Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Silver Drops 36% in Historic Precious Metals Decline – Is Bitcoin Set to Surge?

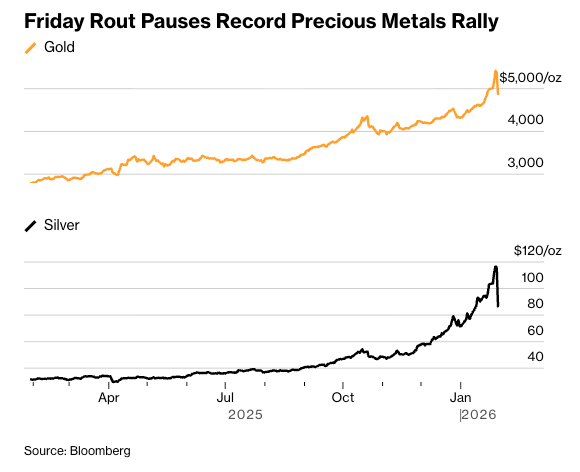

On January 30, precious metals experienced a dramatic downturn as gold dropped over 12% to below $5,000 an ounce, while silver witnessed its most significant intraday decline on record, plummeting by as much as 36%, as reported by Bloomberg.

Source: Bloomberg

Source: Bloomberg

The selloff was instigated by President Donald Trump’s selection of Kevin Warsh as chair of the Federal Reserve, which caused the dollar to surge and prompted substantial profit-taking in the commodities markets.

This collapse erased over $15 trillion from the gold and silver markets within a single day, an amount that is equivalent to half the total size of the U.S. economy.

In spite of the severe correction, both metals concluded January with positive results (gold increasing by 12% and silver by 16%), while Bitcoin fell to a nine-month low of $82,000, igniting speculation on whether the digital currency will mimic the trend of precious metals or pursue its own direction.

Historic Selloff Fueled by Warsh Nomination and Technical Factors

Spot gold prices fell more than 12% at one stage, reaching a low of $4,682 per ounce in its largest single-day drop since the early 1980s, ultimately closing down 9.25% at $4,880.

Silver saw an even more severe drop, sinking 36% intraday to $74.28 per ounce before finishing 26.42% lower at $85.259, marking its most significant decline since March 1980.

Gold and silver have collectively lost $6.52 trillion over the past 48 hours.

That is nearly four times Bitcoin’s entire market cap.

Unbelievable. pic.twitter.com/7tNipGt19e— Joe Consorti (@JoeConsorti) January 30, 2026

“Trump’s announcement of Warsh as his candidate for the next Fed Chair has been favorable for the US dollar and detrimental for precious metals,” remarked Aakash Doshi, global head of gold and metals strategy at State Street Investment Management, to Bloomberg.

“This has likely been intensified by month-end rebalancing, as both short dollar and long precious metals have been the prevailing macro trade for the last two to three weeks.”

The selloff accelerated due to forced selling and margin calls as leveraged positions were unwound.

“This is getting crazy,” stated Matt Maley, equity strategist at Miller Tabak, adding, “Much of this is likely due to ‘forced selling.’ This has recently been the hottest asset for day traders and other short-term investors. Therefore, some leverage has built up in silver. With today’s drastic drop, margin calls were triggered.”

Bloomberg also indicated that technical factors exacerbated the crash as a gamma squeeze compelled dealers to sell futures contracts when prices fell below critical options levels at $5,300, $5,200, and $5,100 for gold.

Gold’s relative-strength index had recently reached 90, the highest in decades, indicating that the precious metal was significantly overbought and due for a correction.

Source: Bloomberg

Source: Bloomberg

Major mining firms faced severe losses, with Newmont down 11.52%, Barrick Gold declining by 12.09%, and AngloGold plummeting by 13.28%.

Copper also retreated by 3.4% from Thursday’s record high above $14,000 per ton, while silver ETFs recorded their worst days ever, with the iShares Silver Trust dropping 31%.

Bitcoin Confronts ‘Two-Path’ Dilemma as Markets Reevaluate Fed Policy

Following Warsh’s nomination, Bitcoin fell to $82,000, with spot Bitcoin ETF outflows accelerating to about $1 billion this month and total liquidations nearing $800 million to $1 billion, according to analysts at Bitfinex.

The digital asset is trading at a nine-month low as investors reevaluate monetary policy directions.

Jeff Park, CIO at Bitwise, presented a crucial framework for understanding Bitcoin’s divergent trajectory from precious metals in his “Two Bitcoin Thesis.”

“Metals indicate that spot debasement is occurring; Bitcoin will signal when the yield curve itself breaks,” Park elaborated, differentiating between “negative rho Bitcoin” that performs better when rates decrease and “positive rho Bitcoin” that excels when financial system assumptions collapse.

Park contended that the current climate represents the worst scenario for Bitcoin’s “negative rho” thesis.

“We are presently witnessing positive deflation in technology sectors while evading negative deflation in credit markets,” he stated.

“This is the most unfavorable environment for Bitcoin: productive enough to keep growth assets appealing, stable enough to maintain the credibility of Treasuries, but not disastrous enough to disrupt the system.”

https://t.co/9aCcpwV6YO pic.twitter.com/XeWgnP55H0

— Jeff Park (@dgt10011) January 31, 2026

In a conversation with Cryptonews, Aurélie Barthere, Principal Research Analyst at Nansen, highlighted several negative catalysts pushing Bitcoin lower: “Fed Chair Powell indicating no Fed cuts in its remaining tenure until June 2026, President Trump seemingly opting for the more hawkish candidate as the new Fed Chair, Kevin Warsh, and a BTC correlation with US equities turning positive again.”

Flow data indicates “slow capitulation in ETFs, options, and miner activity,” she observed.

Eric Jackson, the incoming CEO of EMJX-SRX Health, provided a contrarian perspective on Warsh’s nomination.

“The appointment of Kevin Warsh as Federal Reserve Chairman seems constructively neutral-to-positive for crypto in the medium term, even if the initial market response is cautious,” Jackson told Cryptonews.

“His focus on balance sheet discipline and clearer boundaries between Treasury and the Fed suggests less reflexive quantitative easing and increased transparency regarding liquidity conditions.”

those who still dont understand why warsh won simply dont understand the unspoken truth that the fed-treasury relationship is the most powerful lever to affect the kind of generational change that this system now requires

it was always warsh and bessent

incredibly optimistic— Jeff Park (@dgt10011) January 30, 2026

Park’s analysis implies that Warsh’s appointment could ultimately be bullish for Bitcoin’s “positive rho” scenario by hastening a systemic reckoning.

“If you believe the debt trajectory is unsustainable, if you believe fiscal dominance will eventually surpass monetary orthodoxy, if you believe the risk-free rate will ultimately be exposed as a fiction, then you want Warsh,” he stated.

He concluded that while he cannot confirm if “$82k was indeed the bottom,” historically, “bottoms are almost always marked by a radical shift in market regime that fundamentally resets investor behavior.”

The post Silver Plunges Record 36% as Precious Metals Suffer Historic Collapse – Bitcoin About to Rally? appeared first on Cryptonews.