Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Sales of Crypto Mining Equipment ‘Surge’ in Russia as Moscow Considers ‘Soft Touch’ Regulation

Sales of crypto mining {hardware} in Russia have surged threefold year-on-year, according to a leading Bitcoin mining expert in the country.

In an interview with the Russian news outlet Prime, Sergey Bezdelov, head of the Industrial Mining Association, stated that “in the fourth quarter of 2024,” the demand for industrial mining equipment and services in Russia “rose three times compared to the same period in FY2023.”

Bezdelov made these remarks following comments from a prominent lawmaker indicating that Moscow was prepared to “ease” its approach to crypto regulation.

Is Crypto Mining {Hardware} Thriving in Russia?

The leader of the Industrial Mining Association noted that there was “also significant interest” in Russian crypto mining initiatives “from foreign market participants.”

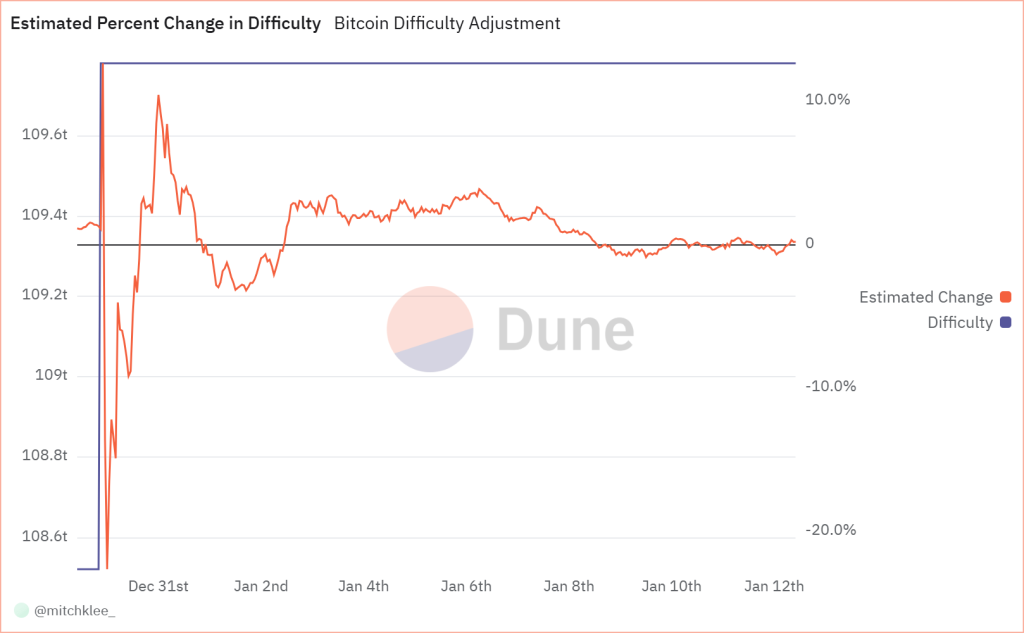

The estimated percentage change in Bitcoin Mining difficulty over the last seven days. (Source: Dune/@mitchklee_)

The estimated percentage change in Bitcoin Mining difficulty over the last seven days. (Source: Dune/@mitchklee_)

Bezdelov mentioned that some of this “interest” in Russian crypto mining was now emerging from “other BRICS member states.”

In May of last year, Bezdelov asserted that the Russian industrial crypto mining sector “doubled in size” in 2023.

The expert suggested that recent legal changes had contributed to the growing popularity of mining in Russia.

A regulation that took effect on November 1, 2024, permits both “legal entities” (private companies) and “individual entrepreneurs” (private citizens) to mine crypto “legally” as long as they do not consume more than 6,000 kWh of energy per month.

“Individuals can mine cryptoassets without being registered in a state-run registry, but within the limits of the electricity consumption threshold. If they exceed this threshold, residents must register as individual entrepreneurs and apply for inclusion in the registry.”

Bezdelov

With the aid of a two-story clock in the Lithuanian capital of Vilnius, the Baltics are counting down the minutes until they disconnect from Russia’s energy grid on Feb. 8. https://t.co/eNgeDsdKGa

— Bloomberg (@business) January 11, 2025

Impending Crypto Taxes?

Currently, the registry only requires companies and individuals to report data on transactions and energy consumption.

However, since the entity managing the registry also oversees Russia’s taxation system, it is highly likely that any miner using more than 6,000 kWh will soon be required to pay taxes on their earnings.

