Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

SEC’s Crypto Enforcement Drops 60% Under Trump Appointee Paul Atkins

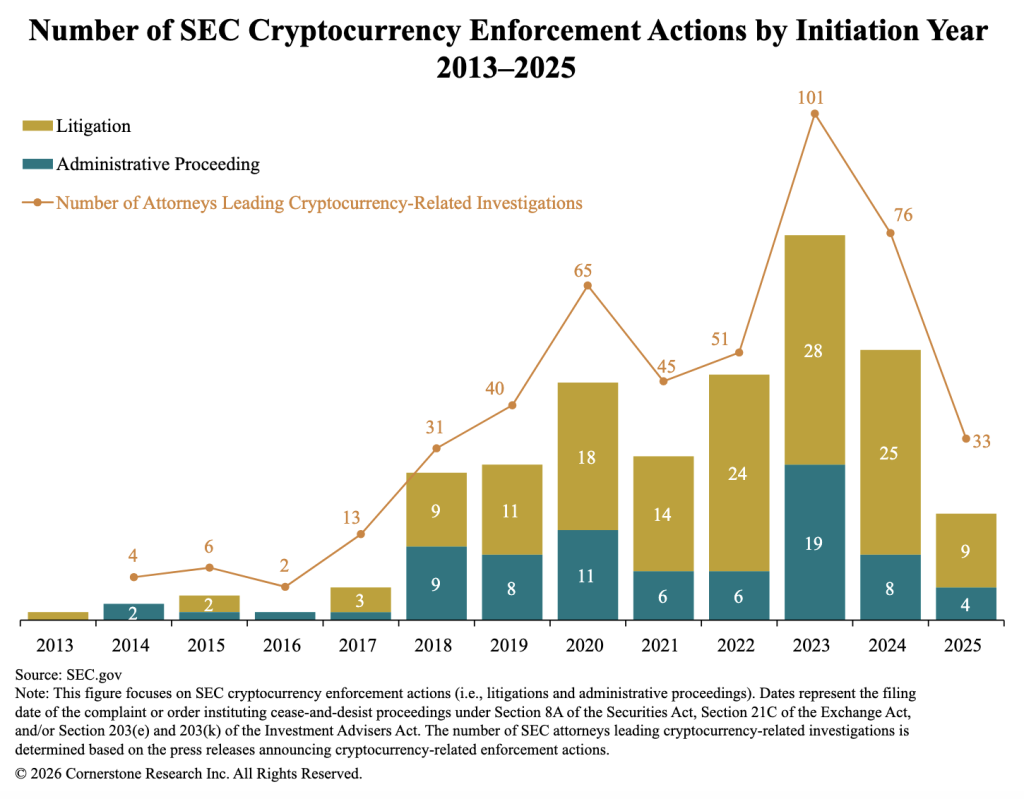

In 2025, US securities regulators initiated significantly fewer enforcement actions related to crypto, with a Cornerstone Research report indicating a notable change in focus following President Donald Trump’s appointment of Paul Atkins as SEC chair.

The report revealed that the SEC launched 13 crypto-related actions in 2025, a decrease from 33 in 2024, representing a 60% drop and marking the lowest figure since 2017.

This total includes a transition at the executive level, as five of the 13 actions were initiated under Gary Gensler prior to his exit in January 2025, while eight were started under Atkins. Among those eight were claims of fraud.

This composition is significant for crypto markets, which have spent recent years preparing for regulatory enforcement.

Image Source: Cornerstone Research

Reduced Actions, Yet A More Defined Focus Under Atkins

As the SEC concentrates new crypto cases on fraud, the emphasis has shifted from broad registration theories to cases centered on explicit investor harm, which are more straightforward to present in court.

The same report noted that 29 crypto-related actions were resolved in 2025, which included seven that the SEC dismissed under Atkins’ leadership.

Additionally, total financial penalties imposed on participants in the digital asset market reached $142M in 2025, which Cornerstone reported was less than 3% of the penalties levied in 2024.

SEC’s Focus Expands To Frameworks Beyond Litigation

“Enforcement actions under Chair Atkins illustrate a transformation in the SEC’s strategy for overseeing digital assets, aligning with the priorities established in early 2025,” commented Robert Letson, a principal at Cornerstone Research.

“Regulation of digital assets continues to progress, and it is an area we will monitor closely in 2026.”

Atkins assumed office in April 2025 following a brief period with an acting chair, and legal analysts have observed a broader shift in tone within the agency since the leadership transition.

If the SEC maintains its focus on cases it can define as fraud, the forthcoming phase of US crypto regulation may rely less on unexpected lawsuits and more on what rulemaking, guidance, or negotiated standards the commission opts to propose in 2026.

The post SEC Crypto Crackdown Shrinks 60% Under Trump Pick Paul Atkins appeared first on Cryptonews.