Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Prognosis for Bitcoin Price: Unexpected CPI Boosts BTC – Is Wall Street Ready to Dive Back In?

Bitcoin has re-entered the spotlight following the release of US inflation data that alleviated concerns about ongoing price pressures, rekindling interest in risk assets and propelling BTC solidly above the $95,000 threshold. With CPI data confirming a deceleration in inflation and technical indicators shifting to a bullish stance, Bitcoin seems less like a speculative bounce and more like a continuation of a wider trend driven by institutional investors.

Core CPI at 2.6% Boosts Bitcoin Toward $95,000

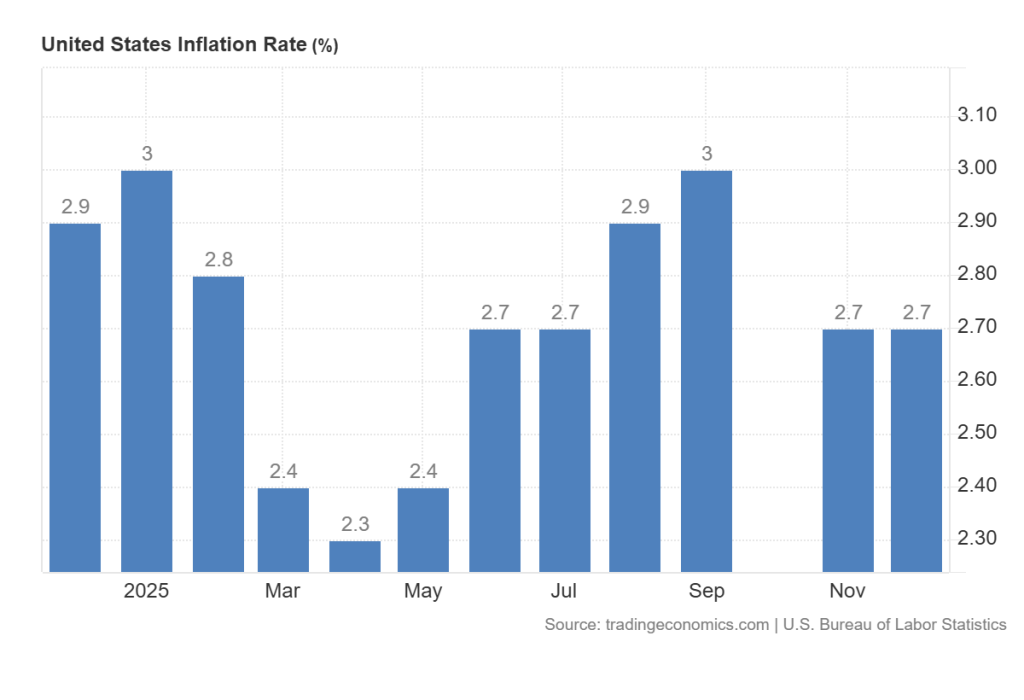

Bitcoin is currently trading close to the $95,000 mark after a rise of over 3% in the last 24 hours, bolstered by softer inflation figures and a slight retreat in the US dollar. The most recent US Consumer Price Index report indicated that headline inflation remained steady at 2.7% year-on-year in December, aligning with market forecasts, while core inflation held steady at 2.6%, marking its lowest level since 2021.

United States Consumer Price Index (CPI) – Source: Tradingeconomics

United States Consumer Price Index (CPI) – Source: Tradingeconomics

On a month-to-month basis, CPI climbed by 0.3%, in line with expectations, primarily driven by rising shelter costs. Energy prices increased by 2.3%, and food prices saw a rise of 3.1%, indicating that price pressures are uneven rather than broadly accelerating. Importantly for the markets, the lack of an unexpected increase in core inflation diminished fears that the Federal Reserve might need to maintain a restrictive monetary policy for an extended period.

This environment is significant for Bitcoin. Stable inflation and a contained core reading lessen the pressure on Treasury yields and the US dollar, facilitating capital flow toward alternative stores of value. With real yields stabilizing, Bitcoin has reaped benefits alongside a broader array of risk assets.

During a bilateral meeting, Japan’s finance minister and US Treasury Secretary Scott Bessent expressed concerns over the weakening yen as the currency approached a critical threshold where authorities have previously intervened https://t.co/el2QVQwBT1

— Bloomberg (@business) January 13, 2026

Currency markets reflected this transition. The Japanese yen fell to multi-month lows, while the euro and British pound exhibited limited follow-through, underscoring ongoing unease regarding global monetary and fiscal conditions.

Amidst this backdrop of fiat instability and moderating US inflation, Bitcoin’s status as a policy-insensitive asset has garnered renewed interest from both institutional and macro-oriented investors.