Nonetheless, Bezdelov pointed out that prior to last year’s legal amendment, crypto mining existed in a “grey” legal area.

Until November, mining had no legal recognition. Now, however, Russian law acknowledges it as a form of “entrepreneurship.”

While Bezdelov and others have previously indicated that the majority (around 90%) of domestic miners focus on Bitcoin (BTC), Cryptonews.com has observed evidence suggesting that many Russian home-based miners prefer Ethereum (ETH).

Last year, Bezdelov mentioned that Litecoin (LTC) was also popular among a smaller segment of Russian miners.

Litecoin prices over the past year. (Source: CoinGecko)

Litecoin prices over the past year. (Source: CoinGecko)

Shifts in Russian Media and Lawmaker Perspectives on Crypto

The same media outlet reported that mining serves as a “good source of additional income.” It further noted that Russian companies and individuals could utilize crypto as an “opportunity to diversify their assets.”

It also suggested that companies might use the crypto they mine as a settlement method “when engaging in foreign economic activities within the framework” of the Central Bank’s sandbox.

This type of positive discourse regarding crypto was once nearly unheard of in Russian mainstream media outlets.

Moldova’s pro-European central government stated that Russia caused the energy crisis and seeks to portray itself as the power coming to the separatist region’s aid. https://t.co/FCHnoW0sLE pic.twitter.com/oX2Qusqx9M

— Reuters (@Reuters) January 12, 2025

Politicians previously spoke of crypto with disdain. The Central Bank has led several attempts to implement a China-style crackdown on crypto in Russia.

However, President Vladimir Putin initiated a shift in perspective last year when he began discussing crypto mining in favorable terms.

While many energy-scarce regions have imposed bans on crypto mining until 2031, Putin has encouraged other areas of the Russian Federation to mine crypto “if they have surplus energy.”

Tax Revenue Increase

The association has claimed that the Russian Treasury could anticipate earning over $500 million annually from taxing crypto miners.

Others assert that Russia’s ambition to become an AI “powerhouse” has influenced Putin’s pivot towards crypto.

Bezdelov advised qualified Russian investors to “allocate up to 5% of their portfolios to mining services and digital currencies.”

China warmly welcomes the new addition to the BRICS family, a Chinese Foreign Ministry spokesperson stated on Tuesday, in response to Brazil, as the BRICS chair for 2025, releasing a statement on Monday night announcing the official entry of Indonesia as a full member into BRICS.… pic.twitter.com/XqZycI9onG

— Global Times (@globaltimesnews) January 7, 2025

Potential for a Softer Crypto Approach, Lawmaker Indicates

Meanwhile, TASS reported that the chief architect of Russia’s crypto legislation has “allowed for the possibility of softer regulation” for domestic companies using crypto to circumvent US, UK, and EU-led sanctions.

The state-run news agency quoted Anatoly Aksakov, Chairman of the State Duma’s Committee on Financial Markets, as stating that crypto “market participants” are expressing concerns about “over-regulation” within the Central Bank’s sandbox.

Anatoly Aksakov, the Chairman of the Russian State Duma’s Committee on Financial Markets. (Source: Secretariat of the World Russian People’s Council/YouTube/Screenshot)

Anatoly Aksakov, the Chairman of the Russian State Duma’s Committee on Financial Markets. (Source: Secretariat of the World Russian People’s Council/YouTube/Screenshot)

The Central Bank desires all Russian companies utilizing crypto as a payment method to exchange funds through the sandbox, rather than engaging directly with foreign partners in crypto.

“We need to quickly launch an experimental [sandbox]. We then need to observe how the standards we’ve adopted in this market function. After that, we can make further adjustments later. Quite possibly, we will move towards a softer regulatory [stance].”

Lawmaker Anatoly Aksakov, Chairman of the Russian State Duma’s Committee on Financial Markets

Aksakov also mentioned that companies are dissatisfied with the Central Bank’s protocols. Many, it seems, believe these protocols are overly complex. The lawmaker stated:

“Many companies are suggesting that we need to somehow simplify the turnover of cryptocurrencies so that the market can develop effectively. As [crypto settlements] are new and dynamic, this is proving to be the case.”

The post Crypto Mining {Hardware} Sales ‘Triple’ in Russia as Moscow Teases ‘Light Touch’ Regulation appeared first on Cryptonews.