Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Russian Pension Fund Overwhelmed by Crypto Inquiries Amidst Mining Revenue Controversy

In 2025, Russia’s Social Fund managed approximately 37 million inquiries, with questions related to cryptocurrency ranking among the most frequent, alongside those about traditional social benefits.

A local news report indicated that residents were curious about the possibility of receiving pensions in digital currencies and whether earnings from mining would be considered in social benefit assessments. Officials clarified that all governmental payments are strictly made in rubles, while the taxation of cryptocurrencies is governed by the Federal Tax Service.

The notable surge in questions regarding crypto underscores the increasing interest in digital currencies within Russia, where mining is currently producing about 1 billion rubles daily, and regulatory frameworks are evolving with implementation deadlines set for mid-2026.

As reported by Rossiyskaya Gazeta, Russia’s Social Fund stated that its centralized contact center received around 37 million inquiries in 2025, with many asking if pensions could be disbursed in cryptocurrency and if mining earnings would be factored into social benefits. The Fund clarified…

— Wu Blockchain (@WuBlockchain) January 11, 2026

Political Support for Mining Income Recognition Grows

Recently, senior Kremlin official Maxim Oreshkin advocated for the classification of crypto mining as an export activity in Russia’s official trade records, arguing that mined digital assets essentially circulate internationally, despite not crossing physical borders.

During the Russia Calling investment forum, Oreshkin referred to mining as “a new export item” that Russia “underestimates,” highlighting how these transactions impact foreign-exchange markets and balance of payments beyond formal statistics.

Industry estimates bolster his argument for recognition, with the Social Fund observing that “many individuals are curious about the possibility of receiving pensions in cryptocurrency and whether mining income will be considered when determining social benefits.”

Experts from the fund “explained politely that all payments from the SFR are exclusively in rubles, and that the taxation of digital assets falls under the Federal Tax Service’s purview.”

Last year, Russia’s mining activities accounted for over 16% of the global hashrate, placing the nation second worldwide, while corporate operations now face a 25% tax rate following the legalization in November 2024.

Russia’s Central Bank has confirmed that crypto mining strengthens the ruble, as Kremlin officials advocate for formal export classification amid ongoing underground activities. #Russia #Crypto #Mining https://t.co/P0JGyFTYfp

— Cryptonews.com (@cryptonews) December 22, 2025

Shortly after Oreshkin’s remarks, Central Bank Governor Elvira Nabiullina acknowledged that mining bolsters the ruble’s strength but noted that quantifying its effect remains challenging, as substantial parts of the industry operate in gray markets.

Although legalization mandates Federal Tax Service registration for legal entities and exempts household miners consuming under 6,000 kWh monthly, illegal operations continue to cost Russia billions each year due to electricity theft and unpaid taxes.

Development of Regulated Trading Infrastructure

At the end of last month, both the Moscow Exchange and St. Petersburg Exchange confirmed their readiness to initiate crypto trading once Russia’s legislative framework comes into effect by July 1, 2026, following the Bank of Russia’s release of a regulatory concept on December 23.

The St. Petersburg Exchange stressed that it already possesses the required technological infrastructure for trading and settlements, while the Moscow Exchange mentioned that it is actively developing solutions to cater to the cryptocurrency market.

The regulatory framework distinctly separates market access among different investor categories.

Non-qualified investors face annual purchase limits of 300,000 rubles through single intermediaries, restricted to liquid cryptocurrencies on designated lists after passing mandatory knowledge assessments, while qualified investors face no volume limitations but must demonstrate risk comprehension and cannot acquire anonymous tokens that obscure transaction data.

