Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

SEC Reverses Course: Regulator Apologizes for Deceptive Claims on Crypto Securities

The U.S. Securities and Exchange Commission (SEC) is facing significant criticism for its methods of regulating cryptocurrencies, especially in relation to its classification of digital tokens as “crypto asset securities.”

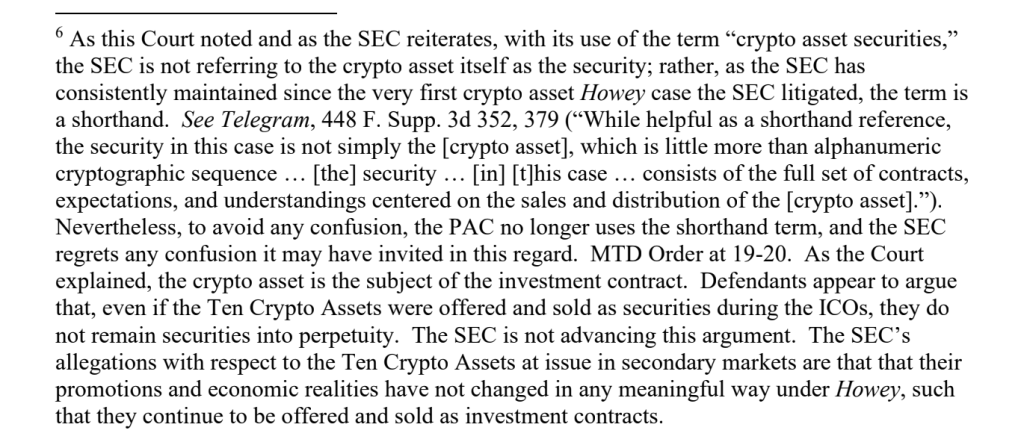

Recently, the SEC admitted that its usage of the term “securities” was not intended to suggest that the tokens themselves qualify as securities. This acknowledgment, noted in a footnote of its revised complaint against Binance, has drawn criticism and raised concerns regarding the SEC’s clarity and consistency in regulation.

The SEC has historically pursued crypto firms for allegedly trading in unregistered “crypto asset securities.” However, in its most recent filing, the SEC clarified that this term was merely a “shorthand” for the entire context of agreements, expectations, and understandings related to the sale of such assets, rather than the assets themselves.

Source: Paul Grewal On X

Source: Paul Grewal On X

The agency further asserted that it has consistently held this viewpoint, referencing previous cases, including the one against Telegram. Nonetheless, the SEC conceded that it would refrain from using the term “crypto asset securities” in this context going forward, expressing regret for any confusion its terminology may have caused.

SEC Altered Stance on Crypto Assets: “The SEC Regrets Any Confusion It May Have Caused”

The SEC’s change in position surfaced amid its ongoing legal confrontation with Binance. The regulator has accused the crypto exchange of numerous breaches of U.S. securities laws, including the unregistered offering of what it calls “crypto asset securities.”

The SEC continues to widen its allegations while simultaneously stepping back from its previous broad interpretation of the term “securities” in relation to digital tokens.

In the revised complaint submitted on September 12, 2024, the SEC underscored that its terminology did not specifically categorize the assets as securities but was meant to describe a broader context of associated agreements and investor expectations.

