Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Kraken Broadens US Equities Portfolio with Additional Passive Income Opportunities

Kraken, a digital assets and financial services platform based in the US, is reinforcing its commitment to connect traditional finance with cryptocurrency. The exchange has recently unveiled a series of enhancements to its equities product for US users, introducing new functionalities in Kraken Pro along with a more user-friendly interface.

The equities platform at Kraken now allows investors to swiftly transfer assets, explore new opportunities for passive income, and trade with greater flexibility on its platform. Its primary objective is to enable users to manage their portfolios across different asset classes within a single, secure account.

You can visit Kraken to discover its range of crypto and stock trading services aimed at simplifying the investment process. Continue reading for a detailed look at the new enhancements in Kraken’s US equities offering.

Kraken Introduces ACATS Support With up to 2% Transfer Bonus

A significant update is Kraken’s incorporation of the Automated Customer Account Transfer Service (ACATS).

ACATS is an electronic mechanism that standardizes the transfer of securities and cash holdings among financial institutions. Typically used for transferring entire brokerage accounts, ACATS stock transfer allows investors to move positions without liquidating them, thus minimizing friction and maintaining market exposure.

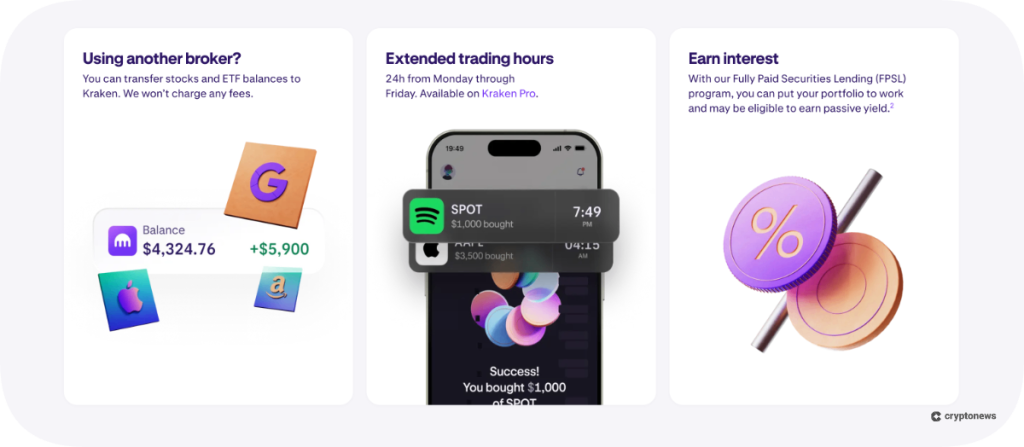

Kraken has now integrated this system directly into its platform, enabling US users to transfer eligible stocks and ETFs from other brokers into their Kraken accounts. To promote adoption, Kraken is offering a limited-time transfer bonus of up to 2% on incoming securities. These bonuses are provided in USDG (a US dollar-pegged stablecoin) and are subject to terms and geographic limitations.

Want to Earn Extra Income? Kraken’s FPSL Program Lets You Lend Your Stocks

Kraken currently provides a Fully Paid Securities Lending (FPSL) program. In a standard fully paid lending arrangement, a broker borrows clients’ fully paid or excess-margin securities to satisfy market demand.

The client lends the stocks to the broker, who may then lend them to other borrowers (often short sellers). In exchange, the broker offers collateral and shares a portion of the borrowing fees with the client. In essence, by participating in Kraken’s FPSL program, eligible users can earn additional income from their unused stocks.

The latest update from Kraken has improved the overall user experience and transparency, allowing you to easily track estimated yields and monitor your lifetime earnings. This will assist investors in assessing whether the potential income outweighs any associated risks.

It is crucial to understand that lending income is not guaranteed, and not all stocks qualify. Regulatory guidance indicates that securities lending carries several risks, including market volatility that may lead to losses if recall requests are delayed. Consequently, Kraken adopts a compliance-first approach and ensures sufficient collateralization.

Kraken Stock Trading: Pro Users Can Now Trade US Stocks and ETFs 24/5

Another enhancement addresses the need for increased flexibility. Kraken Pro users can now enjoy 24-hour stock trading from Monday to Friday, aligning with the “always on” nature of Web3 markets.

This will allow investors to react to global news and events in real-time. For instance, it will create opportunities to take advantage of after-hours earnings reports or international market movements. However, liquidity may be comparatively lower during these hours, so users should be mindful of the risks before engaging in after-hours trading.

Get Better Insights With Enhanced Market Depth on Kraken Pro

Kraken Pro’s upgraded market-depth view now offers actionable insights into liquidity data. For example, you can see precisely how many buy and sell orders are placed at each price point, making it easier to identify where significant trading interest (and likely price floors or ceilings) exists.

Clearer market data can also assist you in determining whether a single large trade could influence the market by revealing imbalances between supply and demand. This enhanced clarity aligns with Kraken’s objective of democratizing institutional-grade analytics for retail investors.

Trade Stocks, ETFs, and Crypto on Kraken’s Unified Platform

Kraken continues to streamline the investing experience by consolidating multiple asset classes into a single account. You can trade over 11,000 US stocks and ETFs on Kraken with zero commissions and even purchase a fraction of expensive shares instead of acquiring a whole one.

The exchange ultimately allows you to hold cash, stablecoins, cryptocurrencies, and equities all in one place. This unified design is particularly beneficial for beginners, as they won’t need to navigate across various platforms. Even for advanced users, this structure facilitates flexible trading strategies across asset classes with fewer steps.

Visit Kraken

A Unified Infrastructure for Digital and Traditional Assets

As previously mentioned, Kraken’s equities expansion is part of a larger trend of merging traditional and digital finance.

However, what is even more significant is that it reflects a broader vision of establishing an investment infrastructure for the future. By combining regulated brokerage services with crypto-powered technology, Kraken Pro offers speed, transparency, and global access to everyday investors.

Through its recent upgrades, Kraken is creating pathways that enable users to engage with markets on their own terms. By integrating stock transfers, securities lending, fractional trading, and continuous execution, it provides a comprehensive suite rarely found on a single platform.

Conclusion: How Kraken Is Building the Future of Investing

Kraken’s updated equities offering signifies a notable advancement toward a unified financial future. The integration of ACATS simplifies the process for US users to transfer their existing stock and ETF holdings onto the platform and earn a limited-time transfer bonus of up to 2%.

Conversely, FPSL allows you to transform your idle equities into income-generating assets. Additionally, the 24/5 stock trading on Kraken Pro reflects the continuous nature of crypto markets, providing investors with the flexibility to respond to global events. Lastly, Kraken’s sophisticated market depth tools offer institutional-level insights to retail traders.

As regulatory frameworks evolve, Kraken’s hybrid approach positions it at the forefront of a financial landscape that merges TradFi and DeFi.

Visit Kraken

The post Kraken Expands Equities Offering in the US With New Ways to Earn Passive Income appeared first on Cryptonews.