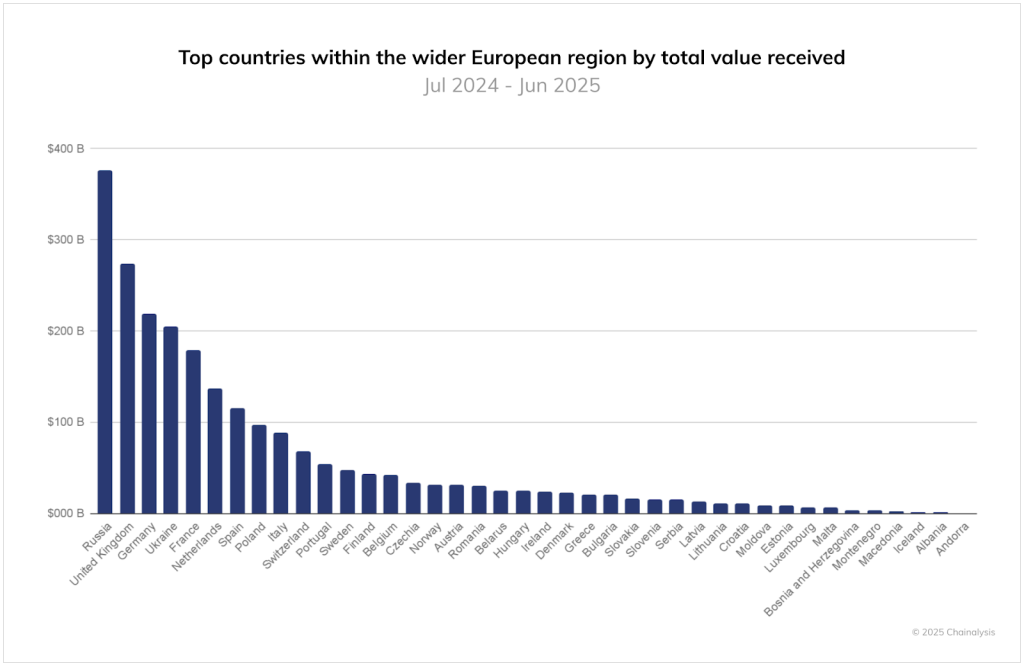

Between July 2024 and June 2025, Russia recorded a crypto transaction volume of $376.3 billion, surpassing the UK’s $273.2 billion, making it Europe’s largest crypto market by transaction volume.

Source: Chainalysis

Source: Chainalysis

During this timeframe, large transfers exceeding $10 million rose by 86%, nearly double the 44% increase seen across Europe, while DeFi activity skyrocketed eightfold in early 2025 before stabilizing at three and a half times the levels of mid-2023.

Banking Sector Adopts Digital Assets

In December, Sberbank, Russia’s largest bank, announced that it is now offering regulated crypto-linked investments amounting to 1.5 billion rubles in structured bonds and digital financial assets associated with Bitcoin, Ethereum, and broader crypto portfolios.

Deputy Chairman Anatoly Popov confirmed ongoing discussions with the Bank of Russia and Rosfinmonitoring regarding the integration of crypto services within regulated frameworks while developing proprietary blockchain infrastructure for issuing and managing digital financial assets.

Additionally, it was announced today that Tether has registered its asset tokenization platform Hadron trademark in Russia after submitting the application in October 2025, with Rospatent approving it in January 2026, granting trademark protection until October 2035.

According to RIA, Tether has secured the trademark for its asset tokenization platform Hadron in Russia. The application was filed in October 2025 and received approval in January 2026, with trademark protection valid until October 2035. The trademark encompasses blockchain-based financial services,…

— Wu Blockchain (@WuBlockchain) January 11, 2026

The trademark includes blockchain-based financial services, crypto trading and exchange, crypto payment processing, and related advisory services, with Tether’s USDT maintaining a market capitalization of approximately $187 billion, making it the third-largest crypto asset globally.

Despite the advancements in adoption and infrastructure, State Duma Committee Chairman Anatoly Aksakov recently reiterated payment restrictions, stating that cryptocurrencies “will never become money within our country” and can only serve as investment instruments, necessitating all domestic payments to be made in rubles.

Regulators are currently preparing for a strict regulatory framework for cryptocurrencies and new penalties this year.

The post Russian Pension Fund Flooded With Crypto Questions as Mining Income Debate Heats Up appeared first on Cryptonews.