Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Portugal Prohibits Polymarket Following €4M Insider Trading Scandal

Portugal’s gaming authority has prohibited the cryptocurrency prediction platform Polymarket after observing questionable trading behaviors during the nation’s presidential election, in which over €4 million was staked in merely two hours before the results were announced.

The Portuguese Gaming Regulation and Inspection Service (SRIJ) mandated the platform to halt its operations and face blocking, concluding that its activities contravene national legislation that forbids political betting.

The issue revolves around dubious fluctuations in betting odds that manifested exactly when exit polls began to circulate privately, raising significant concerns regarding information leaks and insider trading within prediction markets.

Portugal Takes Action Against @Polymarket: A Wake-Up Call for Crypto Prediction Markets?

As reported by Rádio Renascença, Portugal’s gambling regulator SRIJ has instructed the blockchain-based prediction platform Polymarket to immediately cease operations in the country and… https://t.co/4dVlcPNCiG— Tax guy

(@cryptaxpt) January 20, 2026

Questionable Betting Trends Prompt Investigation

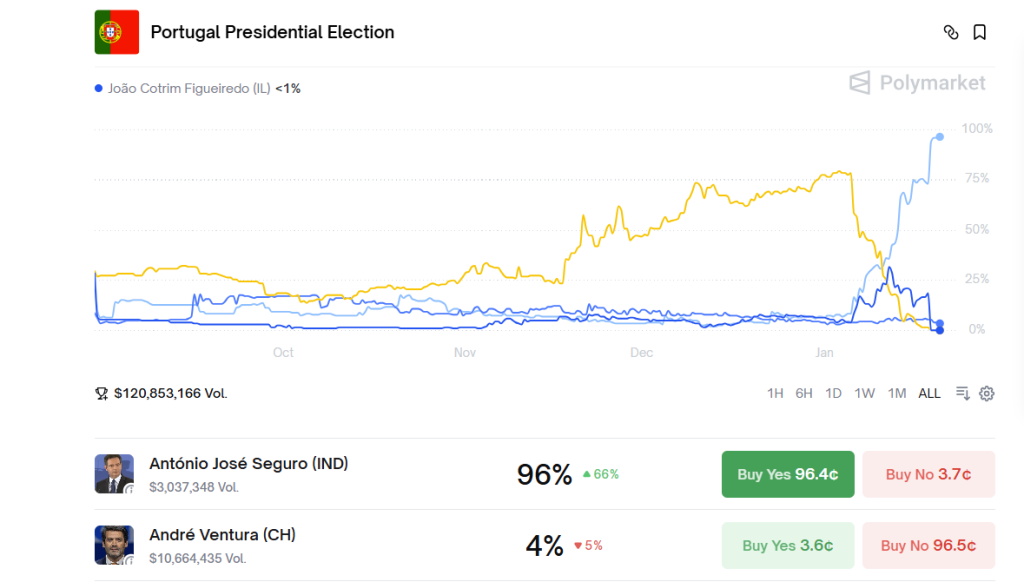

Reports from the Portuguese media outlet Renascença indicate that António José Seguro entered the presidential election on Sunday with a 60% probability on Polymarket, while his opponent, André Ventura, held only 30%.

By 6 PM, one hour prior to the closing of polls, Seguro’s likelihood surged to 96%, reaching 100% once official projections confirmed his win.

Source: Polymarket

Source: Polymarket

The timing appeared even more dubious in markets forecasting the next President of the Republic.

At 6:30 PM, Seguro’s probability of reaching Belém Palace soared from 68.6% to 93.2% within just one hour.

Simultaneously, Cotrim de Figueiredo’s odds plummeted from 22% to a mere 2.5%, ultimately settling at 95% for Seguro by 8 PM when the Portuguese electorate first learned the results.

Between 6 PM and 8 PM, during the crucial gap between Seguro’s probability increase and the public announcement of results, over €5 million was traded across various markets.

A trader with insider knowledge turned $576 into $2,300 in just one hour on Polymarket

In the market “João Cotrim de Figueiredo vote share in Portuguese presidential first round?” there was extreme volatility

The “16%-18%” range was at 97%, then dropped to 15%, and an hour later… pic.twitter.com/4FfmHntGHw— Logics (@immortalhowwl) January 19, 2026

The overall volume in the primary presidential market surpassed $120 million (approximately €103 million), while alternative markets garnered nearly $10 million (around €8.1 million).

The apparent enigma of how bettors accurately identified the winner two hours before the official announcements clarifies upon closer inspection.

Around 6 PM, initial exit poll forecasts began circulating privately, all indicating a decisive victory for Seguro with over 30% of the vote.

The two candidates are set to compete in a runoff election on February 8, although Polymarket will not be accessible to Portuguese bettors this time.

Portugal’s Regulatory Crackdown and Compliance Measures

The SRIJ confirmed it became aware of Polymarket “very recently” and views the company’s operations as “illegal.”

As per Renascença, the regulator stated that “the website is not authorized to offer betting in Portugal, and under national law, wagering on political events or occurrences, whether domestic or international, is prohibited.”

Polymarket received a notice on Friday to terminate its Portuguese operations within 48 hours.

By Monday, the site was still active, leading SRIJ to inform network services for platform blocking.

Portugal joins an expanding list of countries that are imposing restrictions on the platform.

Polymarket has been banned in Ukraine, Singapore, and France, while facing blocks in Australia, Belgium, Germany, the UK, Iran, and North Korea, among others.

Ukraine blocks @Polymarket over unlicensed gambling and “war bets.”#Polymarket #Ukrainehttps://t.co/GkEnLZVayy

— Cryptonews.com (@cryptonews) January 13, 2026

Significantly, concerns about insider trading in prediction markets have escalated following notable bets on geopolitical events, particularly after Polymarket nearly flawlessly predicted President Trump’s 2024 win.

Austin Weiler, a researcher at the blockchain intelligence firm Messari, contended that preventing insider trading is “realistically possible only on prediction markets implementing Know Your Customer (KYC) measures.”

“For KYC-compliant platforms, the most effective strategy is to restrict access from the outset for users to specific markets,” Weiler explained, adding that state actors could be excluded from political or geopolitical markets.

Kalshi Challenges Polymarket’s Dominance in Prediction Market

KYC requirements vary greatly across established prediction platforms.

Kalshi mandates identity verification as part of its regulated framework under the authority of the US Commodity Futures Trading Commission (CFTC), leading regulated exchanges like Coinbase to create prediction market websites functioning through Kalshi’s federally sanctioned structure.

While Polymarket is also legally acknowledged by the CFTC, access and allowable markets differ markedly, with ongoing legal uncertainties regarding whether the platform offers contract trading or gambling under a different guise.

Amid regulatory challenges and Kalshi lawsuits, Polymarket’s volume breakdown for December 2025 indicated a 28% rise in political betting, with over $4.3 billion wagered compared to Kalshi’s $5.96 billion during the same timeframe.

Source: Messari

Source: Messari

The post Portugal Bans Polymarket Over €4M Insider Trading Scandal appeared first on Cryptonews.