Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ripple’s CEO Anticipates 90% Likelihood of U.S. Crypto Legislation Approval by April – Implications for XRP Value

Ripple’s CEO Brad Garlinghouse indicates there is a 90% likelihood that the US CLARITY Act will be enacted by the end of April. Should this occur, the prolonged period of uncertainty regarding crypto regulations may finally come to an end.

Garlinghouse highlighted the significant momentum building in Washington following months of delays in the Senate.

Legislators are working towards a negotiation deadline of March 1 established by the White House. If the legislation is approved, it would provide institutions with the definitive legal frameworks they have been seeking before potentially engaging in substantial spot market activities.

Key Takeaways

The Signal: Garlinghouse increases the likelihood of passage to 90% by April, surpassing estimates from prediction markets.

The Timeline: The White House aims for a final agreement on stablecoin regulations by March 1.

The Impact: Establishes clear parameters for CFTC and SEC oversight, alleviating challenges for utility tokens.

Why Is The Clarity Act Happening Now?

The Digital Asset Market Clarity Act, H.R. 3633, is at a pivotal moment.

The House passed it in July 2025 with a significant bipartisan vote of 294 to 134. However, the Senate stalled due to jurisdictional disputes, causing a standstill.

Great to be back on with @MariaBartiromo discussing Ripple’s banner year and accelerating momentum as we start 2026.

Already, we are actively seeing Boards and CEOs pushing their CFOs and treasurers to understand how they can leverage and benefit from stablecoins. For…— Brad Garlinghouse (@bgarlinghouse) February 19, 2026

Currently, the momentum appears different. Garlinghouse notes that new discussions with banking leaders and crypto executives have helped to resolve the impasse.

Regulators also seem prepared. Following the Senate Agriculture Committee’s movement on a related draft on January 29, SEC Chairman Paul Atkins mentioned that the SEC and CFTC are collaborating through “Project Crypto.”

The industry can no longer rely solely on enforcement; it seeks established regulations.

Breaking Down the US Clarity Act Odds

Garlinghouse’s 90% probability is more optimistic than market expectations.

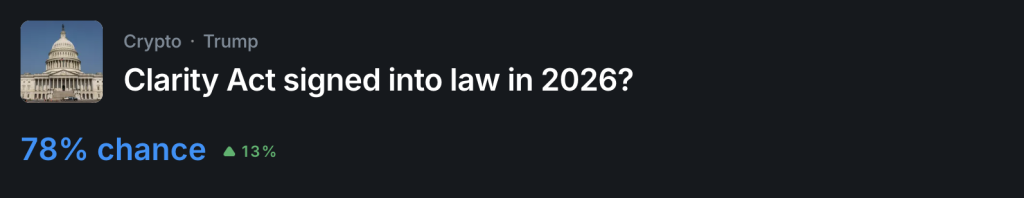

Prediction markets estimate the bill’s chances at approximately 78% by the end of the year, making an April conclusion seem ambitious. Nonetheless, he presented it as an essential step.

The primary contention revolves around stablecoins. Legislators are discussing whether platforms can provide yield-style incentives. This topic has already hindered Senate Banking discussions earlier this year.

While Washington deliberates, Ripple is not remaining idle. Since 2023, it has invested $3 billion in acquisitions to enhance custody and treasury infrastructure.

What Does This Mean for XRP Price?

For XRP traders, concrete legislation is the final requirement.

Ripple has already secured a court ruling affirming that XRP is not classified as a security. However, a federal law would solidify that designation. Such clarity could facilitate institutional participation on a larger scale.

Xrp (XRP)24h7d30d1yAll time

Xrp (XRP)24h7d30d1yAll time

Garlinghouse mentioned that corporate treasurers are exploring stablecoins and cross-border transactions. The interest exists, but they require federal guidelines before committing significant capital.

If April brings the anticipated outcome, we may witness a swift shift back into large-cap assets with genuine utility, particularly if it coincides with the ongoing market pullback.

Discover: Here are the crypto likely to explode!

The post Ripple CEO Predicts 90% Chance U.S. Crypto Bill Passes by April – What It Means for XRP Price appeared first on Cryptonews.