Fitch Cautions on Bitcoin-Backed Securities Risk

Fitch Ratings has recently warned that debt instruments backed by Bitcoin come with heightened risk due to BTC’s price volatility, especially in contexts involving leverage and collateralized lending. Notably, the agency did not include spot BTC ETFs in this warning, suggesting that the broader acceptance of ETFs could potentially help stabilize long-term volatility instead of exacerbating it.

Fitch Ratings alerts to the risks associated with Bitcoin-backed securities

Fitch Ratings, a leading rating agency, has expressed that Bitcoin-backed securities carry substantial risks and speculative credit profiles.

The inherent volatility of BTC prices can swiftly diminish the value of… pic.twitter.com/B4kDhYp2kC— Atlas21 (@Atlas21_eng) January 13, 2026

This distinction holds importance for institutional investors. The approach to Bitcoin is increasingly transitioning toward regulated, transparent frameworks rather than speculative credit products. A prime example is the introduction of 21Shares’ Bitcoin Gold ETP (BOLD) on the London Stock Exchange, which allocates approximately two-thirds to gold and one-third to Bitcoin, positioning BTC alongside a traditional safe-haven asset.

In conjunction, the expansion of spot ETF access and hybrid products is enhancing Bitcoin’s appeal to institutions while decreasing reliance on leverage-driven crypto credit models.

BTC and Gold Align as 21Shares Unveils BOLD ETP in the UK

21Shares has introduced its Bitcoin Gold ETP (BOLD) on the London Stock Exchange, providing UK investors with access to a regulated product that merges gold and Bitcoin within a single structure. The fund allocates about two-thirds to gold and one-third to Bitcoin, trading in both US dollars (BOLU) and British pounds (BOLD).

Disclaimer: Don’t invest unless you’re willing to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes awry. Take 2 mins to learn more: https://t.co/d9gFbwImMu

Introducing the 21shares Bitcoin Gold ETP… pic.twitter.com/neRbphESOr

— 21shares (@21shares) January 13, 2026

BOLD is fully physically backed, holding actual gold and Bitcoin, and was created in collaboration with ByteTree Asset Management. By combining gold’s long-established role as a safe haven with Bitcoin’s emerging reputation as “digital gold,” the product aims to provide inflation protection and navigate macro volatility.

The listing enhances Bitcoin’s institutional credibility and sustains long-term demand through regulated investment avenues.

Bitcoin (BTC/USD) Technical Outlook: BTC Breaks Symmetrical Triangle as $95,000 Becomes Support

From a technical perspective, Bitcoin’s price outlook appears optimistic as BTC’s structure has decisively turned bullish. On the 2-hour chart, BTC has clearly broken above a long-formed symmetrical triangle that had restricted price movement throughout early January. The breakout followed a distinct sequence of higher lows pressing against descending resistance, a classic setup for a directional breakout.

Bitcoin Price Chart – Source: Tradingview

Bitcoin Price Chart – Source: Tradingview

Previous resistance in the range of $94,500 to $95,000 has now transformed into support, establishing a robust demand zone reinforced by shallow pullbacks and tightly grouped candles. The leading indicator, RSI, remains elevated in the upper-60s without displaying bearish divergence, suggesting that momentum is strong but not overextended.

If Bitcoin maintains its position above $95,000, the technical trajectory points toward:

- Initial resistance around $97,600

- A higher extension toward $98,800–$99,000

A retracement toward $95,000–$94,500 would likely be seen as constructive, with downside risk contained beneath $93,000. As long as BTC stays above the broken triangle resistance, the broader trend favors continuation, sustaining optimism for the next upward movement.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is ushering in a new chapter for the Bitcoin ecosystem. While BTC continues to be the benchmark for security, Bitcoin Hyper introduces what it has always been missing: Solana-level speed. The outcome: lightning-fast, low-cost smart contracts, decentralized applications, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project prioritizes trust and scalability as adoption increases. And momentum is already significant. The presale has exceeded $30.4 million, with tokens priced at just $0.013575 before the next increment.

As Bitcoin activity rises and the demand for efficient BTC-based applications grows, Bitcoin Hyper distinguishes itself as the link bridging two of crypto’s largest ecosystems. If Bitcoin laid the groundwork, Bitcoin Hyper could enhance it by making it fast, adaptable, and enjoyable once more.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: CPI Surprise Sends BTC Flying – Is Wall Street About to Go All-In Again? appeared first on Cryptonews.

Fitch Ratings alerts to the risks associated with Bitcoin-backed securities

Fitch Ratings alerts to the risks associated with Bitcoin-backed securities