Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Morningstar DBRS Cautions That Stablecoins May Impact U.S. Bank Deposits and Payment Systems

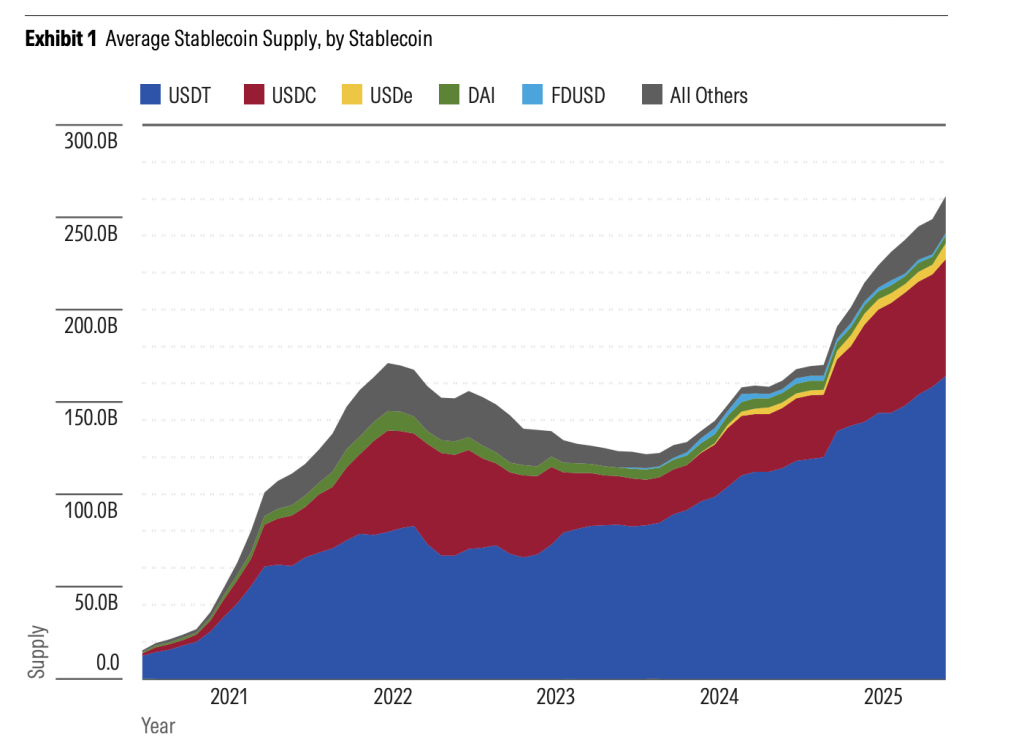

Stablecoins have swiftly emerged as a fundamental component of the digital asset landscape, currently surpassing a total market capitalization of $230 billion as of mid-2025, as reported by Morningstar DBRS.

The market is primarily dominated by Tether (USDT) and Circle (USDC), with additional participants such as USDe, DAI, and FDUSD (refer to Exhibit 1). This expansion has been driven by their stability—tied to the U.S. dollar—and their capacity to operate as digital cash within the blockchain framework.

The enactment of the first federal stablecoin legislation on July 17 has further propelled adoption. With regulations established, U.S. banks are starting to investigate the possibility of launching their own stablecoins, according to the agency.

“Stablecoins provide efficiency and innovation within the financial system, yet they also present both opportunities and challenges for banks,” Morningstar DBRS analysts noted in a report released on Tuesday.

How Stablecoins Operate: More Affordable, Quicker, Smarter Currency

Morningstar clarifies that stablecoins are intended to merge the dependability of fiat currencies with the effectiveness of blockchain technology. In contrast to conventional payment methods—such as credit cards, ACH, or wire transfers—stablecoin transactions are settled within seconds.

“Stablecoins are programmable money,” Morningstar emphasizes, pointing out their application in smart contracts that autonomously execute financial transactions.

This feature has rendered them appealing for international payments, e-commerce, and remittances. Major issuers like Tether, Circle, and PayPal support their coins with reserves of short-term U.S. Treasuries and cash equivalents, ensuring stability and the ability to redeem.

The efficiency difference is significant: while wire transfers may incur costs up to $50 and take several days to complete, stablecoins transact instantly with minimal fees. This situation is attracting users away from traditional banking systems.

Risks to U.S. Banks: Deposits and Payments at Risk

Morningstar cautions that the growth of stablecoins presents genuine threats to the fundamental business models of U.S. banks. The most pressing issue is the potential for deposit flight.

If consumers increasingly opt to hold their funds in stablecoins for incentives, convenience, or integration with decentralized finance, banks could face a loss of deposits that are essential for their lending activities.

According to the Bank for International Settlements, stablecoins currently represent only 1.5% of total U.S. deposits, but their growth is accelerating.

A significant transfer of funds from bank accounts to stablecoins could limit banks’ capacity to finance new loans or extend credit,” Morningstar analysts stated.

Banks also risk forfeiting valuable payment fees. Stablecoins circumvent networks like ACH and SWIFT, allowing for cheaper and quicker transfers. As illustrated in Exhibit 2, the cost advantage is considerable, posing a threat to revenue from transaction services.

Not All Negative: A Path Forward for Banks

In spite of the risks, Morningstar underscores potential opportunities. Banks might utilize their regulatory authority to act as custodians of stablecoin reserves, manage U.S. Treasury holdings, and offer settlement and compliance infrastructure. These services could create new streams of fee income.

The recently enacted GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) establishes capital and reserve requirements for issuers, fostering a more equitable environment. Some banks are contemplating the launch of their own fully backed stablecoins, integrated into existing compliance frameworks, to retain deposits and maintain competitiveness.

“Whether stablecoins ultimately signify an opportunity or a challenge for U.S. banks will hinge on regulatory frameworks and market acceptance,” Morningstar concludes.

The post Stablecoins Threaten to Disrupt U.S. Bank Deposits and Payments, Morningstar DBRS Warns appeared first on Cryptonews.