Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

MicroStrategy Expands Bitcoin Holdings with Additional $1.5 Billion Acquisition

In a development that has become nearly customary, MicroStrategy has once again garnered attention by acquiring a substantial quantity of Bitcoin (BTC).

According to a Form 8-K filed with the U.S. Securities and Exchange Commission (SEC) on Dec. 2, MicroStrategy purchased 15,400 BTC for around $1.5 billion in cash. This form is utilized by public companies to report unexpected material events or corporate changes.

The business intelligence firm paid an average of $95,976 per Bitcoin, inclusive of fees and expenses.

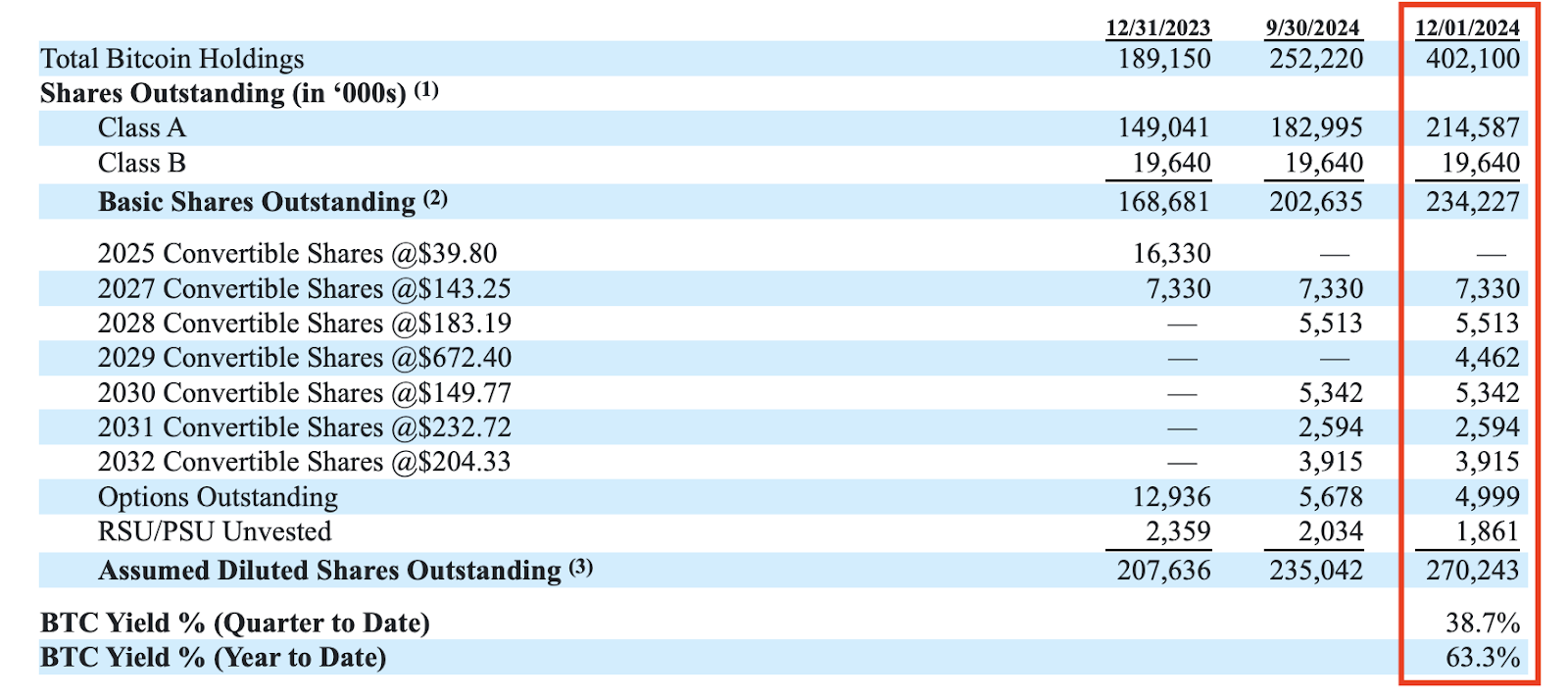

This acquisition elevates MicroStrategy’s Bitcoin return to 38.7% for the quarter and 63.3% year-to-date.

