Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Michael Saylor’s Approach Approaches “Risk Zone” as mNAV Risks Falling Under 1

Michael Saylor’s Bitcoin-centric firm Strategy is once again approaching a crucial valuation benchmark, as its market-to-net-asset-value multiple, or mNAV, is lingering just above levels that could challenge the rationale for holding its stock as a means of gaining Bitcoin exposure.

During early trading on January 2, Strategy shares experienced a slight increase, providing temporary relief following months of downward pressure.

Despite this uptick, the stock is still down approximately 66% from its peak in July.

The company’s mNAV, a metric that compares its market valuation to the value of its Bitcoin assets, was around 1.02, allowing little room before it could drop below 1.0.

A decline under that figure would indicate that the market is valuing Strategy at less than the Bitcoin it possesses.

Concerns Arise as Strategy’s Bitcoin Discount Grows

This distinction is significant, as the appeal of Strategy’s equity has historically depended on trading at a premium to its Bitcoin reserves.

When mNAV dips below 1.0, investors could theoretically acquire Bitcoin at a lower cost by purchasing the asset directly instead of holding a stock that represents it.

Historically, such circumstances have led to selling pressure, as the justification for incurring corporate risk, dilution, and management expenses diminishes.

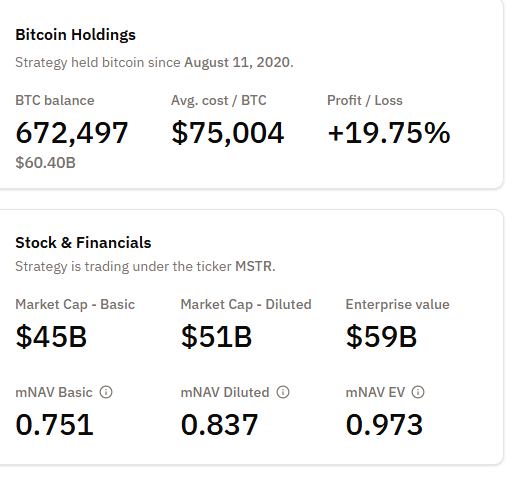

The company’s balance sheet illustrates this tension. Strategy possesses 672,497 bitcoins, the largest corporate reserve globally, accumulated since August 2020 at an average purchase price of approximately $75,000 per coin.

With Bitcoin trading around $90,000, these holdings are valued at roughly $60.7 billion, resulting in an unrealized gain of about 20% for the company.

Nonetheless, Strategy’s basic market capitalization is closer to $45 billion, and its diluted valuation is approximately $50 billion, already suggesting a discount to the underlying assets.

Source: Bitcoin Treasuries

Source: Bitcoin Treasuries

On an enterprise value basis, which factors in debt and cash, Strategy’s mNAV is projected to be just under 1.0. This closeness has intensified scrutiny since the company depends on issuing equity at a premium to finance additional Bitcoin acquisitions.

If the stock consistently trades below the value of its reserves, raising capital through share sales becomes increasingly challenging and potentially dilutive.

Management has implemented measures to mitigate near-term funding risks. In recent weeks, Strategy secured $747.8 million through stock sales under its ATM program.

Billionaire Michael Saylor’s Strategy enhances USD reserves by $748M to $2.19B via its ATM program, while maintaining 671,268 BTC unchanged.#BTC #Bitcoinhttps://t.co/gOqBzbzzXy

— Cryptonews.com (@cryptonews) December 22, 2025

The company indicates that the reserve now covers approximately 21 months of dividend and interest commitments, reducing the necessity to liquidate Bitcoin during times of market stress.

Executives have characterized the sale of Bitcoin as a last resort, to be contemplated only if other financing avenues are unavailable and the firm’s valuation falls below its asset base.

Bitcoin Premium Diminishes as Strategy Stock Falters

Nevertheless, another threshold exists below the mNAV line. Should Bitcoin drop below Strategy’s average acquisition price of around $74,000, the company’s holdings would fall below cost, potentially testing investor confidence.

While some shareholders perceive such situations as long-term buying opportunities, they can also heighten volatility among traders who are less committed to the strategy.

The stock’s recent performance mirrors that uncertainty, with Strategy shares declining over 60% in the past six months and finishing 2025 down nearly 50%, making it the worst performer in the Nasdaq-100 last year.

Source: Google Finance

The downturn followed a significant rally earlier in 2025, when the stock surged alongside Bitcoin before reversing as risk sentiment shifted in the latter half.

Bitcoin itself remains elevated, trading about 28% below its all-time high but has seen a sharp increase in recent sessions with rising volume.

This divergence between Bitcoin’s strength and Strategy’s equity weakness has sparked debate over whether the company now resembles an investment vehicle rather than a functioning business.

Critics, including economist Peter Schiff, have cited the stock’s decline as evidence that aggressive Bitcoin acquisition has negatively impacted shareholders.

The post Michael Saylor’s Strategy Nears “Danger Zone” as mNAV Threatens to Slip Below 1 appeared first on Cryptonews.

Billionaire Michael Saylor’s Strategy enhances USD reserves by $748M to $2.19B via its ATM program, while maintaining 671,268 BTC unchanged.#BTC #Bitcoinhttps://t.co/gOqBzbzzXy

Billionaire Michael Saylor’s Strategy enhances USD reserves by $748M to $2.19B via its ATM program, while maintaining 671,268 BTC unchanged.#BTC #Bitcoinhttps://t.co/gOqBzbzzXy