Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Justin Sun Denies Liquidation Speculations, Criticizes Leveraged Trading Approach

Justin Sun, the creator of the Tron cryptocurrency initiative, has refuted the speculation regarding the liquidation of their holdings. He addressed the liquidation rumors on X on Monday.

“The claims about our positions being liquidated are untrue,” Justin stated. “We seldom participate in leveraged trading strategies as we believe such transactions do not provide substantial advantages to the industry.”

The claims about our positions being liquidated are untrue. We seldom participate in leveraged trading strategies as we believe such transactions do not provide substantial advantages to the industry. Instead, we prefer to engage in activities that offer greater support to the industry and…

— H.E. Justin Sun 孙宇晨 (@justinsuntron) August 5, 2024

Speculation began circulating on the X platform early Monday morning, indicating that Justin was facing liquidation amid a significant downturn in the crypto market. He was accused of liquidating funds, which exacerbated the market decline.

One user, with over 11K followers, remarked that Justin Sun “finally got liquidated.” Another user claimed that he is on the “verge of liquidation.”

Justin Sun finally got liquidated pic.twitter.com/HC3BQDONvp

— Honeybadger (@HoneybadgerC) August 5, 2024

This speculation arose as the total value of liquidated positions exceeded $1 billion within the past 24 hours. This led to a decline in two of the largest cryptocurrencies, with Bitcoin falling further below $50K and Ether dropping beneath $2,200.

In addition to rejecting all allegations, Justin also criticized leveraged trading strategies, stating that they “rarely” engage in such practices. This is due to their belief that these trades do not significantly benefit the industry.

However, he emphasized that he and his team “prefer to engage in activities that provide greater support for the industry and entrepreneurs, such as staking, operating nodes, working on projects, and assisting project teams in providing liquidity.”

The Crypto Liquidation: Here’s What the Stats Say

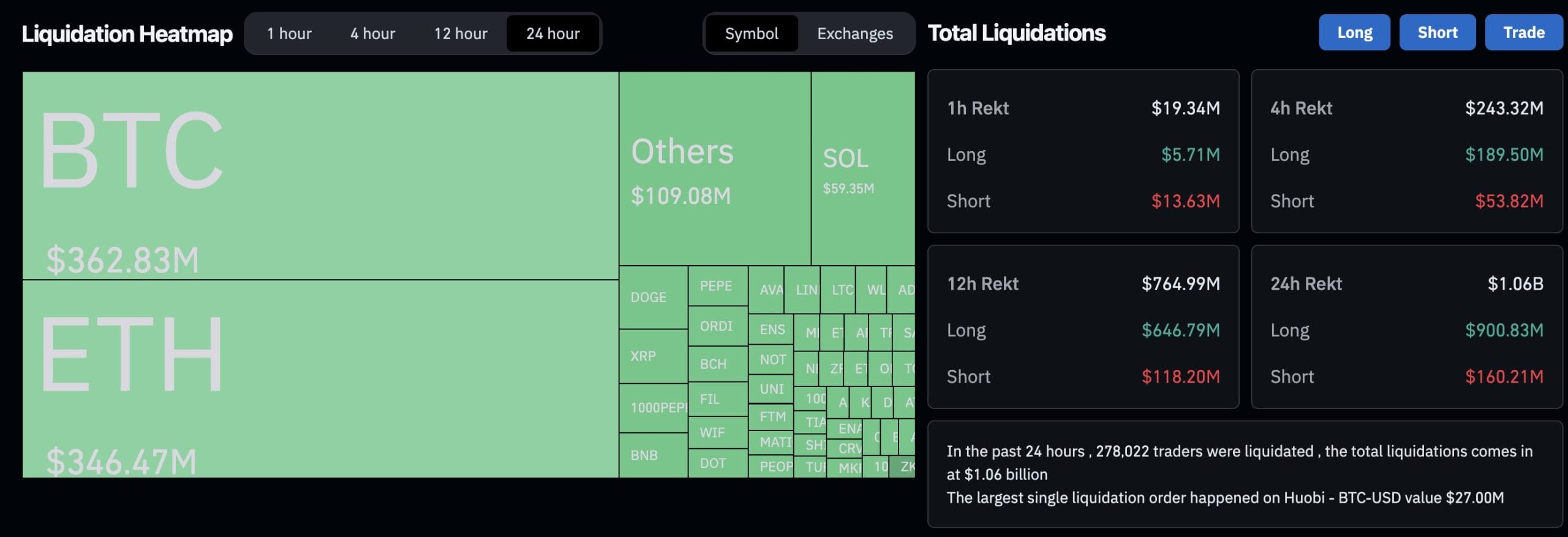

As per data from Coinglass, long positions were the most affected, with $900.83 million in liquidations. Meanwhile, short positions accounted for $160.21 million in liquidations at the time of reporting.

Source: Coinglass

Source: Coinglass

Bitcoin alone experienced $362.83 million in liquidations, primarily from long positions, while Ethereum faced $346.47 million.

During this tumultuous period, 278,022 traders were liquidated, bringing the total liquidations to $1.06 billion. The largest single liquidation order occurred on Huobi for BTC-USD, valued at $27 million. These figures highlight the current volatility of the market and the strain on leveraged trades.

The post Justin Sun Calls Liquidation Rumors “False”, Slams Leveraged Trading Strategy appeared first on Cryptonews.