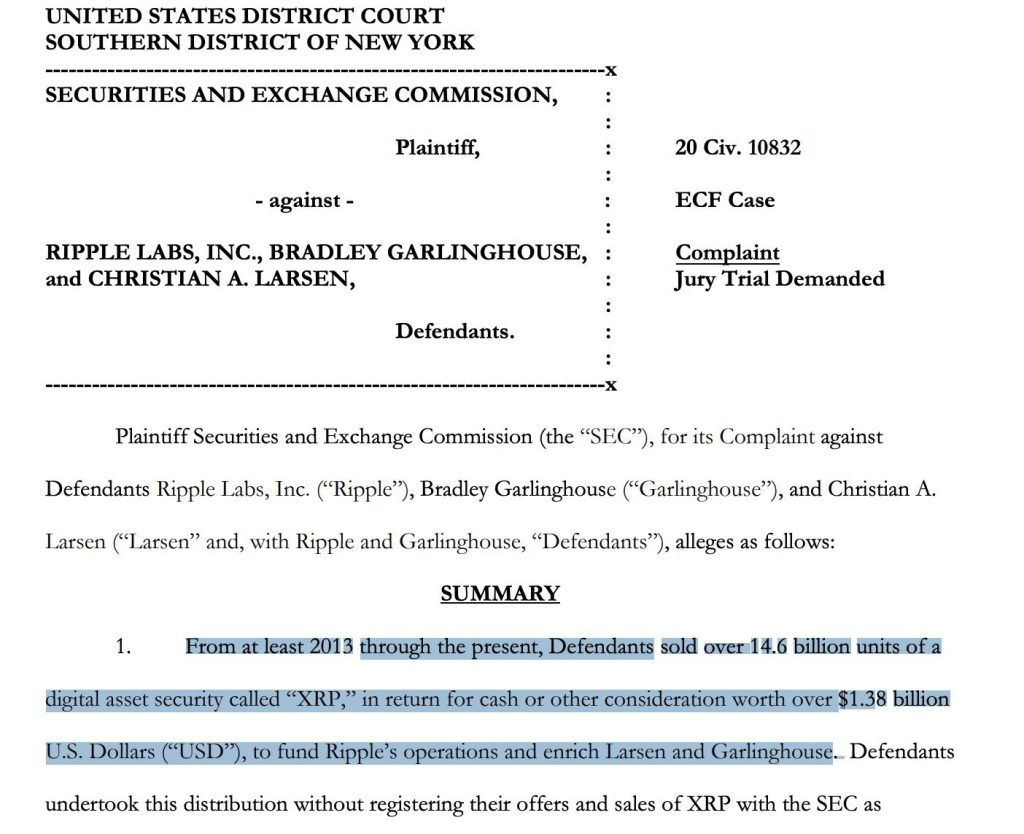

Many within the crypto sector have not taken this subtle shift positively. Detractors argue that the SEC’s former actions, such as its pursuit of Ripple and the classification of XRP as a “digital asset security,” contradict the agency’s recent comments.

Source: Paul Grewal On X

Source: Paul Grewal On X

Paul Grewal, Chief Legal Officer at Coinbase, pointed out the inconsistency in a social media post. He emphasized that the SEC’s amended complaint against Binance includes a regretful recognition of the confusion surrounding the term “crypto asset securities.”

“The SEC regrets any confusion it may have caused” by inaccurately and repeatedly asserting that the tokens themselves are securities. This is the remarkable acknowledgment in Footnote 6 of @SECGov’s Amended Complaint against Binance. I hope @s_alderoty is getting some good sleep tonight.… pic.twitter.com/PpbprvkGxh

— paulgrewal.eth (@iampaulgrewal) September 13, 2024

He challenged the SEC’s past regulatory approach, accusing the agency of misleading both the courts and the public through its enforcement efforts.

Stuart Alderoty, Chief Legal Officer at Ripple, also criticized the SEC’s alteration in position.

He noted that the SEC’s admission essentially validates that “crypto asset security” is a contrived term and that the agency’s requirement to prove a “crypto asset security” necessitates demonstrating a collection of “contracts, expectations, and understandings.”

So the SEC finally acknowledges that 1/ “crypto asset security” is a fabricated term and 2/ to establish a “crypto asset security” is an investment contract, the SEC must provide evidence of a bundle of “contracts, expectations, and understandings”?

I think it’s time for @SECgov to concede it has… https://t.co/iJIYTnNvxs pic.twitter.com/E58Pft7irc— Stuart Alderoty (@s_alderoty) September 13, 2024

Alderoty compared the SEC’s actions to a “twisted pretzel of contradictions,” calling for enhanced transparency and consistency in the agency’s definitions and regulations regarding digital assets.

Are Binance and Other Firms Now Unencumbered?

The SEC’s lawsuit against Binance, which initially included accusations that the exchange enabled the sale of unregistered securities, has been a central point of regulatory dispute.

In July 2024, the SEC expressed its intention to modify its complaint to eliminate the court’s need to determine the securities status of specific tokens at this stage.

Some interpreted this move as a strategic adjustment by the SEC to bolster its case without the immediate obstacle of substantiating each token’s classification under the Howey test—a legal criterion used to identify what constitutes a security.

The most recent amendments to the complaint involve adding additional tokens to the list of purported unregistered securities, including Cosmos Hub, Axie Infinity, and Filecoin, which now further complicate the case against Binance.

Despite the recent acknowledgment of its ambiguous terminology, the SEC continues its efforts to enforce securities laws within the crypto sector.

The SEC has persistently cited violations based on its established guidelines, even as it confronts backlash from industry leaders who contend that the regulatory framework is ill-equipped to address the unique characteristics of digital assets.

In addition to the legal challenges faced by Binance, the SEC has pursued other enforcement actions, including settlements with the financial services firm eToro, which paid a $1.5 million penalty for dealing in unregistered crypto asset securities.

SEC Chair Gary Gensler has been a prominent figure in this regulatory approach, frequently asserting that the majority of cryptocurrencies qualify as securities and should, therefore, fall under SEC oversight.

Gensler’s position has drawn criticism from the crypto community, with many claiming that the current regulatory framework does not cater to the decentralized nature of digital assets.

His actions have also faced political scrutiny, with allegations of politically motivated hiring practices contributing to the controversy surrounding his leadership.

Binance and its co-defendants are gearing up to respond to the SEC’s amended complaint by October 11, 2024. This case represents a pivotal moment for the future of crypto regulation in the U.S.

The post SEC Backtracks: Regulatory Body Regrets Misleading Statements on Crypto Securities appeared first on Cryptonews.