Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Markus Theilin Indicates ‘Low $40,000s’ Range is Optimal for Purchasing During Market Dip

10x Research CEO Markus Theilin warned traders, indicating that a “low $40,000s” Bitcoin represents the most favorable entry point for those looking to buy the dip.

Theilin contends that Bitcoin’s price must revert to levels observed around the introduction of spot Bitcoin ETFs for an ideal entry opportunity. Bitcoin was last within this range on February 6th, trading at $42,577. He stated:

“To optimally time the next bull market entry, we are targeting Bitcoin prices to decline into the low 40,000s.”

This perspective aligns with sentiments shared by other analysts. Specifically, in a post on X, Cane Island Alternative Advisors founder Timothy Peterson mentioned that “$40k and $80k are equally probable in the next 60 days.”

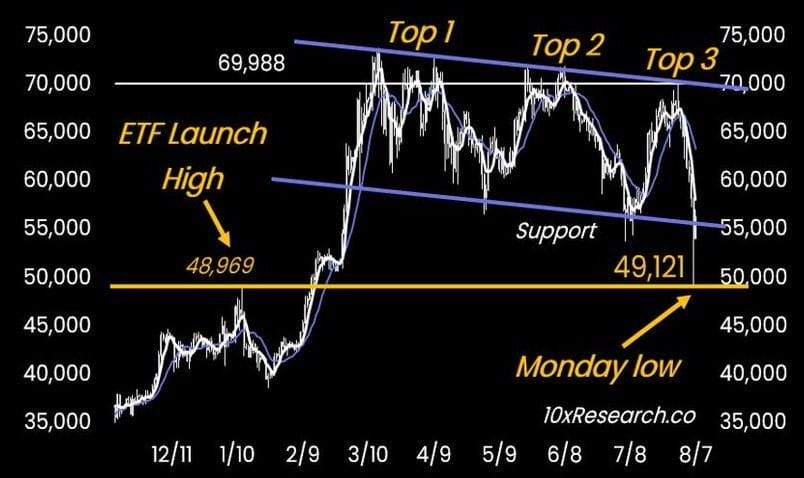

A report from 10x Research emphasized the importance of a break below the support Bitcoin has established during its downtrend.

Despite Bitcoin’s ongoing recovery efforts, significant resistance from the clearly defined downtrend is expected to be “more challenging” following the recent support break, the firm noted.

CryptoSeacom founder CryptoRover pointed out this as a clear signal that “$40k is next,” addressing his 808,400 followers on X.

If #Bitcoin breaks this support, $40k is next. pic.twitter.com/nIsdTmr3rS

— Crypto Rover (@rovercrc) August 5, 2024

“I would be pleased to see Bitcoin drop to $50K, or even $40K. That would present an excellent chance to acquire more,” Gokhstein Media founder David Gokhstein remarked.

Thielen Warns Against ‘Buying the Dip’ Prematurely

Thielen has also advised traders that “buying the dip” on Bitcoin is “too risky” despite indications of stabilization and potential recovery.

“Financial markets resemble puzzles that require periodic reassembly, with new factors influencing asset prices emerging,” Markus Thielen stated. “This is one of those instances.”

Furthermore, he pointed out that this dip is distinct from those in April and June. While sharp declines were countered by increased leverage during those times, this may not occur now due to the current “slow trading” environment.

“August and September are known for sluggish trading. Many institutional players are on vacation, and deploying significant amounts of capital is not a priority for them,” Thielen added.

Consequently, Thielen emphasizes that appropriate risk management is “critical” during this slow phase.

“Opportunities are likely to emerge once this period concludes,” he stated.

ETF Inflows Remain Stagnant

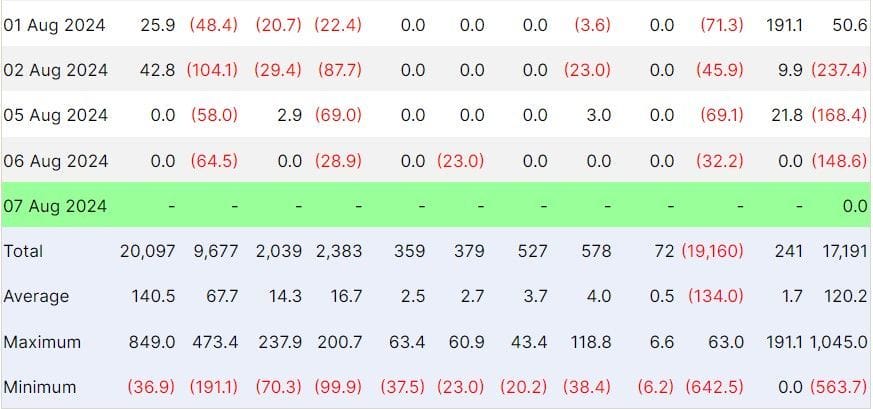

Spot Bitcoin exchange-traded funds (ETFs) based in the United States have also been impacted by heightened economic concerns, experiencing three consecutive days of outflows, totaling $148.6 million on August 6th.

The Fidelity Advantage Bitcoin ETF Fund and Grayscale Bitcoin Trust ETF were the primary contributors, losing $64.5 million and $32.2 million, respectively, according to Farside Investors data.

In fact, all 11 Bitcoin ETFs recorded zero net inflows overall. Theilin noted this as significant, indicating that retail investors are not engaging in buying the dip.

Theilin observed that investors in the Bitcoin ETFs are now “underwater” since the average price is “around $60,000.”

The post Bitcoin ‘Low $40,000s’ Zone Marks Best Entry for Buying the Dip Says Markus Theilin appeared first on Cryptonews.