Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

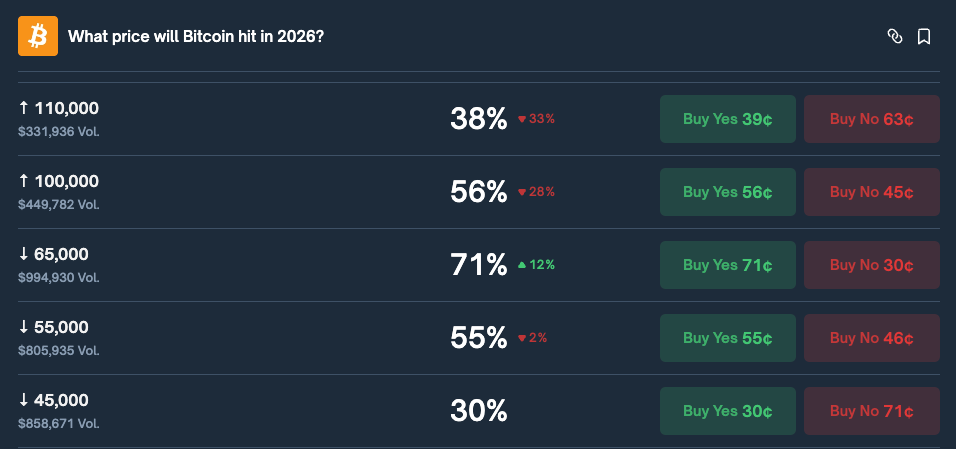

Polymarket Gamblers Predict Over 70% Likelihood of Bitcoin Dropping Below $65K — Is Their Prediction Accurate?

Participants in the prediction market on Polymarket are estimating a 71% likelihood that Bitcoin will fall beneath $65,000 in 2026, as the cryptocurrency hovered around $75,000 after a weekend sell-off that brought it to nine-month lows.

This pessimistic outlook mirrors a combination of technical signals, struggling ETF positions, and analyst alerts indicating that the market has entered a prolonged downturn instead of a fleeting correction.

A number of analysts are now highlighting support levels between $62,000 and $65,000 as essential tests for Bitcoin’s path, with some cautioning that a breach below these points could initiate an extended bear market similar to previous cycle declines.

The prediction market insights are consistent with escalating concerns from both on-chain analysts and conventional market watchers, who observe increasing signs of structural frailty rather than typical volatility.

Source: Polymarket

Source: Polymarket

Key Support Levels Capture Market Focus

Jurrien Timmer from Fidelity highlighted $65,000 as a significant level in early January, observing that Bitcoin has been “more closely following the internet S-curve compared to the power law curve.”

He cautioned that “the $65k (previous peak), and further down, $45k” signify crucial thresholds, with the power law trendline potentially aligning closer to $65,000 if consolidation persists throughout the year.

Bitcoin, on the other hand, has taken a break this year (or at least in recent months). It is now tracking the internet S-curve more closely than the power law curve.

Interestingly, many Bitcoin enthusiasts are declaring that the four-year cycle is over and a new structural up… pic.twitter.com/ibQr4hAzlf— Jurrien Timmer (@TimmerFidelity) January 9, 2026

The $62,000 mark holds added importance as Binance’s Reserve RP indicator, which monitors average acquisition costs on the exchange, currently stands at that price according to a recent Cryptonews analysis.

“Bitcoin has never touched this level since the Spot ETF approval,” Kesmeci mentioned, indicating that the metric has surged from $42,000 before the ETF due to institutional involvement altering market dynamics since January 2024.

CryptoQuant’s Julio Moreno anticipates possible lows between $56,000 and $60,000 based on Bitcoin’s realized price assessment.

“People keep believing this is a ‘bull market’ correction. It’s not,” Moreno asserted, stressing that “we have been stating we are in a bear market since early November” when Bitcoin was priced around $100,000.

He remarked that “bear market bottoms require months to form,” advising caution against trying to time entries following each downturn.

People continue to think this is a “bull market” correction. It’s not.

We have been asserting we are in a bear market since early November, when Bitcoin was around $100K, with some indicators even at $110k.

The indicators that typically help identify bottoms in a bull market are not applicable right now.…— Julio Moreno (@jjcmoreno) January 31, 2026

ETF Investors Encounter Growing Pressure

US Spot Bitcoin ETFs have entered underwater territory, with the average acquisition cost at about $87,830 per coin while Bitcoin trades significantly below that figure, according to Galaxy’s Alex Thorn.

The products experienced their second and third-largest weekly outflows on record last month, with approximately $2.8 billion in net redemptions over a fortnight, as per Coinglass data.

Strategy’s substantial 712,647 BTC position now reflects unrealized losses exceeding $900 million after Bitcoin fell below the company’s average cost basis of $76,037, Lookonchain reported.

Strategy shares have plummeted about 61% over the past six months, currently trading around $149.71, despite the firm’s ongoing accumulation strategies and Michael Saylor’s recent hint of another buy.

CryptoQuant data indicates heightened volatility signals on Binance, with range z30 rising to approximately +3.72, a level that “has frequently preceded significant price movements, either through sharp upward breakouts or rapid downward shifts caused by widespread liquidation,” according to their analyst report.

Source: CryptoQuant

Source: CryptoQuant

Daily trading volume reached about 39,500 BTC, indicating renewed speculative interest despite stable price movements.

Conflicting Theories on Bitcoin’s Future

Jeff Park from Bitwise presented a contrarian viewpoint in his recent analysis, proposing that Bitcoin’s decline to $82,000 following rumors of Kevin Warsh’s nomination as Fed Chair might have represented the cycle’s low point.

“Honestly, I can’t say if $82k was definitively the bottom, and of course, no one can genuinely claim to know for sure,” Park wrote, but noted that “historically, bottoms are almost always characterized by a radical shift in market conditions that fundamentally resets investor behavior and expectations.”

Peter Schiff’s prediction from March 2025 that Bitcoin could hit $65,000 if the NASDAQ enters a bear market now appears remarkably insightful.

“If this correction turns out to be a bear market, and the correlation where a 12% decline in the NASDAQ equates to a 24% decline in Bitcoin remains valid, when the NASDAQ is down 20%, Bitcoin will be around $65K,” Schiff cautioned at that time.

The NASDAQ is down 12%. If this correction turns out to be a bear market, and the correlation where a 12% decline in the NASDAQ equates to a 24% decline in Bitcoin holds, when the NASDAQ is down 20%, Bitcoin will be about $65K.

But if the NASDAQ enters a bear market, history…— Peter Schiff (@PeterSchiff) March 16, 2025

The accuracy of Polymarket’s 71% probability may hinge on Bitcoin’s capacity to maintain the $75,000-$77,000 range, where the latest liquidations occurred.

In fact, CoinSwitch Markets Desk informed Cryptonews that if this support level holds, “selling pressure may diminish, and the price could stabilize or gradually recover, with $80K as the initial resistance.”

The post Polymarket Bettors See Over 70% Chance Bitcoin Falls Below $65K — Are They Right? appeared first on Cryptonews.