Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Prediction Markets Outperform Social Media in Truth Discovery, According to Vitalik Buterin

Ethereum co-founder Vitalik Buterin has defended prediction markets against detractors who consider wagering on real-world occurrences to be ethically dubious, asserting that these platforms provide more effective truth-seeking mechanisms compared to social media while addressing worries about their potential to encourage harmful behavior.

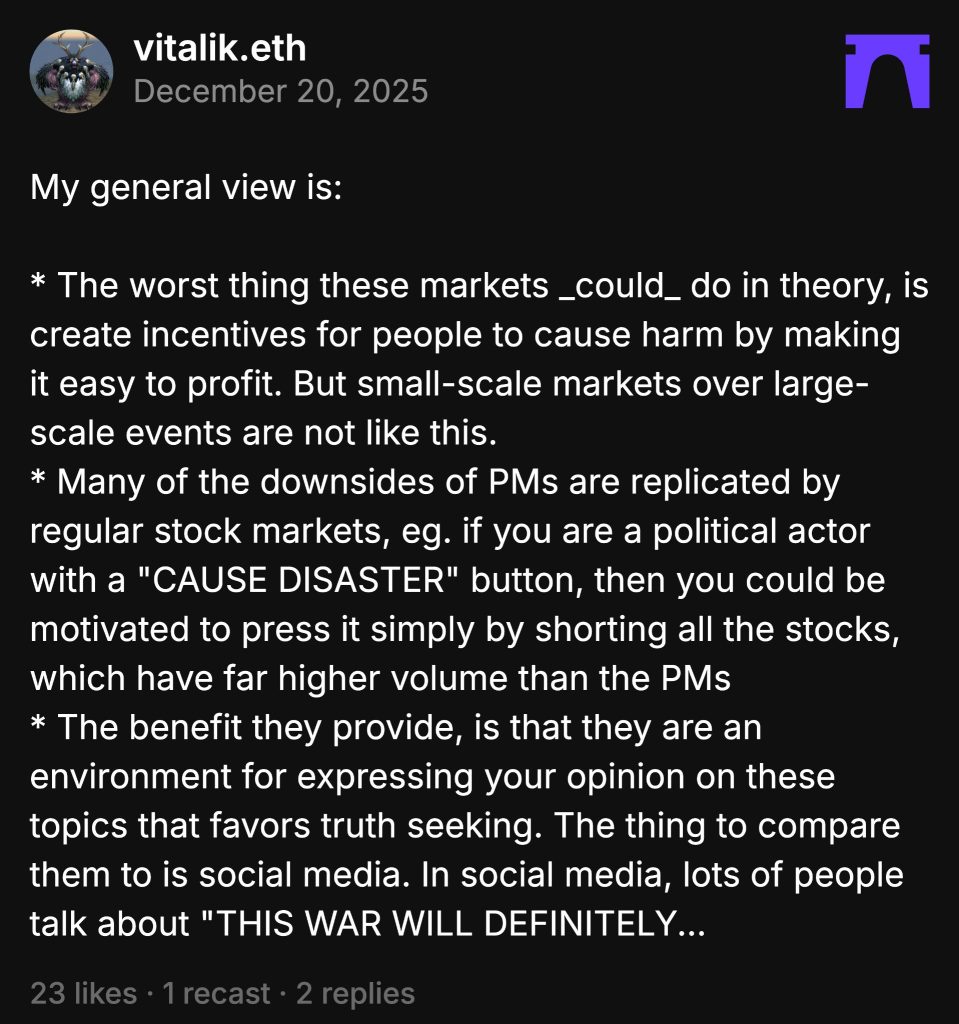

In a post on Farcaster, Buterin recognized that prediction markets could, in theory, create incentives for detrimental actions but downplayed this risk for smaller markets focused on significant events.

He pointed out that conventional stock markets raise similar issues, noting that political figures could gain from disasters merely by shorting stocks with volumes significantly greater than those on prediction markets.

Source: Farcaster

Source: Farcaster

Truth-Seeking Versus Social Media Sensationalism

Buterin framed prediction markets as remedies for the inherent accountability gap in social media.

