Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Market Adjustments Anticipated, Fed Discusses Rate Increases. Implications for Bitcoin Value?

Minutes from the January meeting indicate that rate increases remain a possibility. Should inflation stagnate, policymakers are prepared to tighten monetary policy once more. This serves as a clear warning to risk markets.

For the price of Bitcoin, this alters the narrative. The market had been anticipating cuts, leading to increased liquidity and more favorable conditions. Now, the Fed is indicating a contrary stance.

Increased rates. Stricter liquidity. This fundamentally alters the landscape for cryptocurrency.

Key Takeaways

- The Signal: Federal Reserve officials talked about potential “upward adjustments” to rates if inflation remains above target levels.

- The Split: The vote was 10-2 in favor of maintaining rates, but a notable “hawkish” faction is opposing cuts.

- The Risk: Prolonged higher rates typically reduce liquidity, posing challenges for Bitcoin and ETF inflows.

Why Does This Matter for Crypto and Bitcoin Price?

Markets were previously at ease. Cuts in 2026 seemed almost assured. Now, that assurance has been disrupted.

The Fed maintained rates at 3.5% to 3.75%, pausing after three consecutive cuts in late 2025. However, the tone was not accommodating. Within the discussions, a hawkish group made it evident that they are not inclined to guarantee further easing.

hawkish fed stance dampening macro sentiment

— Binan Smart Kid

(@Binansmartkid) February 18, 2026

Some officials even suggested “upward adjustments” if inflation persists. This represents a significant change. The market had expected a steady decline. The analysis of the minutes suggests otherwise.

The Fed seeks clear evidence that disinflation is genuine before considering further cuts. This places considerable importance on the February CPI report. If inflation remains elevated, the prospect of rate hikes shifts from theoretical to practical.

What Happens Next?

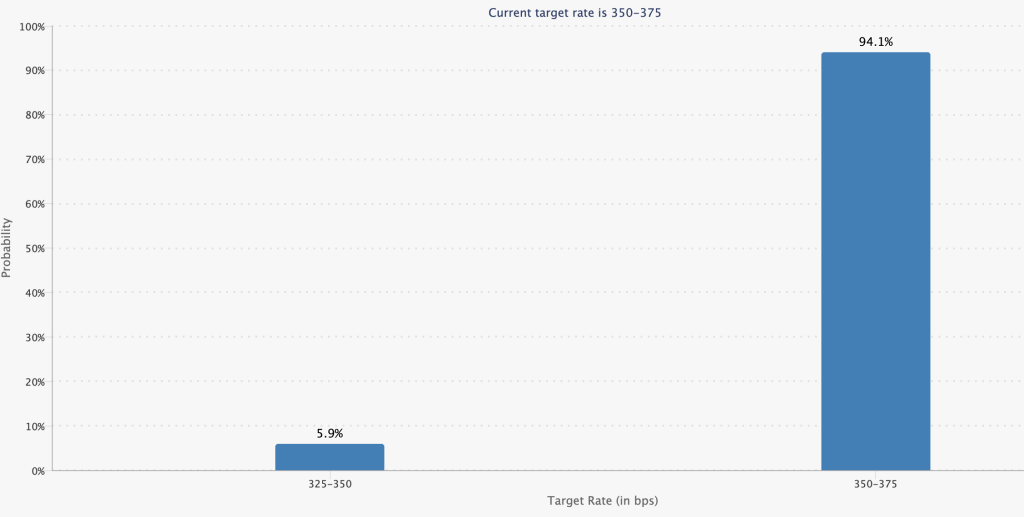

Pricing is becoming complicated. CME futures still indicate a 94% likelihood of a pause in March. However, the risk of a hike is no longer negligible.

Source: CMEgroub

Source: CMEgroub

Ultimately, it hinges on inflation data. If the next report shows high inflation, the Fed’s concerns will be confirmed. If not, this anxiety may dissipate as quickly as it arose.

Discover: Here are the crypto likely to explode!

The post The Market Priced in Cuts, the Fed Mentioned Hikes. What Is Means For Bitcoin Price? appeared first on Cryptonews.

(@Binansmartkid) February 18, 2026

(@Binansmartkid) February 18, 2026