Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Organizations Expected to Explore Bitcoin DeFi Solutions

Bitcoin (BTC) is undergoing significant transformation. While the Bitcoin network has mainly served as a platform for payment transactions, recent activities seem to mirror those of Ethereum at the peak of decentralized application (Dapp) development.

The launch of Bitcoin Runes and BRC-20 tokens – which surfaced during the fourth Bitcoin halving event – has probably catalyzed the growth of Bitcoin-native decentralized finance (DeFi).

The Rise of Bitcoin DeFi

Rena Shah, VP of Products at Trust Machines – a group dedicated to expanding the Bitcoin economy – informed Cryptonews that two years prior, Bitcoin DeFi was not a topic of discussion within the ecosystem.

However, Shah observed that the rise of staking platforms and lending protocols on the Bitcoin network has generated interest among investors in shifting assets from merely a store of value to a source of value.

The expansion of the Bitcoin DeFi (BTCFI) ecosystem is remarkable

@ALEXLabBTC is at the forefront, with @Bitflow_Finance & @StackingDao following suit.

– Data from @signal21btc pic.twitter.com/87MP5hMCbL

— stacks.btc (@Stacks) May 8, 2024

“The aspiration to transition from a passive to a productive Bitcoin asset is evident in 2024,” she stated. “We have been working towards this future as we recognize that Bitcoin DeFi is attractive not only to retail investors but also to institutional investors.”

Institutional Interest in Bitcoin DeFi

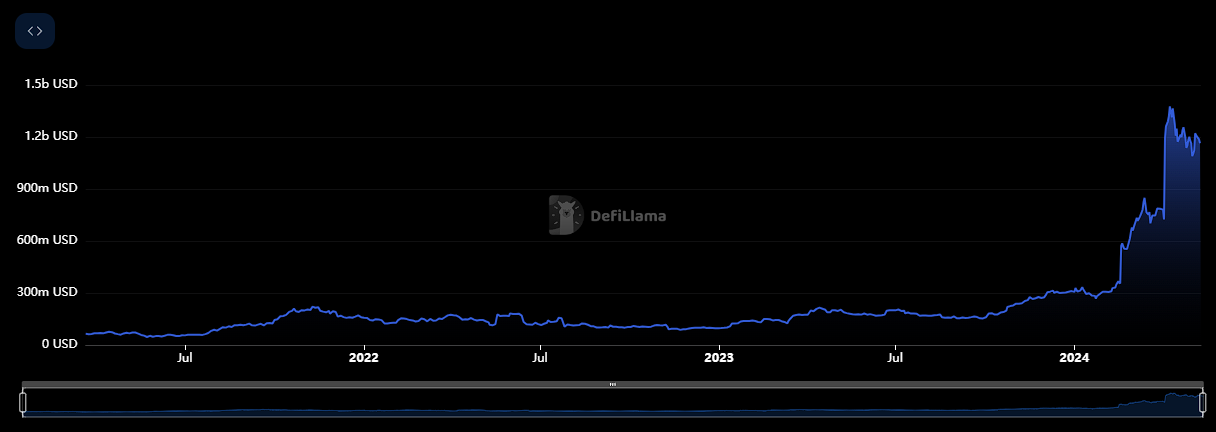

According to data from DeFiLlama, Bitcoin’s total value locked (TVL) is approximately $1.2 billion. However, Shah mentioned that nearly $1 trillion in capital is secured on the Bitcoin blockchain.

“Even minor percentages of capital becoming productive in DeFi will create significant impacts within the Bitcoin ecosystem,” Shah emphasized.

This, combined with the recent approval of spot Bitcoin exchange-traded funds (ETFs) in the United States, is enhancing the prospects for Bitcoin DeFi applications. This is particularly likely to attract institutions holding Bitcoin as well as retail investors.

Tycho Onnasch, co-founder of Zest Protocol, shared with Cryptonews that he views BTC as a more institutional asset compared to other cryptocurrencies.

“Therefore, I anticipate that institutions will play a more significant role in utilizing and supporting Bitcoin DeFi,” Onnasch remarked.

Bitcoin DeFi Solutions for Institutions

Although Bitcoin DeFi remains a relatively nascent concept, several projects aim to facilitate and advance this sector.

For instance, Onnasch explained that Zest Protocol is developing a lending protocol specifically tailored for Bitcoin. He indicated that the platform’s objective is to establish a permissionless financial infrastructure for BTC lending markets.

“Zest allows users to use BTC as collateral to borrow other tokens such as stablecoins,” he stated. “The platform also enables users to earn yield on their BTC.”

Indeed, the main purpose behind Bitcoin DeFi applications appears to be to ensure that Bitcoin evolves into a more productive asset for investors.

Dr. Chiente Hsu, Co-Founder of ALEX and XLink, informed Cryptonews that Alex represents a new financial layer for the Bitcoin network.

