Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Markets Anticipate Trump’s Return to White House: Implications for Bitcoin Prices?

With Bitcoin currently priced at $97,630, reflecting a decrease of approximately 0.13% over the last 24 hours and a market capitalization of $1.93 trillion, market participants are closely observing the cryptocurrency’s path. Recent advancements in regulatory clarity, institutional acceptance, and political changes are influencing Bitcoin’s prospects, with some analysts forecasting new peaks in 2025.

Trump’s Impact on Bitcoin’s Progress

Donald Trump’s potential re-election in November has significantly affected BTC’s surge. Previously a critic of cryptocurrencies, Trump has altered his stance, advocating for the U.S. to become “the crypto capital of the world.”

His administration has appointed Paul Atkins, a prominent supporter of crypto, as SEC Chair, generating optimism for favorable regulatory adjustments.

The countdown has begun!

Paul Atkins is soon in office and will transform the crypto landscape #PaulAtkins #Trump #SEC pic.twitter.com/T1nsaDIeqG— Paul Atkins – SEC Chair (@paulatkinsx) January 5, 2025

With talks of a potential strategic BTC reserve emerging in Washington, the U.S. government’s endorsement of Bitcoin could further enhance its market position.

Pieran Maru, a fund manager at Liontrust, remarks, “The incoming Trump administration may establish the most crypto-friendly environment globally, paving the way for exponential growth.”

The prospect of U.S. government involvement in Bitcoin is viewed as transformative, likely to promote wider adoption and solidify its status as a globally recognized asset.

Recent Institutional Adoption Boosts Bitcoin’s Credibility

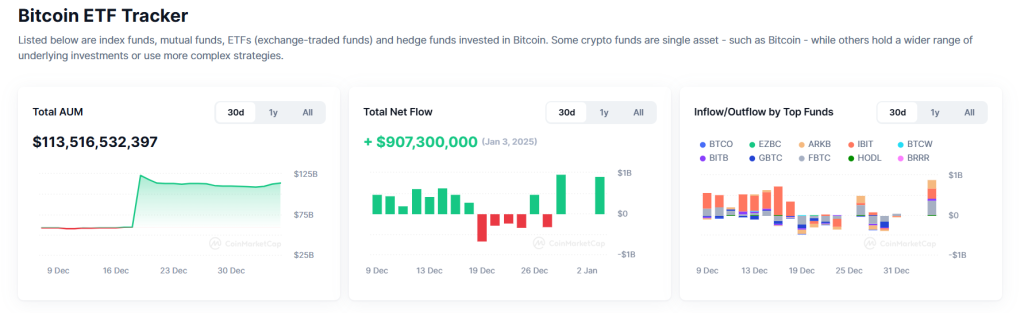

Institutional interest in Bitcoin continues to rise, fueled by the increasing acceptance of spot Bitcoin ETFs. As of January 3, 2025, Bitcoin ETFs manage $113.52 billion in Assets Under Management (AUM), with net inflows of $907.3 million on the same day, highlighting strong demand from institutional investors.

Spot ETFs have made it easier for banks, pension funds, and hedge funds to access Bitcoin, solidifying its role in mainstream finance.

BlackRock’s analysis emphasizes Bitcoin’s diversification benefits, indicating that a 1-2% allocation in a 60/40 portfolio offers a risk-reward profile similar to leading tech stocks.

Regulatory changes further enhance Bitcoin’s credibility. The U.S. SEC is promoting crypto-friendly policies, while the UK’s Financial Conduct Authority is relaxing restrictions.

Combined with increasing ETF inflows, these factors strengthen Bitcoin’s position as a legitimate institutional asset.

Bitcoin’s Technical Perspective: Key Levels to Monitor

Bitcoin is testing significant resistance around $98,000, a level reinforced by a downward trendline. Immediate resistance levels are at $98,000, followed by $100,071 and $102,010.

On the downside, support levels are located at $96,375, $95,446, and $93,344.

The Relative Strength Index (RSI) is at 58, indicating neutral momentum, while Bitcoin remains above its 50-day Exponential Moving Average (EMA) at $96,375.

This suggests moderate bullish sentiment but also underscores the necessity of breaking the $98,000 resistance to unlock further upside potential.

$BEST Wallet: Web3 Simplified, $6.27M Raised in Presale

Best Wallet is transforming Web3 with an innovative platform that supports thousands of cryptocurrencies across 50+ major blockchains, including Bitcoin and Ethereum. It enables users to securely buy, sell, and swap assets within and across chains—without the need for KYC verification.

The $BEST token presale has successfully raised an impressive $6,270,984, with less than 24 hours remaining until the next price increase. Currently priced at $0.02345, $BEST offers exclusive rewards and early access to projects within its rapidly expanding ecosystem.

Why Invest in $BEST?

- Utility-Driven: Designed for seamless use in DeFi, staking, and token claims.

- Early-Mover Advantage: Gain access to presale benefits and exclusive project launches.

- Expanding Ecosystem: Rapidly growing community with partnerships on trending platforms like Pepe Unchained.

Best Wallet continues to attract attention, as evidenced by active engagement on its Twitter and Telegram channels.

The post Markets Await Trump Return to White House: What to Expect From Bitcoin Price? appeared first on Cryptonews.