Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ray Dalio Cautions That Federal Reserve Bubble May Propel Gold and Bitcoin Prices Upward Before a Collapse

Ray Dalio has issued a serious caution that the Federal Reserve’s choice to cease quantitative tightening signifies the onset of a perilous cycle of “stimulating into a bubble” instead of addressing economic frailty.

The billionaire investor and founder of Bridgewater Associates contends that the Fed’s transition from reducing its balance sheet to expanding it illustrates a typical late-stage debt cycle pattern that could propel gold and Bitcoin significantly higher prior to an unavoidable downturn.

The Fed declared it would conclude quantitative tightening, effective December 1, 2025, shifting to balance sheet maintenance at $6.5 trillion, while reallocating agency security income into Treasury bills instead of mortgage-backed securities.

Dalio perceives this as more than a mere “technical maneuver,” as officials have characterized it, especially since the change coincides with substantial fiscal deficits and robust private credit growth.

At the same time, the S&P 500 earnings yield of 4.4% slightly surpasses the 10-year Treasury yield of 4%, resulting in equity risk premiums at a minimal 0.4%.

https://t.co/BytVjrzXkL

— Ray Dalio (@RayDalio) November 5, 2025

Historic Reversal: From Depression Stimulus to Bubble Fuel

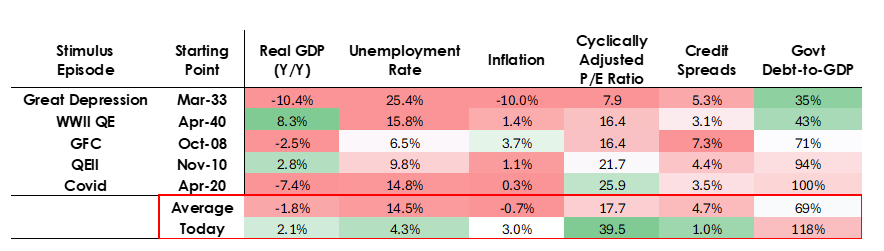

Dalio underscores that prior instances of quantitative easing took place under fundamentally different circumstances, marked by economic downturns, declining asset prices, low inflation, and broad credit spreads.

Conversely, the current landscape displays the opposite. Stock prices are reaching new peaks, the economy is expanding at an annual rate of 2%, unemployment stands at just 4.3%, and inflation is exceeding the Fed’s 2% target, currently above 3%.

Source: X/@RayDalio

Source: X/@RayDalio

“This time the easing will be into a bubble rather than into a bust,” Dalio cautioned, pointing out that AI stocks are already categorized as bubble territory according to his proprietary indicators.

The combination of substantial fiscal deficits, shortened Treasury maturities to offset weak long-term bond demand, and central bank balance sheet expansion exemplifies what he refers to as “classic Big Debt Cycle late cycle dynamics.“

Market analysts have echoed these concerns.

Cristian Chifoi observed that while discussions around QE and QT dominate the narrative, actual liquidity began to inundate markets between October and December 2022, when the tightening effectively ceased, with the Reverse Repo Program acting as the conduit.

The FED will end QT in December

So everyone prepared for the REAL liquidity injections to start in December right?

While we are late in the cycle and everyone thinks the 4y cycle is over

But QE or QT were always narratives, liquidity was starting to flood markets since… https://t.co/TQmID4D3vu pic.twitter.com/odHw9vnZ0b— Cristian Chifoi (@ChifoiCristian) October 29, 2025

Ted Pillows also cautioned that cryptocurrency markets, historically responsive to liquidity conditions, may not reach a bottom until actual quantitative easing commences rather than merely halting tightening.

He referenced the 40% drop in altcoins that followed the Fed’s 2019 QT pause before new stimulus was introduced.

Gold Surges as Liquidity Mechanics Shift

Gold has reacted significantly to the policy change, rising above $4,000 per ounce after initial fluctuations following the Fed’s announcement.

The World Gold Council reported that global demand in Q3 2025 rose 3% year-over-year to 1,313 tons, with investment demand achieving the highest quarterly total on record as prices reached 13 new all-time highs during the quarter.

Source: World Gold Council

Source: World Gold Council

Dalio clarified the factors enhancing gold’s attractiveness: with zero yield and gold trading at around $4,025 while 10-year Treasuries yield 4%, investors must anticipate gold price appreciation exceeding 4% annually to favor the metal over bonds.

“The higher the inflation rate, the more gold will increase because most of inflation is due to the value and purchasing power of other currencies declining due to their increased supply, while there isn’t much increased supply of gold,” he stated.

Central bank purchases have surged 10% year-over-year, with Poland announcing expanded programs and Brazil resuming purchases for the first time since July 2021.

However, during periods of financial uncertainty and crisis, Bitcoin has outperformed Gold and all other risk assets.

The Melt-Up Before the Crash

Dalio’s most foreboding warning revolves around the prediction that heightened Fed balance sheet expansion, coupled with interest rate reductions amid substantial fiscal deficits, would represent “classic monetary and fiscal interaction of the Fed and the Treasury to monetize government debt.“

This scenario is expected to lower real interest rates, compress risk premiums, expand price-to-earnings multiples, and particularly enhance long-duration assets, such as technology and AI stocks, alongside inflation hedges, including gold and inflation-indexed bonds.

“It would be reasonable to anticipate that, akin to late 1999 or 2010-2011, there would be a significant liquidity melt-up that will ultimately become too risky and will need to be curtailed,” Dalio remarked.

“During that melt-up and just before the tightening that is sufficient to control inflation that will burst the bubble is classically the ideal time to sell,” he concluded.

The post Ray Dalio Warns Fed Bubble Could Send Gold, Bitcoin Soaring — Then Implode appeared first on Cryptonews.