Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

MicroStrategy Increases Bitcoin Assets with Acquisition of 1,070 BTC

MicroStrategy (Nasdaq: MSTR), a company specializing in enterprise intelligence software, has maintained its proactive Bitcoin acquisition strategy, purchasing 1,070 BTC for $101 million at an average price of $94,004 per bitcoin.

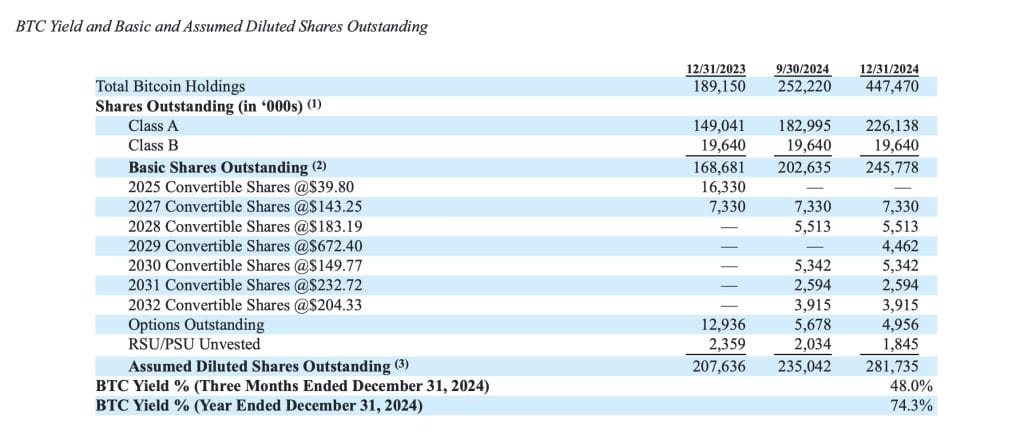

In a filing, the company reported achieving a BTC yield of 48.0% in the fourth quarter of 2024 and 74.3% for the entire year of 2024. As of January 5, the company possesses 447,470 BTC, acquired for $27.97 billion at an average price of $62,503 per bitcoin.

MicroStrategy has acquired 1,070 BTC for ~$101 million at ~$94,004 per bitcoin and has achieved BTC Yield of 48.0% in Q4 2024 and 74.3% in FY 2024. As of 01/05/2025, we hold 447,470 $BTC acquired for ~$27.97 billion at ~$62,503 per bitcoin. $MSTR https://t.co/CkLrLSkB5M

— Michael Saylor

(@saylor) January 6, 2025

MicroStrategy Plans Additional $2B Stock Offering

On January 3, MicroStrategy announced its intention to raise another $2 billion through a perpetual preferred stock offering. The proceeds are intended to enhance its balance sheet and further increase its Bitcoin holdings, in line with the company’s ambitious “21/21” strategy.

This new offering is distinct from MicroStrategy’s ongoing plan to raise $21 billion in equity and $21 billion in fixed-income instruments, as clarified by the Bitcoin-focused enterprise intelligence firm.

The post MicroStrategy Expands Bitcoin Holdings by Acquiring 1,070 BTC appeared first on Cryptonews.

(@saylor) January 6, 2025

(@saylor) January 6, 2025