking and Digital Token Services

Singapore’s assessment revealed that banks, particularly those involved in wealth management, are at the highest risk for money laundering. This is due to the large sums of money that banks manage and their clientele, who may be more inclined to participate in illicit activities.

In addition to banks, Singapore’s assessment also highlighted payment companies that facilitate international money transfers and investment firms managing foreign assets as significant areas of concern for money laundering.

In April, Singapore’s financial regulator took measures to mitigate these money laundering risks. It announced amendments to the Payment Services Act, which will enhance the agency’s oversight of companies engaged in digital currencies.

The post Singapore Flags Higher Terrorism Financing Risk for Digital Payment Token Services appeared first on Cryptonews.