“Our aim is to seamlessly connect Bitcoin with layer-2 (L2) solutions and the Ethereum Virtual Machine (EVM) ecosystem,” Hsu explained. “This will help us to broaden the Bitcoin economy,” he added.

For example, Hsu noted that investors can earn yield on their BTC by linking a Bitcoin wallet to XLink. He highlighted that XLink is powered by ALEX’s automated market maker (AMM) and decentralized exchange (DEX), facilitating cross-chain swaps between Bitcoin L2s and the EVM ecosystem.

“Bitcoin DeFi for institutions will focus on generating yield from Bitcoin assets,” Hsu stated.

Hsu believes this is likely due to the substantial amount of capital present on the Bitcoin network.

“There is over $1 trillion in Bitcoin capital that is ‘idle’ in the sense that its value fluctuates with the Bitcoin spot price,” he remarked. “However, unlike Ethereum, Bitcoin cannot be natively locked to produce a yield. This is a challenge that ALEX is actively addressing, which will allow institutions holding Bitcoin to earn yield through their Bitcoin capital.”

Bitcoin DeFi Mirrors Ethereum Counterparts

Another noteworthy observation is that while Bitcoin DeFi is distinct, its applications often resemble DeFi projects on Ethereum (ETH). This is significant, as institutions have begun to express interest in various current DeFi applications.

Digital asset management firm Fireblocks recently reported a rise in institutional DeFi activity on its platform. The firm noted a 75% increase in the first quarter of 2024.

Fireblocks indicated that some of the most frequently used Dapps by institutional clients across swapping, lending, staking, and bridging include Uniswap, Aave, Curve, 1inch, and Jupiter.

Jeff Yin, CEO of Merlin Chain – a Bitcoin L2 that enables rapid, cost-effective transactions with support for BTC Dapps – shared with Cryptonews that DEXs, derivatives, and lending are all areas where BTC has gained significant insights from ETH. He added that numerous new protocols are emerging.

“For instance, ‘Surf’ is a derivatives trading protocol that launched on Merlin Chain and now has a daily trading volume exceeding $10 million. These are akin to their Ethereum counterparts,” Yin noted.

Yin elaborated that a specific Bitcoin DeFi application aims to replicate one of the largest ETH DeFi protocols, Lido – which manages $28 billion and constitutes half of Ethereum’s DeFi TVL.

“SolvBTC is currently developing an underlying BTC yield protocol,” Yin stated. “Moreover, Unicross has implemented a Rune trading protocol on a BTC L2, enabling users to trade Layer 1 (L1) assets more affordably on L2. These represent the more innovative facets of the sector.”

Bitcoin DeFi Could Surpass Ethereum

While Bitcoin DeFi may seem similar to Ethereum, Shah believes that decentralized finance utilizing BTC may ultimately exceed Ethereum.

Certain solutions are also facilitating the transition of Ethereum Dapps to Bitcoin.

Zack Voell, Director of Marketing at Botanix Labs, informed Cryptonews that Botanix has developed a “Spiderchain” that simplifies DeFi on Bitcoin.

“Spiderchain creates a fully EVM-equivalent environment for Dapps and smart contracts on Ethereum to be easily transferred to operate natively on Bitcoin,” Voell explained. “Botanix Labs is constructing the Spiderchain to merge the two most established technologies in crypto — the EVM and Bitcoin — rather than attempting to create an entirely new protocol or virtual machine.”

Obstacles May Hinder Adoption

While it is premature to ascertain the future of Bitcoin DeFi, certain challenges may impede its adoption.

For example, Yin pointed out that liquidity fragmentation often arises from the complexities of implementing DeFi on an L1 network. This, in turn, leads to most activities being spread across various L2 solutions, making it challenging to concentrate liquidity.

“A potential remedy could be the establishment of omnichain liquidity, akin to the Stone protocol in the Ethereum ecosystem,” he suggested. “We anticipate future implementations like M-STONEBTC and Solv Protocol that could unify BTC L2 liquidity.”

Additionally, Shah highlighted that Bitcoin’s challenge lies in maintaining the base layer’s security, stability, and integrity.

“This is where scaling becomes crucial,” she stated. “A robust and diverse L2 ecosystem will ultimately drive Bitcoin DeFi, as a vertical, to thrive.”

Shah added that programming environments on Bitcoin are inherently challenging since many developers from other ecosystems may be less familiar with Bitcoin script.

She noted that one approach to address this is to develop WebAssembly (WASM) or alternative run-time environments like Rust, Solidity, and Cosmos with L2s.

“This strategy will likely assist in attracting new developers to the ecosystem,” she remarked.

The post Institutions Likely To Show Interest in Bitcoin DeFi Applications appeared first on Cryptonews.

@ALEXLabBTC is at the forefront, with @Bitflow_Finance & @StackingDao following suit.

@ALEXLabBTC is at the forefront, with @Bitflow_Finance & @StackingDao following suit.