“The appropriate comparison is social media,” he stated, elaborating on how these platforms favor sensationalism over factual accuracy.

“In social media, many individuals assert ‘THIS WAR WILL DEFINITELY HAPPEN’ and instill fear, with no real accountability: you gain influence in the moment (which is often highly monetizable!), and there’s no responsibility afterward.”

He contrasted this with prediction markets, where financial stakes promote truth-seeking.

“In prediction markets, if you make a poor bet, you incur a loss, and the system (i) gradually becomes more truth-seeking, and (ii) presents probabilities that more accurately reflect genuine uncertainty in the world compared to these other systems,” Buterin clarified.

The Ethereum founder recounted personal experiences utilizing prediction markets to validate distressing news.

“I can personally recount instances where I read a news headline, felt anxious, then checked polymarket prices and felt reassured – those knowledgeable about the topic understand what’s happening, and the likelihood of anything unusual occurring is only 4%,” he noted.

Buterin also defended prediction markets against parallels with financial markets.

“I actually find prediction markets to be healthier to engage in than traditional markets,” he remarked, explaining that “prices are confined between 0 and 1, making them much less susceptible to reflexivity effects, ‘greater fool theory’, pump-and-dumps, etc.”

Fierce Ethical Debate Divides Industry

Buterin’s defense ignited intense discussions with critics led by Quilibrium founder Cassie Heart, who contended that wagering on fatalities accounts for the widespread disdain toward crypto.

“I don’t know, but if you ask me, the notion of gambling on whether a group of people will die is why this industry is disliked by many,” Heart expressed on Farcaster.

Source: Farcaster

Source: Farcaster

Heart intensified her critique with provocative scenarios. “Perhaps they’ll start placing sponsor labels on missiles while we’re at it,” she suggested, adding,

“These children were killed thanks to the good bidders at Polymarket and Kalshi. Thank you, Coinbase!”

When Buterin characterized prediction markets as informational tools, Heart directly challenged this perspective.

“Alright, here’s my counter: a prediction market for whether or not someone will be killed to influence a prediction market outcome,” she posed, questioning whether Buterin accepted such scenarios.

Other commenters provided historical context supporting the use of prediction markets.

One user referenced “Superforecasting,” noting that the NSA under Bush and Obama operated private prediction markets where participants acting as information gatherers outperformed CIA and NSA agents.

“We can engage in moral discussions about this, but the bottom line is that governments and individuals have been financializing war swaps since the Dutch East India Company,” the user explained, arguing that democratization merely broadened access beyond elite bankers.

Heart dismissed this defense outright. “Oh great, let’s democratize profiting from killing people, that’s much better,” she replied.

Rapid Mainstream Adoption Continues

Despite ethical objections, prediction markets are experiencing rapid growth in traditional finance.

Google Finance recently incorporated live data from Polymarket and Kalshi, enabling users to inquire about future events and view market probabilities alongside historical sentiment changes.

Competition is also escalating as major exchanges enter the sector.

Just last week, Coinbase initiated lawsuits against Michigan, Illinois, and Connecticut to contest state authority over prediction markets, asserting that they fall under the exclusive jurisdiction of the CFTC ahead of its January 2026 launch with Kalshi.

@Coinbase has filed lawsuits against the US states of Michigan, Illinois, and Connecticut, escalating a growing legal fight.#Coinbase #Cryptohttps://t.co/hTmVsGS8yu

— Cryptonews.com (@cryptonews) December 19, 2025

Chief Legal Officer Paul Grewal stated, “Prediction markets clearly fall under the jurisdiction of the CFTC, not any individual state gaming regulator.”

Regulatory clarity has also emerged as the CFTC granted no-action relief to Polymarket US, LedgerX, PredictIt, and Gemini Titan earlier this month, alleviating enforcement pressure while mandating full collateralization and transparent transaction data.

The post Prediction Markets Beat Social Media at Finding Truth, Says Vitalik Buterin appeared first on Cryptonews.