Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

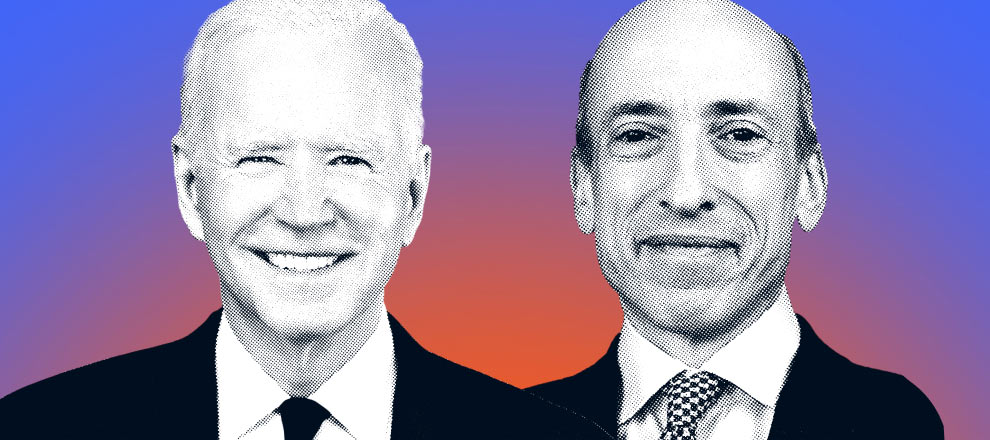

SEC and Joe Biden “Squeeze” Cryptocurrency Sector

Crypto exchange Coinbase has accused the U.S. Securities and Exchange Commission (SEC) of “destroying digital assets” by persistently tightening regulatory measures. U.S. President Joe Biden has vetoed a resolution aimed at easing regulations for cryptocurrency firms.

Attorneys representing Coinbase submitted a petition to the U.S. Court of Appeals, alleging that the SEC and its officials intend to “strangle” the domestic crypto sector.

The petition asserts that the regulator’s representatives do not see the necessity of establishing transparent and equitable regulations for the crypto sector. Instead, the SEC continues to “destroy digital assets” through selective enforcement. Coinbase argues that the regulator views the current regulations as adequately functional, despite their reliance solely on legal precedents.

In support of its claims, Coinbase’s statement referenced the opinions of SEC members who also believe the commission is obstructing the growth of the digital asset sector and threatening the future of emerging technologies. Paul Grewal, Chief Legal Officer at Coinbase, stated that the SEC’s regulations are impractical for digital asset firms, with all attempts by the crypto exchange to engage in direct dialogue with the regulator’s representatives proving futile. Consequently, Coinbase is requesting that the court prevent the SEC from acting “without proper authorization from Congress and without establishing clear rules for the crypto industry.”

The SEC initiated legal action against Coinbase in June 2023, accusing the exchange of unlawful conduct. Coinbase’s legal team has been attempting to resolve the case for a year, achieving only a partial success.

The tensions within the crypto sector were heightened by U.S. President Joe Biden’s actions. He vetoed a resolution that sought to overturn the SEC’s accounting rule, SAB 121. Biden justified his decision by stating that he does not wish to endorse measures that could endanger the welfare of consumers and investors or undermine the authority of the financial regulator.

The SAB 121 rule mandates that crypto-asset custodial organizations account for crypto-assets as liabilities and requires banks to include their customers’ crypto-assets on their balance sheets. On May 8, 2024, members of the House of Representatives voted to repeal the rule, and on May 16, the Senate supported this decision.

Biden’s decision faced significant backlash from the crypto community. Representatives from the Blockchain Association expressed their discontent that the President’s administration disregarded the views of the bipartisan majority in Congress, which acknowledged the detrimental effects of the SAB 121 rule. Cody Carbone, Chief Policy Officer at The Digital Chamber, remarked that Biden dealt “a slap in the face to innovation and financial freedom” with his choice. Brad Garlinghouse, CEO of Ripple, also conveyed profound disappointment regarding the current U.S. president’s decision.

U.S. officials have also criticized Joe Biden’s actions. Republican Senator Cynthia Lummis stated that the President missed an opportunity to adjust his stance on crypto-assets amid the election campaign. She remarked that Biden acted against “the will of the American people.” Lummis indicated that the administration appears determined to suppress crypto-assets and financial innovation.

Recent research has indicated that the stance of U.S. presidential candidates on cryptocurrency is a crucial factor that will influence voters’ final decisions in the 2024 election.

Сообщение SEC and Joe Biden “Strangle” Crypto Industry появились сначала на CoinsPaid Media.