MicroStrategy has acquired 15,400 BTC for ~$1.5 billion at ~$95,976 per #bitcoin and has achieved BTC Yield of 38.7% QTD and 63.3% YTD. As of 12/2/2024, we hodl 402,100 $BTC acquired for ~$23.4 billion at ~$58,263 per bitcoin. $MSTR https://t.co/K3TK4msGp0

— Michael Saylor

(@saylor) December 2, 2024

Strategic Stock Sales Support Bitcoin Accumulation

This recent acquisition was financed through the sale of Class A common stock under a previously established sales agreement. Between Nov. 25 and Dec. 1, MicroStrategy sold approximately 3.7 million shares, resulting in net proceeds of about $1.48 billion after accounting for sales commissions.

This sale is part of a larger strategy under the sales agreement with various financial institutions, which permits the issuance and sale of up to $21 billion worth of shares.

As of Dec. 1, MicroStrategy’s total Bitcoin holdings amount to 402,100 BTC, acquired at a total purchase price of roughly $23.4 billion. This translates to an average price of $58,263 per Bitcoin, including related fees and costs.

MicroStrategy’s Bitcoin holdings and share dilution. Source: MicroStrategy

MicroStrategy’s Bitcoin holdings and share dilution. Source: MicroStrategy

The sales agreement, initiated on Oct. 30 with TD Securities (USA) LLC and other sales agents, has enabled the sale of shares, leaving the company with approximately $11.3 billion worth of shares available for future transactions.

2025 Expected to Be the “Year of the Crypto Renaissance”

MicroStrategy remains committed to actively acquiring Bitcoin. To finance these purchases, the company is strategically issuing shares to enhance its cryptocurrency holdings.

This approach aligns with CEO Michael Saylor’s strong advocacy for Bitcoin, further reinforcing MicroStrategy’s status as a prominent institutional holder of the cryptocurrency.

MicroStrategy describes Bitcoin as “the highest performing uncorrelated asset that a corporation can hold on its balance sheet” in its recent presentation regarding the company’s Bitcoin strategy.

In the presentation, MicroStrategy forecasts that 2025 will be the “year of the crypto renaissance.” This forecast is based on expected developments such as Wall Street’s acceptance of Bitcoin exchange-traded funds (ETFs), widespread adoption of fair value accounting for digital assets, and a pro-Bitcoin stance from the next U.S. president and cabinet.

Further supporting this “renaissance” are MicroStrategy’s anticipations of increasing congressional backing for crypto, the establishment of a “Bitcoin Strategic Reserve,” and a clear regulatory framework for digital assets in the U.S.

MicroStrategy’s stock (MSTR) is closely linked to Bitcoin’s performance, albeit with greater volatility. While Bitcoin has risen 150% this year, MSTR has surged by 513%. This increased volatility was evident in November when MSTR jumped 58%, surpassing Bitcoin’s 37% increase for the month.

$MSTR November 2024 Returns: +58.47%

December will be very interesting to see how we close out this amazing quarter and year.

Then onto 2025. pic.twitter.com/RgtXfQWn5H

— MSTR Updates (@MSTRUpdates) November 30, 2024

More Companies Adopt Bitcoin as Inflation Hedge

MicroStrategy is not alone in its Bitcoin acquisition efforts. An increasing number of companies are incorporating the cryptocurrency into their balance sheets as a potential safeguard against inflation.

Artificial intelligence firm Genius Group also joined this trend on Nov. 18, acquiring 110 Bitcoin for $10 million and expressing its intention to hold up to 90% of its reserves in Bitcoin in the future.

Additionally, tech solution provider Semler Scientific expanded its Bitcoin holdings to 1,570 BTC by purchasing 297 coins for $29.1 million between Nov. 18 and 22 at an average price of $75,039 per coin.

Contributing to this trend, Japanese investment firm Metaplanet plans to raise over $62 million through a stock acquisition plan to purchase additional Bitcoin, augmenting its current holdings of 1,142 Bitcoin.

The post MicroStrategy Continues Bitcoin Buying Spree with Another $1.5 Billion Purchase appeared first on Cryptonews.